in Investor Briefings , Other , Aviation Banks and Lenders

Tuesday 13 December 2016

Managing the next cycle

Aviation finance has already hit a cyclical peak according to an audience of financiers, airlines and lessors which met in London last week for Ishka’s inaugural conference.

The conference, titled, Managing the Next Cycle, was split broadly between three themes: identifying what might prompt the next downturn, assessing the likely impact and finally, strategies on how to best mitigate that risk.

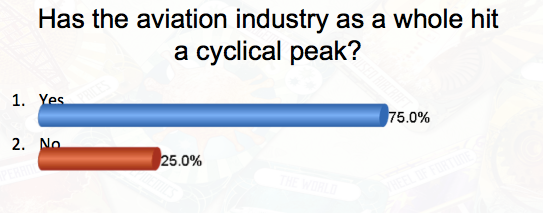

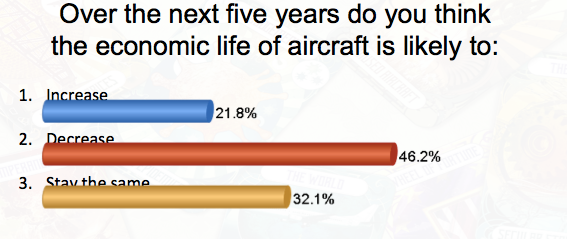

Around 75% of delegates believed that the aviation industry, as a whole, had already reached a cyclical peak, while a further 46.2% believed that the economic life of aircraft was likely to shorten over the next five years.

The Ishka View is that there appeared to be consensus that the aviation industry was exhibiting signs of heading towards a downturn. Traffic figures suggest early signs of overcapacity while lease rates, for many assets, remain keenly competitive. Drivers discussed at the conference for the next downturn include rising fuel prices and interest rate rises, as well as foreign exchange risk.

Current state of the market

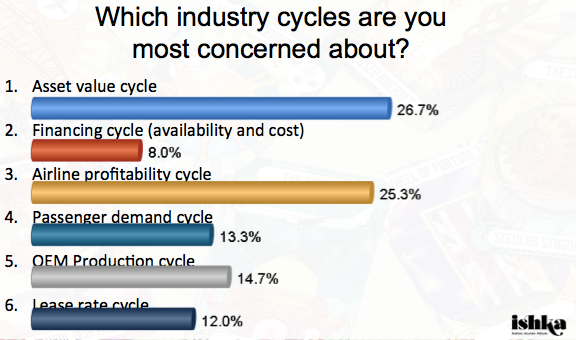

One of the immediate debates centered on defining which of the various cycles was the most pressing, and important, for aviation investors. Delegates appeared to be concerned that aircraft asset prices and lease rates are set to suffer over the next 12 months.

83.1% of delegates believe that over the next ten years, relative to the last ten years, aircraft depreciation rates were likely to accelerate.

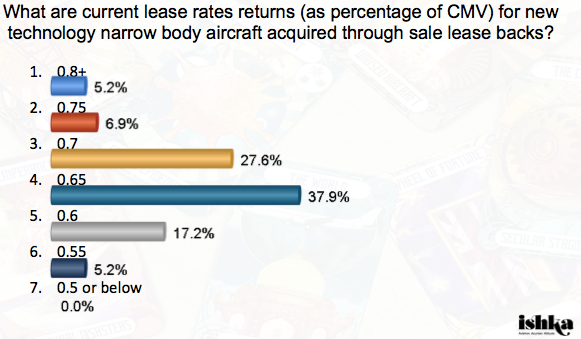

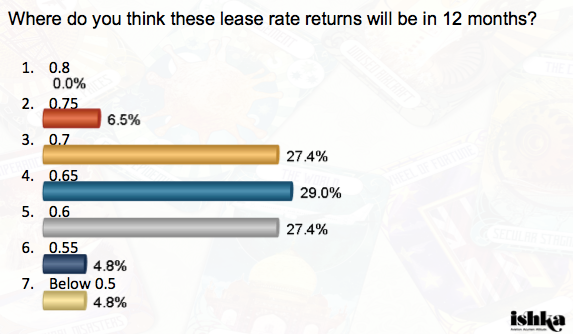

Delegates also believed that lease rates returns (as a percentage of CMV) for new technology narrow body aircraft through sale/leasebacks is currently tight, (37.9% estimated that returns were at a lease rate factor of 0.65) and likely to tighten over the 12 months.

Cycles and drivers

One of the key questions asked was in regards to what should investors be monitoring when assessing or preparing for a downturn. The consensus, from the panellists, is that the large macro economic drivers of yield, traffic, and GDP as fuel prices were still the best general indicators for market behaviour.

Manufacturers appear to have learnt from previous crises. After both the Gulf War and 9/11 airlines were faced with incoming aircraft deliveries at the same time as demand was dropping and airlines were seeking to reduce capacity. However OEMs appear to be more disciplined in controlling their production rates. In a future crisis financiers and lessors were confident that Airbus and Boeing would seek to cut production rates. Airframe and engine OEMs at the event did stress that production cuts were difficult to achieve, as they were disruptive to their suppliers and the supply chain as a whole, but nonetheless possible.

Recent aviation crises have been caused by a range of factors. These have included: oil supply fears, terrorism, health scares, a lack of adequate financial regulation, public health events and natural disasters.

However, the immediate risk for the worst type of crisis tends to be overcapacity, and depending on the severity of the crisis, this creates an increase in parked and stored aircraft. This has put subsequent pressure on older aircraft values, and accelerated the demise of older aircraft technology.

Fuel and the financial crisis

The most recent aviation dislocation was the global financial crisis, which drastically reduced the availability of funding for airlines. The aviation industry, through the support of lessors and export credit agencies, was able to survive this crisis relatively unscathed.

The abundance of liquidity and new investors into the sector is one reason why there appeared to be little concern about the lack of financing as a cycle to watch. This is despite the current absence of export credit agencies in the market place, and the risk of onerous new regulation from the latest Basel III amendments, which could deter banks from lending against aircraft assets.

Another potential driver discussed was fuel. Fuel is an airline’s single biggest cost and the predicted rise in fuel prices was identified as a potential key driver for a future crisis. Bankers believed that even if fuel hit $60 a barrel in 2017 most airlines are hedged, and that any real impact of fuel prices would occur in 2018 rather than next year.

Managing a crisis

The discussion throughout the course of the day threw up a variety of potential management strategies to help aviation investors through a crisis. One of those most frequently identified was to continually monitor key drivers and indicators to understand which phase of the cycle the industry is experiencing. Crisis drivers were identified as macro level events ranging from oil supply to political disruption and a slowdown in GDP.

General crisis indicators however were industry level factors which included traffic/capacity, airline profits, and aircraft supply and demand. However, as one speaker highlighted, traffic growth is not strongly correlated across different regions, which has the benefit of mitigating geopolitical risk but makes forecasts more problematic for investors.

Delegates discussed a range of potential management strategies that investors and airlines are either already employing, or are expected to deploy, in the expectation of a downturn. The most recent trend, according to delegates, involves lessors arranging leases with long terms but lower returns with good credits, in an attempt to mitigate the downside risks of a crisis. Many lessors are looking to sell older assets with the view that young aircraft with long leases are more likely to weather a downturn. Airlines themselves have become more disciplined in using lessors as a means to return aircraft and reduce capacity when needed. New technology aircraft remained more desirable following an immediate market dislocation but there was more debate on the perceived attractiveness of wide body aircraft assets.

Key questions raised at the conference

- How attractive are wide body assets, particularly in a crisis?

- Will regulatory issues force banks away from the aviation sector and could this prompt asset sales as banks look to reduce the capital held on their books against aircraft assets?

- How faithful is institutional investors appetite, if interest rates were to rise and investors found better returns away from aviation?

- What will happen when the ‘new lessors’ face their first remarketing tests?

The Ishka View

Delegates agreed that the industry has already hit a cyclical peak, with lease rates becoming increasingly competitive. One reason for this has been the abundance of new lessors aggressively acquiring assets through sale/leasebacks. Another, has been the willingness of lessors to agree long leases with relatively low returns with better credits as a risk mitigants.

However, one of the problems in managing a crisis is to monitor not just how an individual airline is performing but the whole sector. Airlines are easier to assess but understanding the whole aviation space and the potential impact on aircraft values remains challenging.

Managing the cycle well relies on a variety of strategies. Investing in highly liquid assets helps, ideally with new technology, but one of the most reliable strategies is still to choose a good management team. The quality of either the investor management team itself, or that of the lessor it is partnered with, is probably one of the best investments to help manage through a crisis.

The better the management team, the better the risk controls, the better geographic distribution of assets and generally the better the relationship with clients. In addition, better management teams have strong remarketing capabilities, and the ability to react quickly to a deteriorating situation or credit.

Sign in to post a comment. If you don't have an account register here.