in Lessors & Asset managers , Airline trends & analysis

Wednesday 20 March 2019

Jet Airways faces repossession crisis

Jet Airways has reached a critical juncture in the negotiations for its survival, with potential rescuers Etihad and the State Bank of India (SBI) locking horns as more aircraft are grounded. India’s aviation authority, the DGCA, estimates that only one-third of the fleet remains operational. The rest is sitting idle in airports throughout the country or, in the case of a few aircraft, being returned to their respective lessors.

As Ishka goes to press on 20th March, Indian newspapers were reporting that Etihad had offered to sell its 24% stake on the airline, leaving lenders led by the SBI to come up with an alternative rescue plan. Jet Airways filed a clarification with the Bombay Stock Exchange saying the “stakeholders” remain “closely engaged to arrive at a mutually acceptable solution.”

Ishka understands that leasing companies exposed to the ailing carrier are uncertain about the airline’s survival prospects. Details about the negotiations are leaked to the press every day, but much of the information is unreliable.

One thing is clear: Jet Airways is running out of time. According to the DGCA, flight cancellations triggered by the groundings have reduced capacity to around a fifth from a year earlier. The airline is now the fourth biggest carrier by capacity, not the second. Pilots are threatening a strike from April 1 over unpaid salaries. The airline is defaulting on interest payments. And lessors are starting to look at remarketing their aircraft.

Ishka examines the current state of Jet Airways’ leased fleet, the latest moves by lessors and the pressures keeping it afloat.

A looming election and insolvency crisis

The Indian government is resolute in preventing major bankruptcies and job losses before the country goes to the polls in April and May – including at Jet Airways, with over 20,000 employees. As part of that effort, the government is understood to be pressuring state-owned banks, led by the SBI, to rescue the airline through a debt-for-equity swap. This would give the banks a controlling stake in the carrier which would, in turn, encourage other equity investors to make funds available, helping the airline gets its cashflow back on track.

But while it may be in the Indian government’s interest to rescue the airline, the carrier’s fate will be out of their control if the cash injection does not come early enough. Money is urgently needed to pay salaries and return leased aircraft to operation. Industry sources say lessors grounding aircraft expect at least one month of lease dues to be paid before their aircraft can return to operation.

Earlier this month, Fly Leasing CEO Colm Barrington told analysts during a results call that the lessor is waiting for “the airline to approve all its restructuring” with SBI, but if they are unable to “get that done” by the end of March, they would take out aircraft and redeploy them.

The clock is ticking for lessors

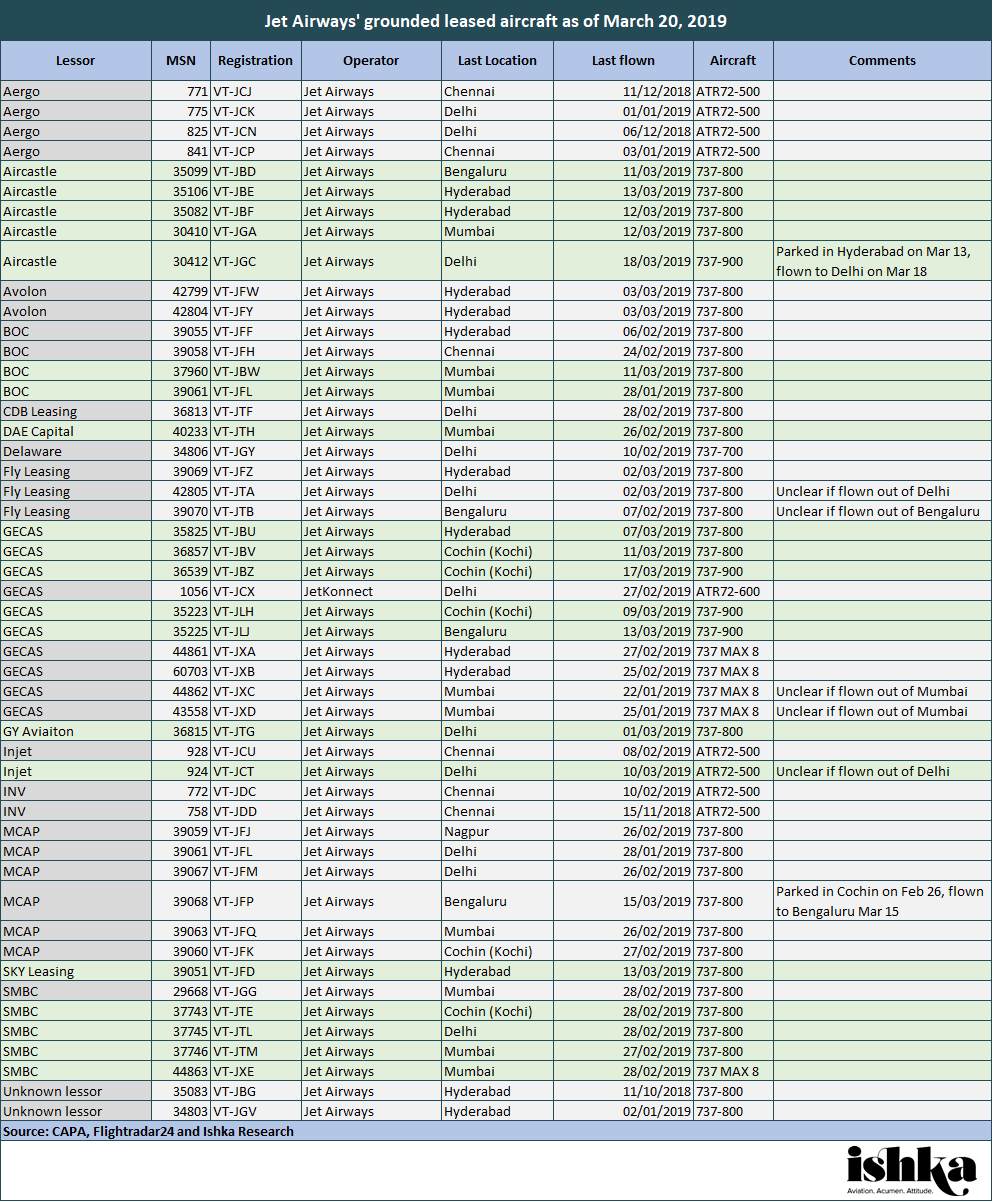

Click here to download the data behind the chart

Source: CAPA, Flightradar24 and Ishka Research

Green indicates aircraft added since the last update (See Ishka's earlier Insight).

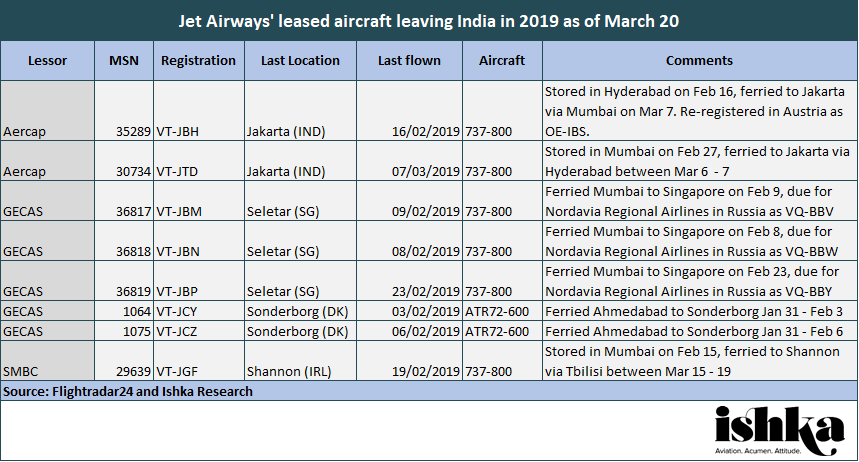

Click here to download the data behind the chart

According to the DGCA, only 41 aircraft remain operational at Jet Airways. Ishka was able to identify 50 leased aircraft grounded at Indian airports as of 20th March, 46 of them since the start of 2019. Since Ishka’s last update (see Ishka’s earlier Insight) which reflected 35 aircraft, 20 new aircraft have been identified as grounded, three have left India (reflected in the second table) and two returned to operation: a BOC 737-800 NG (MSN 39057) and an Aergo ATR72-500 (MSN 793).

Click here to download the data behind the chart

Source: CAPA, Flightradar24 and Ishka Research

Click here to download the data behind the chart

Meanwhile, some lessors have taken aircraft out of India following negotiation with the airline. Ishka understands that these aircraft had only one or two years left on their leases. Since Ishka’s last update (see Ishka’s earlier Insight), three GECAS 737 NGs parked in Singapore have been re-registered in Russia and are due for Nordavia Regional Airlines. Two Aercap 737 NGs were ferried to Jakarta and one (MSN 35289) has been registered in Austria. Separately, SMBC ferried another 737 NG out of India to Shannon in Ireland earlier this week.

The Ishka View

While it is difficult to get an accurate estimation of Jet Airways’ current fleet size, it appears to be quietly shrinking. Lessors know that if the airline was to be declared insolvent their chances of getting out their aircraft in a timely manner would diminish. But if unchecked, the airline’s shrinking fleet could push it closer towards bankruptcy.

Last week BOC Aviation CEO Robert Martin told Bloomberg that the company is seeing “quite a lot of demand” for Boeing 737 NGs and BOC would seek to redeploy theirs if efforts to rescue the airline fall through. Ishka understands that BOC Aviation has 10 NGs with Jet Airways: six in operation and four grounded, according to Flightradar24 data.

Market interest in the NGs is believed to have increased following the grounding of the newer MAX version after the Ethiopian and Lion Air crashes. On 20th March, several reports in Indian newspapers claimed Indian LCC SpiceJet had received offers by lessors for Jet Airways’ NGs to replace its grounded fleet of 12 MAX 8s. But while lessors may be relieved to know that NGs may not be that hard to remarket in the current environment, Jet Airways’ demise would not play to their advantage.

Besides losing a large customer and having to transition Jet’s aircraft into new leases, pushing the airline over the cliff with repossessions would have two other side effects. First, it could create legal hurdles for lessors wanting to take control of their assets due to the unclear enforceability of the Cape Town Convention in India (see Ishka’s earlier Insight). And second, Jet Airways is believed to have 225 MAXs on order. Many lessors have placed MAXs with Jet Airways but in some cases not delivered them yet. If the airline did go bust these lessors would have a considerable MAX remarketing challenge.

Sign in to post a comment. If you don't have an account register here.