FLY drops A320neo options

In what is a rather thought-provoking development, FLY Leasing has chosen not to exercise several opportunities it inherited as part of the AirAsia transaction. The original terms of the AirAsia acquisition deal provided the lessor with an option to buy up to 20 A320neo “naked”—not pre-placed on a lease with a specific operator—aircraft starting in 2019.

The lessor said at the time that any optional aircraft, if delivered, would be marketed by BBAM. Considering the popularity of the A320 family aircraft in the current market, FLY’s explanation for forgoing its 2019 purchase options was remarkably cagey. Speaking on behalf of FLY, the lessor’s top executive, Colm Barrington, said the company didn't exercise options for 2019 “for various reasons.” He also implied there was uncertainty as to whether the options beyond 2019 will be exercised either, noting that FLY was “evaluating [its[ options for 2020 and beyond." Barrington said the ultimate decision was predicated on “how [FLY] see[s] the leasing advancing markets at the time” and the cost of its financing. Ishka cannot help but conclude that softness in lease rates—whether driven by overcapacity or operators’ preference for current-generation aircraft, or both—is the underlying reason for FLY’s decision not to pursue the A320neo optionality.

FLY sells aircraft to ABS issuers

FLY Leasing’s positive results in Q1 2019 belie the magnitude of the remarketing challenge the lessor has faced in recent months. FLY moved quickly to repossess its 3 Boeing 737-800 aircraft from Jet Airways’ fleet upon the airline’s bankruptcy filing early in the year, of which two have already been committed to new operators. The lessor says Jet’s cash security deposits and maintenance reserves will be sufficient to cover both the failed airline’s missed payments and any maintenance-related expenses that may be needed as part of transitioning the Jet aircraft to other carriers. The Jet repossessions came on top of FLY’s other AOG aircraft, three of which are slated to be parked, and the other three are still being actively marketed.

FLY has also been in the market disposing of aircraft. The firm sold aircraft in Q1, and a further 11 aircraft have been either committed for sale or already sold through the end of Q3 2019. Of those, nine have reportedly been placed into an unidentified ABS, and the lessor indicated more aircraft from the portfolio may be earmarked for placement into ABS structures later in the year.

The proceeds from the sales transacted so far are expected to be in excess of $400 million, and the lessor says it has achieved a 12% premium to book value on disposals in Q1—a marked increase on both the volume and low-digit premium levels FLY achieved as recently as 12 months previously. It is not clear how many of the sold aircraft are from the AirAsia portfolio acquired last year.

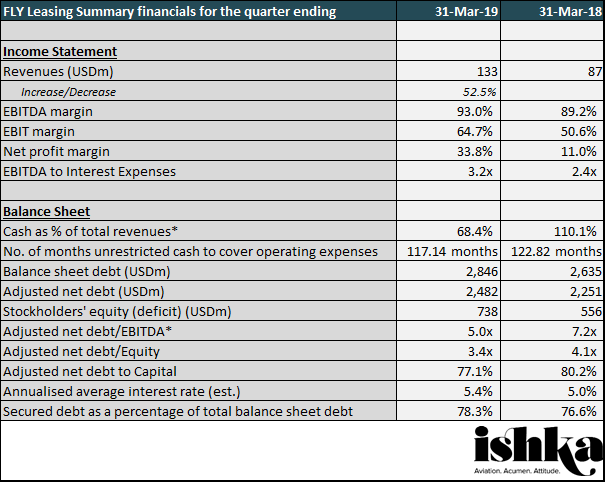

The lessor’s active trading in the quarter has contributed to de-levering the capital structure in the wake of the AirAsia deal—an important consideration for credit ratings agencies—bringing the leverage ratio to 3.4x, down from 4.0x at the end of 2018. However, other credit metrics continue to stand in sharp contrast to the peer group. For example, FLY has one of the highest proportions of secured debt (80% of its overall debt burden) among the top global lessors. It is a marker of FLY’s heterodox strategy in a marketplace where most top lessors have been moving methodically and consistently to an unsecured business model. FLY claims that a funding strategy based on long-term, amortizing secured debt insulates it from the uncertainties of capital markets which, judging by historic precedents, may become unavailable for refinancing on short notice in case of a downturn.

None of the above detracts from the fact that FLY has been very successful in translating the purchase of the AirAsia portfolio into a stronger platform, both in operational and financial terms. The lessor increased its lease rents by 18% in Q1 2019 versus the same quarter the year prior while at the same time trimming the cost base, including on the SG&A side. As a result, adjusted net income nearly tripled to $47.2 million versus the comparable period last year, leading to a dramatic increase in ROE from single digits just 12 months previously to 26% in Q1 2019.

Click here to download the data behind the chart.

The Ishka View

FLY’s acquisition of the AirAsia portfolio appears to have strengthened the platform, both operationally and financially. Both credit and equity metrics for Q1 2019 are reflective of FLY’s improved performance versus the year prior. After a somewhat anaemic period, the lessor’s trading has kicked into a higher gear and generated very respectable gains on sales. Ishka is intrigued by FLY’s decision to forgo the optionality associated with the legacy AirAsia A320neo orders and will continue to monitor the space for signs of a softening market.

.png)

.svg.png)

Sign in to post a comment. If you don't have an account register here.