in Lessors & Asset managers , OEMs, Cargo & Engines , Aviation Banks and Lenders

Wednesday 3 May 2017

Engine trouble: Are airlines paying too much for hourly maintenance deals?

Engine manufacturers are tailoring a new generation of aftercare products to better accommodate the needs of aircraft lessors which acquire aircraft through sale and leaseback transactions. Current hourly usage agreements (HUAs) between an airline and an original equipment manufacturer (OEM) often fail to provide enough comfort to the lessors that acquire these planes through sale and leaseback transactions. Carriers are often having to either overpay, or else pay twice for their on-going maintenance contracts even after signing complex, and little understood, HUAs.

The Ishka View is that engine manufacturers and aircraft lessors need to work together to produce documentation that works for all three parties. Introducing an element of portability is crucial to this.

What’s wrong with hourly usage agreements?

The concept of an hourly usage agreement (HUA) (also called a flight hour agreement or a “power by the hour” agreement) has been around for a long time. The engine manufacturers offer such arrangements to secure the long-term provision of engine maintenance and parts but it is marketed to airlines as a means of providing them with predictable engine maintenance costs over an extended period of time. This is attractive to airlines as it allows them to generate accurate cost projections and hedge against cost spikes caused by engine overhauls.

Examples of HUA products available in the market include TotalCare by Rolls-Royce and OnPoint by GE and CFM. Aftermarket services, including HUAs and traditional “time and materials” maintenance, represents a significant part of most engine manufacturer profits. In 2016, 52% of Rolls-Royce’s underlying revenue stream of £7.07 billion came from aftermarket sales, compared to 48% for engine sales.

HUAs are, in general, a good thing for airlines but misunderstandings and market inconsistencies can cause complex and expensive problems for airlines. The form and coverage of HUAs provided by the engine manufacturers is both varied and ambiguous and so airlines have to understand what they want and need from the agreement. In effect, HUAs are a complex marriage between the legal and the technical.

“The key to these agreements, from an airline’s perspective, is to know what needs to be in there.” says Jim Bell, a partner at Bird & Bird. “This is where it’s hard as it’s not in the manufacturer’s interest to give you the answers and not many people know what is possible. This is where we step in and guide our clients to the best position.”

Aircraft lessors require airlines to pay maintenance reserves during the term of a lease, or maintenance compensation at the end of a lease, to cover the cost of future maintenance obligations, the amount is determined in line with the carrier’s “use” of the aircraft. The payments include amounts to cover the cost of the next engine performance restoration and the cost for the replacement of engine life limited parts. However, where the engines are supported under an HUA, the airline might already be paying the engine manufacturer for the same costs. This has left some airlines with the very expensive problem of paying twice.

The ‘portability’ solution

The solution to this problem is to make HUAs, or the sum of cash already paid to the engine manufacturer in respect of future maintenance, transferable to aircraft lessors and their future lessees. This is known as “portability.” Aircraft lessors do not generally like this solution but, with more and more airlines signing up to HUAs, it may be something that they need to get comfortable with.

“Portability under hourly usage agreements is one of the biggest issues affecting the aircraft leasing business right now.” Says Paul Briggs, a partner, Bird & Bird. “There is a lot of lessor competition in the market, and so the airlines have an abundance of choice. Lessors that are able to get their heads around the issues and accept portability of hourly usage agreements are going to have more leasing opportunities.”

Engine manufacturers are also wary of HUA portability because it means that they have to be far more transparent about the models used to determine hourly costs within their HUAs. However, most recognise it as a necessary and logical next step in the evolution of HUAs. Many of the leading engine manufacturers have told the market that they have, or are in the process of producing, aftermarket products that better accommodate the needs of aircraft lessors, but opinion in the market is sceptical.

In January 2017, Rolls-Royce launched its LessorCare programme which was developed in consultation with AerCap. Under the LessorCare programme, Rolls-Royce offers HUA portability to operating lessors under an Operating Lessor Engine Restoration Agreement (OPERA). The OPERA has been in existence for some time now but has been included within the LessorCare offering.

An OPERA is agreed between the aircraft lessor and the engine manufacturer in respect of each engine upon its delivery and entry into the HUA. Under an OPERA, when the aircraft is repossessed by the lessor – either at the end of the lease term or on a default – the lessor benefits from the cash paid by the airline under the HUA in the form of a credit note. When a performance restoration shop visit is required, the aircraft lessor will only be required to pay a “top up” fee to cover the difference between the cost of the shop visit and cash it has been credited with.

IAE’s V-Secure is different to an OPERA. Upon repossession of the engine by the aircraft lessor, the aircraft lessor may continue to make relevant payments under the HUA until the next lessee has accepted delivery of the engine and entered into a new HUA. If this is not possible, a credit note will be provided towards the next shop visit. Under V-Secure, the aircraft lessor commits to suspend the airline’s obligation to pay maintenance reserves or, as applicable, any end of lease compensation and agrees to support the engine manufacturer in persuading next lessee to enter into an HUA.

Life-based, or term-based pricing

HUA pricing is determined on either a “life” or “term” basis, sometimes referred to as “fully funded” or “partially funded”. OPERAs, V-Secure and other portability agreements are only made available by engine manufacturers where the HUA is life-based. Confusingly, HUAs do not specify whether the pricing is life-based or term-based, and the engine manufacturers rarely explain to airlines what this means and how it might affect their sale and leaseback transactions.

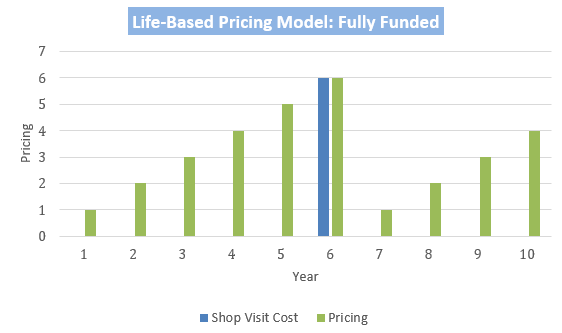

Graph 1 and Graph 2 provide examples of life-based and term-based pricing in HUAs. Life-based pricing, shown in Graph 1, is calculated based on the utility consumed over the full life of the engine (usually around 25 years) and not just the specific term of the HUA. Based on forecast utilisation of the engine, the engine manufacturer will estimate when the next performance restoration shop visit will be needed. The estimated cost of the shop visit will then be applied to the HUA pricing from the date of delivery of the engine and entry into the HUA until the forecast date of such shop visit.

Graph 1. Source: Ishka estimates

Life-based pricing is usually provided in the first proposal for an HUA, as it ensures that the engine manufacturer is fully funded before it completes the next performance restoration shop visit. Airlines then look at the pricing and ask the engine manufacturer to provide better pricing which is lower and evenly spread across the lease term. The easiest way for an engine manufacturer to reduce pricing but maintain its profit is to change the pricing to a term-based model.

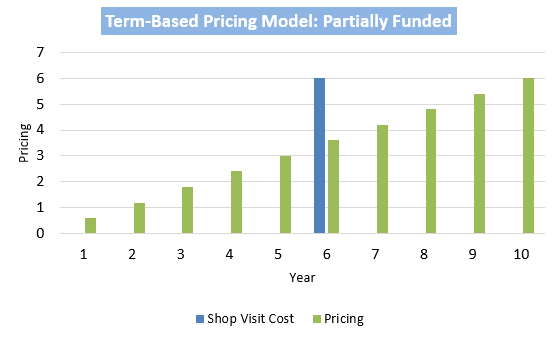

Term-based pricing, shown in Graph 2, is designed to cover a specific term, usually a lease term. In this scenario, the engine manufacturer will determine the number of performance restoration shop visits that will occur during the term (based on forecast of engine usage) and then seek to recover the estimated costs of such shop visits over the term. This means that, at the time of any shop visit, the engine manufacturer will not have received funds equal to the cost of the work, so it is only partially funded, but the manufacturer will be reimbursed for outstanding amounts during the remainder of the term.

Graph 2. Source: Ishka estimates

Under life-based pricing, the engine manufacturer effectively has funds on account for the next performance restoration shop visit on expiry of the term. In contrast, under term-based pricing, the engine manufacturer has no funds on account for the next shop visit on expiry of the term. Accordingly, there are no funds to be made available to the aircraft lessor or the next lessee and so an engine manufacturer would not be able to provide a portability agreement as there is no pot of funds to pass on.

Where the airline has agreed an HUA with life-based pricing, and provided it meets the aircraft lessor’s other requirements, the airline might be able to convince the aircraft lessor to accept a portability agreement with the engine manufacturer in place of maintenance reserves or end of lease compensation in respect of engine performance restoration and engine life limited parts.

Where the airline has agreed an HUA with term-based pricing, the aircraft lessor should still demand maintenance reserves or end of lease compensation in respect of engine performance restoration and engine life limited parts to cover the engine’s utilisation for the period from the date of the last engine performance restoration shop visit until the end of the HUA term.

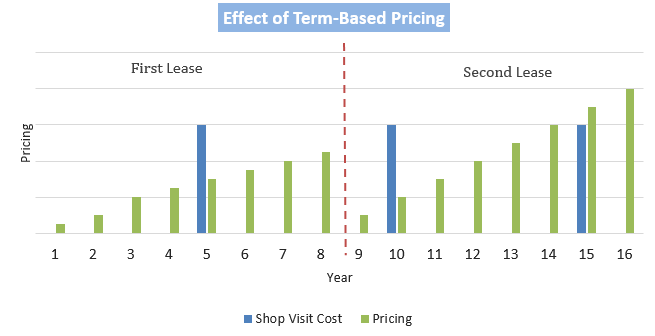

Graph 3. Source: Ishka estimates

Graph 3 provides an example of the impact of term-based pricing on future lessees. In this example, the first term has one forecast performance restoration shop visit and the second term has two forecast shop visits. The pricing for the second term is considerably higher. In contrast, if the manufacturer offered life-based pricing, the pricing would be consistent – albeit at a higher rate per hour – across both terms, subject to the operation utilisation profiles.

“Understanding life-based and term-based pricing is one of many hourly usage agreement considerations,” says Simon Phippard, counsel at Bird & Bird. “There is no market standard position and so their negotiation can be both challenging and time consuming. Where an airline is considering the entry into an hourly usage agreement, it should try to agree its form before completing engine selection as this is when it has the strongest bargaining position.”

Timing is a big consideration in ensuring that the airline is in the best possible position. It would make most sense to agree engine selection, the HUA, any relevant leases, and associated portability agreements at the same time to ensure that both the airline has a strong bargaining position with the engine manufacturer and the HUA, leases and portability agreements marry up correctly.

“Airlines should, wherever possible, involve prospective lessors in their negotiation of hourly usage agreements to ensure that both parties get what they need,” explains Bell. “This is often difficult in practice as there can be many months, if not years, between the entry into an hourly usage agreement and the entry into applicable leases, and so subsequent amendments may be required to one or other documents.”

Ishka View

Confusion over engine aftermarket products continues to cause an issue for engine manufacturers, aircraft lessors and airlines. Historically, HUAs were never designed with the interests of aircraft lessors in mind but engine manufacturers now see the aircraft lessors as an increasingly important customer and so, with time and increased understanding, the market should see better portability offerings.

The Ishka View is that the engine manufacturers and aircraft lessors should work together to produce documentation that works for all three parties. The engine manufacturers that get this right will likely have increased engine sales and the aircraft lessors that are able to accept portability solutions will have more leasing options. In the meantime, airlines and aircraft lessors should ensure that they obtain experienced legal and technical advice to ensure that they are adequately protecting their positions.

Sign in to post a comment. If you don't have an account register here.