Friday 27 January 2017

LCC comparison – WestJet versus IndiGo

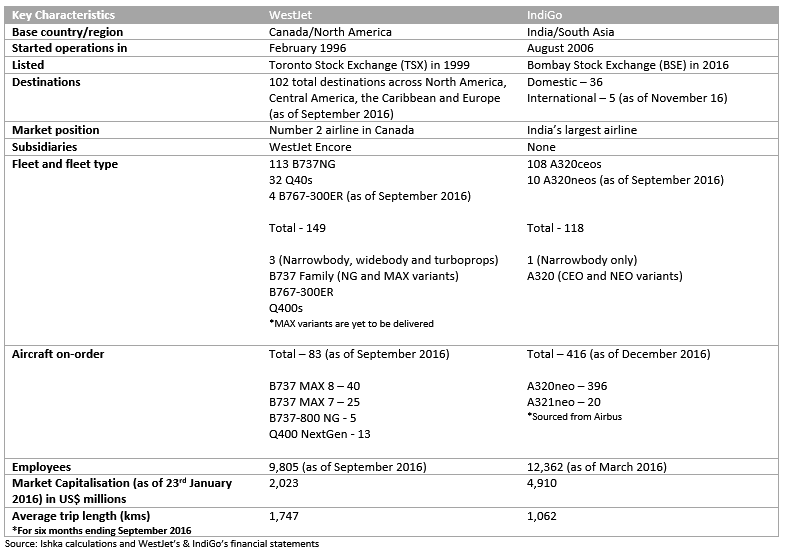

Canada’s WestJet and India’s IndiGo are among the most efficiently-run airlines in the world. Both have enjoyed long periods of profitability and are fundamentally robust. At the heart, both are low-cost airlines and operate primarily a narrowbody fleet. However, despite the similarities, there are some key variations in their business models, long-term strategies and overall aspirations mainly due to the different market dynamics. While IndiGo operates in the fast-growing Indian aviation market, WestJet operates in a more mature Canadian/North American market. Ishka looks at the key similarities and differences between the two low-cost carriers and how the market dynamics affect both airlines’ key per unit performance indicators despite generating equivalent revenues and profitability.

Similar yet different

IndiGo, has been, and plans to operate only a single type of narrowbody aircraft, the A320 Family. WestJet recently added a few widebody aircraft to its fleet as it seeks to expand into the North Atlantic market. The Canadian airline also has a sizeable fleet of Q400s that it uses on thinner regional routes. IndiGo has one of the largest orderbooks in the world with more than 400 aircraft on order as it aspires to capture the booming Indian market. WestJet, on the other hand, has around 80 aircraft on order as it seeks to increase frequency on existing routes, add new routes and also to replace current generation technology aircraft with new generation. As of now, IndiGo is primarily a domestic operator with less than 10% of its revenues generated from the international segment. On the contrary, nearly half of WestJet’s capacity is deployed on transborder and international segment. This, too, is a function of their respective markets.

Twice as many passengers generate similar profitability

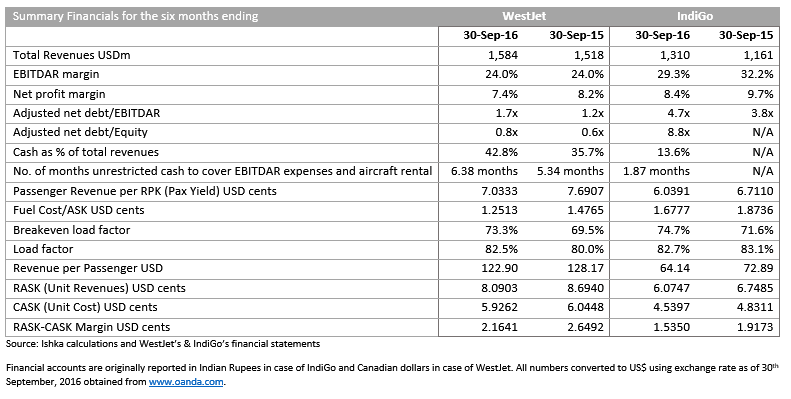

IndiGo and WestJet earn more or less equivalent amount in terms of revenues. Both airlines earn close to $1.5 billion and also generate identical net profitability margins. The two airlines also have matching load factors. However, digging deeper there are some key differences between the two airlines especially in terms of per unit data. These variations are a function of the inherent characteristics of the respective operating environments of the two airlines.

Despite being the fastest growing aviation market in the world, the Indian aviation sector is still extremely challenging to operate in. The biggest challenge being the price sensitive nature of the Indian flyer which is reflected in the revenues per passenger of each airline. As can be seen from the table, while WestJet roughly earns $120 per passenger, IndiGo’s revenue per passenger is almost half of that at $60. To make the difference even more pronounced, Canada is also one of the costliest air travel markets in the world. As a result, IndiGo had to carry nearly twice as many passengers as WestJet in the six months to September 2016 in-order to earn the same level of profit margins as WestJet. The price pressure also keeps the spread between unit revenues and unit cost much narrower for IndiGo compared to WestJet.

Traditionally, fuel price (aviation turbine fuel) has always been relatively more expensive in India compared to other markets. As a result, some Indian airlines (having international operations) sometimes prefer to source fuel from non-Indian cities. IndiGo’s fuel cost per ASK during the six months ending September 2016 was roughly 1.3 times that of WestJet’s during the same period.

In terms of balance sheet strength, WestJet edges past IndiGo in relative terms. This is as a result of WestJet’s consistently profitable operations over a longer duration which has allowed them to keep their leverage minimal while maintaining a strong liquidity position. IndiGo, on the other hand, is no laggard in terms of financial strength. It too has enjoyed consistent profitability for a number of years and is the most profitable airline in India. It is one of fastest growing low-cost airlines in the world and it has achieved its growth in a relatively shorter period compared to WestJet. The Indian carrier has relied primarily on sale leasebacks for aircraft financing requirements. As a result, a substantial number of IndiGo’s aircraft are on operating lease – nearly 82% (as of September 2016) and more on finance lease. This makes the airline relatively more leveraged compared to WestJet which has only 28% of its total fleet on operating lease.

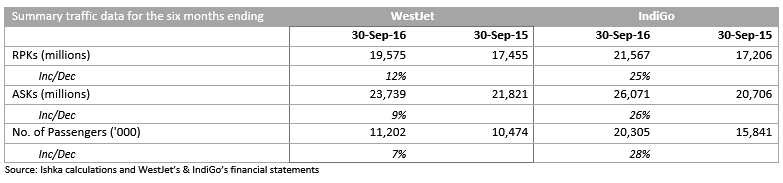

IndiGo’s traffic growth reflects the Indian market’s dynamics

Measured by ASKs, IndiGo, which started a decade later than WestJet is already larger than its Canadian rival. It carried twice as many passengers during the six months ending September 2016. While IndiGo has been fairly disciplined with its growth, it has the advantage of operating in the fastest growing market in the world allowing it to achieve the kind of growth it has managed to achieve and aspires to accomplish going ahead.

The differences in some of these key operational numbers is a reflection of the different operating environments of the two airlines which also influences their aspirations. While WestJet has a modest, but still fairly large, orderbook of 80 aircraft, IndiGo has aims to grab a bigger share of the fastest growing market in the world with an orderbook in excess of 400 aircraft.

Contrasting market dynamics

The base markets of both airlines are as contrasting as they can be, not just in macroeconomic terms, but also demographically. India is currently the fastest growing aviation market in the world where traffic is growing faster than capacity. As per IATA’s latest available traffic statistics, while domestic capacity (as measured by ASKs) in India grew by 21.5% during January to November 2016, traffic growth (as measured by RPKs) during the same period was 23.2%.

In contrast, capacity in North America grew by 3.7% while traffic was up by 3.2% during the same period which is not surprising considering it is mature market. In terms of the usual macroeconomic data, there are significant differences as well. Canada is reliant on its oil and gas revenues and the fall in oil prices had a negative impact on the Canadian economy. In-order to manage the softness in the market, WestJet responded by adjusting capacity out of Alberta, a key market for the airline into the eastern side of the country where the economy was relatively stronger. North America, in general, continued to be affected by falling unit revenues all throughout 2016 mainly as a result of price pressures due to fare discounting by several carriers. India, on the other hand, remains, and has also briefly beaten China, to become the fastest growing major economy in the world.

Interestingly though, like Canadian airlines, the fortunes of Indian airlines, too, are heavily dependent on oil prices, even more so because of the cost conscious Indian flyer that resist fare increases. Therefore, a rise in the cost of aviation turbine fuel cannot be easily and immediately passed onto the flyers. This makes it even more challenging for airlines to manage their spread (unit revenue and unit cost) once the fuel prices start to rise. Ishka will soon be publishing a detailed report on the Indian aviation sector which will cover the characteristics of the sector more in-depth.

The Ishka View

Both, WestJet and IndiGo face their unique set of challenges as a result of being based in completely diverse environments. Both airlines have different set of aspirations as well – while IndiGo aims to stick with operating a single fleet type – the A320 Family, WestJet, has, and is aiming to bring further diversity in its business model. It is not difficult to see why. IndiGo has a significantly large and promising market it can make further inroads into efficiently using the A320 and the A321. In contrast, WestJet operates in a mature market with significantly less growth prospects and therefore needs to look at other avenues of growth, which in WestJet’s case is the North Atlantic long-haul market using a widebody fleet. Despite the variations in their approach, both airlines remain two of the most efficiently run airlines and are likely to remain so in the foreseeable future.

Sign in to post a comment. If you don't have an account register here.