Tuesday 13 September 2016

The MRJ programme: delayed but not defeated

Mitsubishi’s MRJ90 programme has been delayed for over five years and the company is now scheduled to deliver its first aircraft in mid-2018. Delays are typical for aircraft programmes but MRJ faces stiff competition from Embraer with its rival and ‘on schedule’ E2 programme. The Ishka View is that the MRJ programme has plenty of promise but any further delays will hurt future aircraft sales for the Japanese manufacturer as Embraer’s current E175 programme and the E175-E2 would likely gain market dominance.

MRJ’s biggest threat comes from Embraer, partly because of its existing customer base but also because the technical improvements to the E2 programme mirror MRJ’s fuel efficiency savings, not least because they share the same power plant from Pratt & Whitney. In addition, Embraer and MRJ are currently positioned to pass the US FAA certification ahead of rival SSJ Superjet and ARJ21 and as a result will gain access to the US market which is forecasted to be one of the biggest for regional jets over the next 20 years.

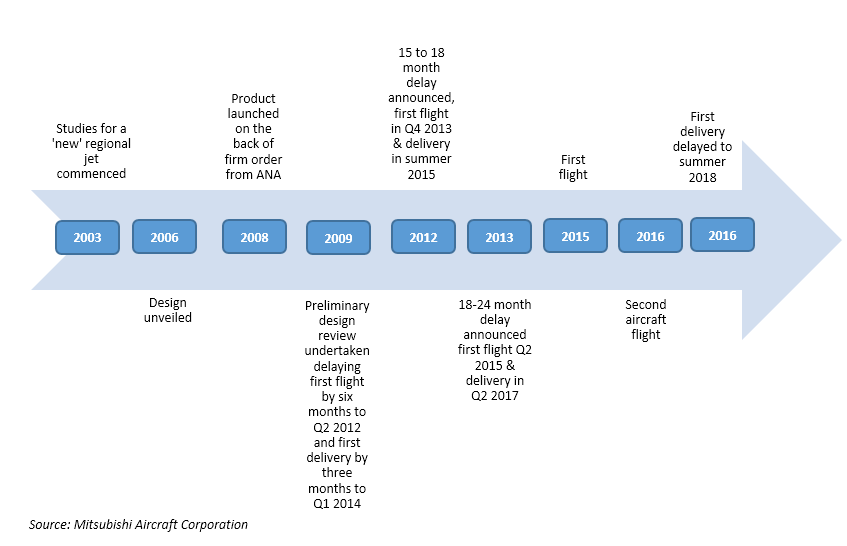

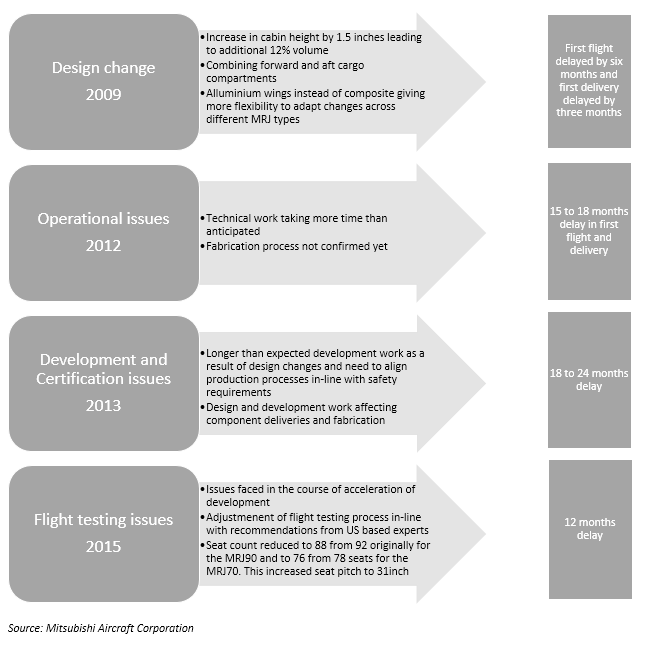

MRJ90 programme timeline and issues

The MRJ90 programme marks the re-entry of Mitsubishi in the field of commercial aircraft. The company has been involved in aviation for more than 50 years – it builds military aircraft and also works alongside Boeing and Airbus on their aircraft programmes. The MRJ90 is a completely new ‘clean sheet’ aircraft. As per Mitsubishi, the aircraft is 20% more efficient than competitors in its class, and offers better passenger comfort through a larger cabin space. However, the aircraft has had to contend with several challenges which have delayed the programme by nearly five years.

Summary of issues and the impact on the programme

After having delayed the programme for five years, Mitsubishi now expects to deliver the first MRJ90 in 2018, the same year as Embraer’s new generation model, the E175-E2. The E2 programme has been running ahead of schedule unlike its competitor programmes. The five-year delay has prevented the MRJ90 programme from gaining any head start on its rival with its clean sheet design.

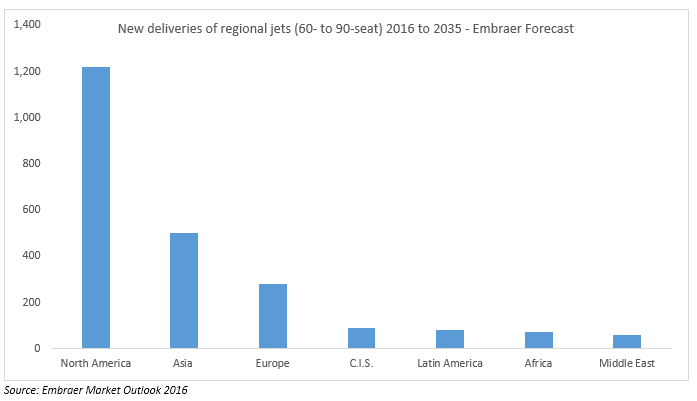

Current market outlook

The regional jet market has significant potential in the next 20 years. It is expected to grow markedly especially in emerging economies. In addition, a number of older regional aircraft are due for replacement which will also create demand for new regional jets. Most OEM’s forecast the <100-seat segment to witness deliveries of 2,000 to 3,000 new regional jets between 2016 and 2035. A commonality of all OEM forecasts is that North America, Asia and Europe will take the maximum deliveries of new regional jets and therefore these markets are key to the MRJ’s success.

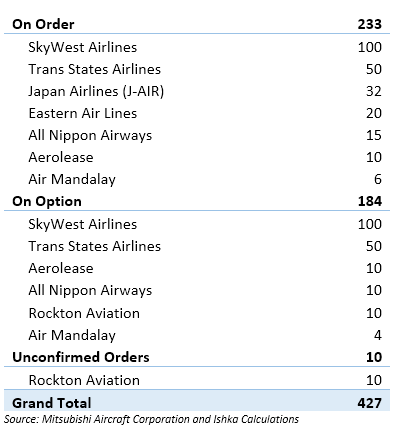

MRJ orderbook

MRJ has firm orders from the US carriers (SkyWest, Trans States Airlines and Eastern Airlines). However, there remains the possibility that these orders could be at risk because of US union rules regarding regional jets. The current pilot contracts in the US forbid contract flying with regional jets either having more than 76 seats or having a maximum take-off weight (MTOW) of more than 86,000 lb. The MRJ90 has up to 88 seats and an MTOW of 87,000 lb for the standard variant (even more for the extended range and long range variants). While the seat issue can be resolved as airlines configure aircraft to 76 seats using a dual-class configuration, they are less able to change the weight of the aircraft. Mitsubishi is banking strongly on the weight restrictions being lifted through contract negotiations by major US carriers. It remains to be seen whether the relief comes before the MRJs are due for delivery to its US customers i.e. in 2018. In the event that the scope clause remains, Mitsubishi could request its non-US customers to prepone their intakes of the MRJ90. In a worst case scenario, the US customers may cancel their orders or swap out for the smaller MRJ70, which is still currently under study.

In terms of recovering the initial investment, Mitsubishi has so far invested around $2 billion in the programme, and with a possible delivery value of $25-$32 million for each aircraft, the company will need to sell many more MRJ90s to recoup its development costs.

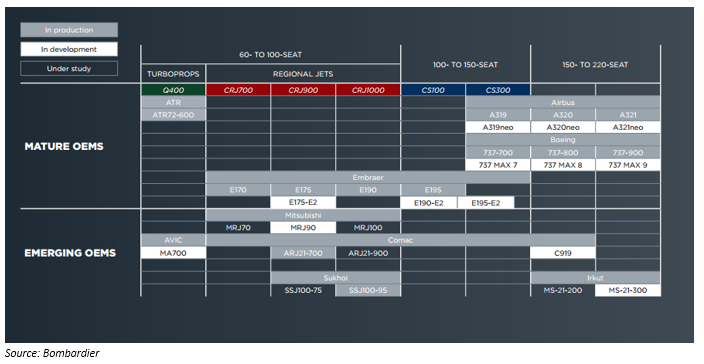

Competitive landscape

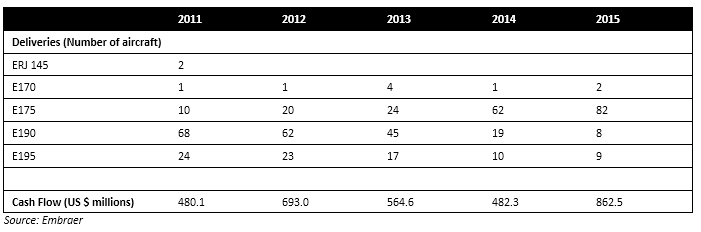

The strongest competition to the MRJ90 programme comes from Embraer’s E-series regional jets, particularly the E175, and Bombardier CRJ series, mainly the CRJ900 and CRJ700. These two companies are the established players in regional aerospace and command nearly two-thirds of the market. The E175 is a critical programme for Embraer. Deliveries for all of Embraer’s regional jet types have fallen substantially between 2011 and 2015, apart from the E175 which saw an eight-fold increase. The aircraft accounted for nearly 81% of Embraer’s commercial deliveries in 2015. This change is reflected in the increased operating cash flow for the company between 2011 and 2015.

Embraer’s commercial aircraft delivery and cash flow (2011-2015)

Embraer continues to invest in the E-series programme. The company is working on an extensively revised derivative of the E175, the E175-E2 (along with E190-E2 & E195-E2) that features new wings, improved avionics, and new engine and aircraft systems. Ishka believes that even though the MRJ90 is a completely ‘new’ aircraft, as opposed to the E175-E2, the Japanese aircraft will face significant competitive pressure from its Brazilian counterpart, especially in the key markets of North America and Europe.

Bombardier, on the other hand, appears to be concentrating on the >100 seat market segment through its C Series programme. The C Series competes mainly with Airbus’ A319neo and Boeing 737-7 MAX. The programme has also been long-delayed and is significantly over-budget. Bombardier invested heavily in the programme and in the process became substantially leveraged. As a result, the potential for investment in the upgradation of the CRJ series may be limited. This augurs well for the MRJ programme, as Bombardier has been a major player in the regional jet market. In addition, with a number of early build CRJ700s and CRJ900s and even the E175s coming up for replacement by 2020, there is potential for the MRJ90 to attract more buyers. However, there is also the potential for competition from the ARJ21, built by Commercial Aircraft Corporation of China (Comac) and the Superjet 100 built by Sukhoi, owned by Chinese and Russian governments respectively. Both are relatively new aircraft and the OEMs are looking to build a presence in the regional aircraft market.

The MRJ90 has some advantages both technical and in terms of sales prospects, over its Chinese and Russian counterparts. China faces the challenge of achieving certification in key markets. The ARJ21 project has been delayed by more than a decade and has not yet received certification from the main international aviation regulators including the United States’ Federal Aviation Administration (FAA). China’s recent endeavour with the MA60 turboprop has had limited traction and was the subject of a number of accidents. Comac has predominantly sold the ARJ21 to Chinese airlines or to countries that recognise the Chinese certification process.

As of August 2016, the ARJ21 had around 60 confirmed orders almost all for Chinese airlines.

The Sukhoi Superjet 100 on the other hand, is limited by the lack of certification from the US FAA. The aircraft has certification from several international aviation regulators including the European Aviation Safety Agency and does have some European and even Mexican airlines as its customers, however, the lack of FAA approval means the aircraft is currently excluded from the key market of the US.

The Ishka View

Mitsubishi needs to avoid any further significant programme delays if it is to achieve the desired success for its new aircraft. The MRJ90 clearly has a better opportunity of selling more aircraft in the North American, European and Asia-Pacific market than the ARJ21 and SSJ100 due to the technical (certification related) challenges affecting the Chinese and Russian programmes. Bombardier is meanwhile focused primarily on the larger C Series aircraft, inferring that the biggest challenge for Mitsubishi will come primarily from Embraer. The E175 is a popular aircraft commanding nearly 17% market share among all regional jets in operation today. With Embraer refreshing its E Series line-up, the new aircraft will continue to challenge the modern MRJ90.

How will lessors be affected?

Embraer has been more successful in selling its aircraft to the leasing market than Mitsubishi. Embraer’s E2 programme has already won orders from lessors including Aircastle and ILFC (now AerCap). MRJ may need to establish itself among airlines first before the major lessors feel comfortable with the untested OEM. However, lessors could begin ordering MRJ’s within two years if Mitsubishi can keep to its promised schedule for the programme and offer pricing that will incentivise early adoption.

How will airlines be affected?

MRJ’s existing orders could potentially be under threat if there are any further delays which would significantly harm the reputation of the programme. In service performance, once deliveries start, will be key to attracting new customers. In the meantime, MRJ will continue to seek early adopters to join the current launch customers.

Further Insights

Look out for our Insight piece next month assessing the risk that US union rules presents to both the MRJ90 and Embraer’s E2 programmes’ US sales effort.

Sign in to post a comment. If you don't have an account register here.