in Lessors & Asset managers , Lessor finances

Tuesday 18 April 2017

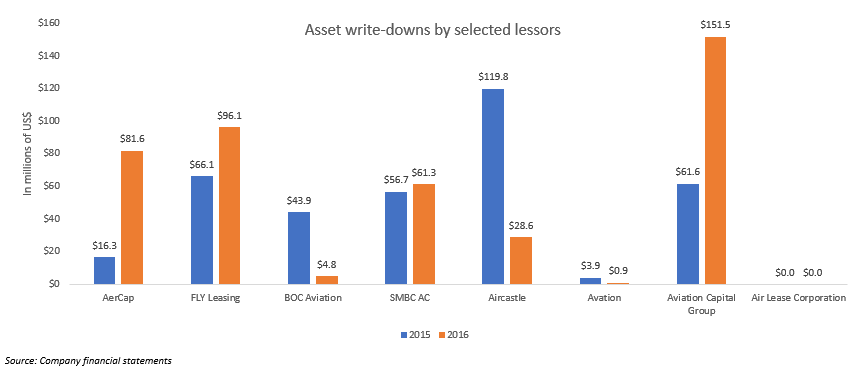

Lessors report higher write-downs for 2016

Four of the eight lessors with public financials have recorded higher impairments for 2016 compared to 2015. AerCap, Fly Leasing, BOC Aviation (BOCA), SMBC AC, Aircastle, Avation and Aviation Capital Group (ACG) have reported a collective write-down of $425 million for aircraft assets in 2016, around 15% higher than their combined $368 million impairment charge of 2015. The bulk of the figure is down to ACG’s $152 million write-down and FLY’s $96 million impairment charge.

In a previous Insight (Predicting the next wave of lessor impairments), Ishka analysed the trends in asset impairments by major lessors and highlighted how- and to what extent- these lessors were exposed to further impairments. The study found that many lessors still had several assets in their portfolio that Ishka identified as having a high-risk of possible impairments within the next three years.

The Ishka View is that viewed collectively last year’s impairments represent only a fraction of the lessors total fleets which now easily exceed $50 billion, but some lessors appear more prone to impairments than others. Impairments will remain a lingering issue for some lessors as airlines' fleet preferences begin to change ahead of the transition to new technology aircraft. Some lessors have already been busy ‘de-risking’ their portfolio through the sale of several older and technologically obsolescent metal. However, the influx of numerous younger aircraft in the next five years and changing market subtleties will continue to affect the expected cash flows and residual values of some previous generation aircraft. Many of the public lessors have already reorganised their fleets making it less likely they will suffer a large one-off impairment charge (relative to their balance sheet) in the next two to three years. What is more concerning is the relatively young age of some the assets written-down by a few of the lessors. Most impairment charges have been for substantially older aircraft, however SMBC and ACG impaired relatively young assets aged between seven to 15 years during 2016.

As can be seen from the chart above, most lessors recorded higher impairment charges in 2016 relative to 2015, in some cases more than doubling the losses over the previous year. Two lessors with relatively large impairments included FLY and Aviation Capital Group (ACG) which wrote-down approximately 4% and 2% of the net book value of assets in 2016. While majority of FLY's impairments were for mid-life and mid-to-end-of-life widebody aircraft, it also wrote-down values of some of its narrowbody aircraft.

SMBC AC and ACG both recorded impairment charges on assets that were on average less than 15 years of age, contrary to the trend so far in which mostly mid-to-end-of-life assets suffered decline in values. In fact, the majority of ACG’s impairments come from assets less than 15 years of age. The lessor wrote-down 19 of 26 aircraft aged 15 years or more under its ownership as of December 2016, resulting in impairments of $59.5 million - just one-third of the lessor’s total impairment charge for the year. The remaining two-thirds of the lessor’s write-down for 2016 is accountable to assets younger than 15 years. Similarly, SMBC in its 2016 financial statement highlights the impairment charge for the year was for assets with an average age of 7.5 years. In both cases, the exact details of each individual aircraft impaired are not explicitly known, neither is the methodology of how these lessors have calculated the average age of the impaired assets. Usually, lessors tend to calculate the weighted average age of their portfolio by weighting them against the net book values of aircraft. As a result, the average age tends to be lower than normal weighting using the number of aircraft. Nevertheless, the lower average age of assets written-down is a noteworthy development.

Between 2015 and 2016, most lessors have been engaged in selling several of their older assets in-order to ‘de-risk’ their portfolio. With most of the vulnerable assets already sold-off or written-down, lessors like Aircastle and BOC Aviation (BOCA) have recorded significantly lower impairment charges in 2016. By the first half of 2016, BOCA had sold all its aircraft older than 10 years and all out-of-production aircraft which as per the lessor helped to significantly limit its impairment charges during the year. Similarly, Aircastle too meaningfully reduced its exposure to some of high-risk assets particularly older converted freighters nearing their end of useful economic lives and some older technology passenger aircraft like the 757-200s and the A330-200s. And despite the five-fold increase, AerCap’s impairment charge was a negligible portion of the lessor’s $32 billion asset size. By the virtue of its business model and fleet management strategy, Air Lease Corporation has so far never been subjected to asset write-downs.

The Ishka View

On average, the eight lessors with public accounts recorded higher impairment charges in 2016 relative to 2015. Collectively, the total impairment charge was $425 million, around 15% higher than 2015. The major lessors have been actively ‘de-risking’ their portfolio and have sold several older and technologically obsolescent aircraft. Despite this, the Ishka View is that impairments will remain a lingering issue for some lessors as airlines prepare to transition to newer technology aircraft. Airlines and lessors both have sizeable orderbooks in the next five years for new aircraft types. The changing market dynamics will continue to affect the expected cash flows and residual values of many previous generation aircraft. However, many of the public lessors have already reorganised their fleets making it less likely they will suffer a large one-off impairment charge (relative to their balance sheet) in the next two to three years. BOCA and Aircastle appear to have started this process earlier than their peers with significant write-downs in previous years.

The total write-down of the eight lessors in 2016 still only represents a tiny percentage of the collective value of their portfolio. However, as noted earlier what interests Ishka is the average age of some of the assets that were recently written-down. SMBC and ACG, both, reduced the carrying values of assets that were on average between seven and 15 years of age, considerably younger than the usual average age cited in most impairment charges. It remains to be seen whether this is a wider trend and to what extent, if any, young to mid-life assets may be becoming more vulnerable to write-downs.

Disclaimer: This research and analysis is based on publicly available data. Out of the universe of lessors, a limited number are publicly traded. Please use caution when interpreting the data. While AWAS also makes its financial accounts public, the latest results were not yet available as of this writing.

Sign in to post a comment. If you don't have an account register here.