in Capital Markets , Investor Briefings

Tuesday 14 February 2017

2016 capital markets review: Investors embrace lessor deals

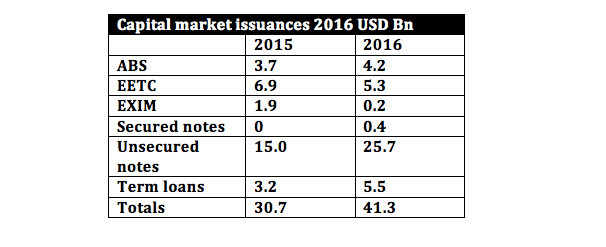

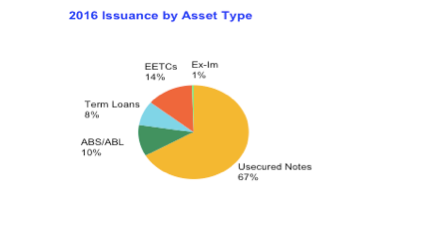

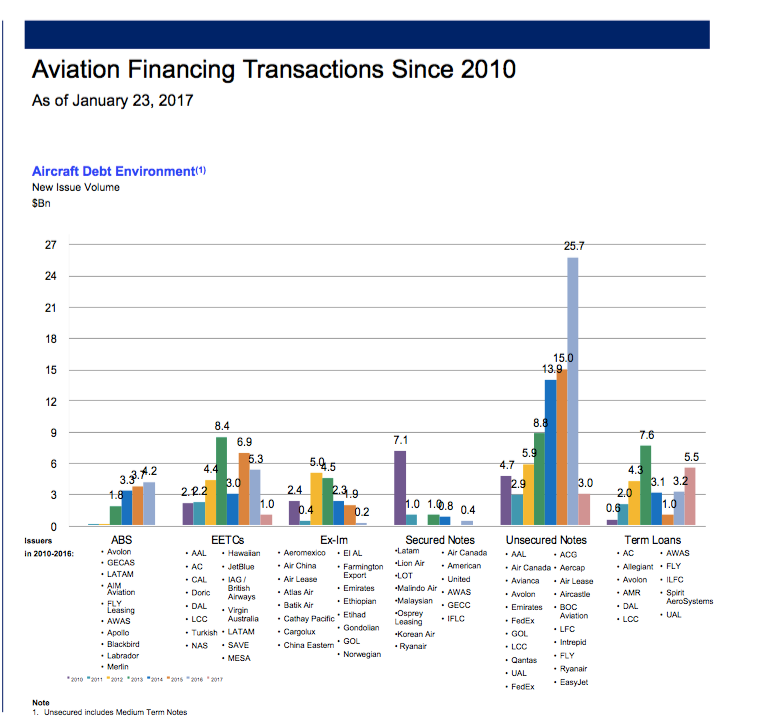

Last year saw more than a $10 billion jump to $41.3 billion, equivalent to a 34% increase, in total aviation US capital market issuances compared to 2015. Nearly all of this rise can be attributed to unsecured bonds for both airlines and aircraft lessors. The increased level of issuances is a further sign that a growing number of investors are warming to aviation credits, while increased issuance has helped lessors achieve investor recognition. Issuances have been assisted by the improved credit worthiness of some of the larger lessors and the better-performing airlines. In addition the flurry of unsecured issuances also underscored the appetite of investors searching for returns in a low-yield environment.

Capital market transactions have steadily increased despite a robust and healthy bank market. The Ishka View is that this is a reflection of the increasing capital requirements of some of the larger lessors and airlines, as well as the continued appetite of an expanding universe of investors. Some of the more frequent issuers have remained top credits but capital market issuers relate to a relatively small group of airlines and lessors, predominantly based in the US. Certain popular capital debt structures, such as Enhanced Equipment Trust Certificates (EETCs), are limited to a small pool of US airlines, and reflect the strength and continued performance of the US airlines compared to the rest of the world. The promise of more EETC issuances from Latin American airlines, for instance, never materialised as GDP slowed across South America, most notably in Brazil.

Source Ishka Calculations Source Morgan Stanley

Going unsecured

As mentioned there was a 71.3% increase in unsecured notes from $15 billion in 2015 to $25.7 billion in 2016, which accounted for the significant rise in the number of total issuance for 2016 of $41.3 billion compared to $30.7 billion in 2015.

Aircraft lessors were enthusiastic issuers of unsecured notes. ALC and AerCap have issued unsecured debt along with SMBC Aviation Capital which issued a $500 million senior unsecured bond. There were also notable transactions from several lessors including new issuers. This indicates the continued trend of widening access to new names such as Goshawk Aviation Limited (Goshawk) which completed a debut $231 million unsecured bond split between a five-year and a seven-year tenors.

Source: Morgan Stanley

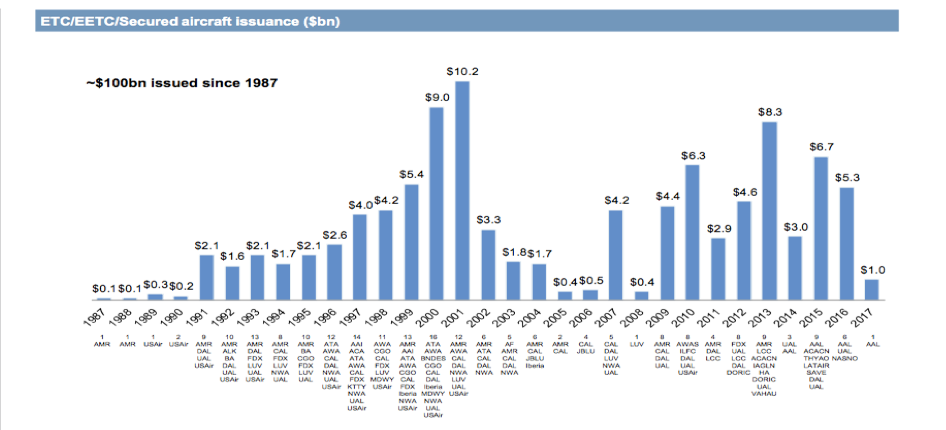

EETCs never took off for Latin American issuers

There were an accumulative total of $5.3 billion of enhanced equipment trust certificates (EETC) transactions in 2016. Only three airlines issued EETCs last year: American Airlines (, United Continental and Norwegian Air Shuttle. Structurally last year’s EETC relied predominantly on the AA/A tranche structure. The popularity of this format also helped drive pricing. Despite, or because of, the fact there were relatively few ETTC issued last year all of the deals issued received a warm reception from investors. Airlines chose to increase the size of their issuances in response to investor demand. Pricing for EETC remained extremely competitive in 2016 with United Continental succeeding in issuing the first EETC to achieve a coupon below 3%. United Continental's $919.6 million EETC was split between a 12-year $636.5 million Class AA notes and had an initial loan to value (LTV) of 38.7% and a weighted average life (WAL) of 9.1 years with a coupon of 2.875%. The 12-year $283.1 million Class A notes had an initial LTV of 55.8% and a WAL of 9.1 years, priced at 3.100%. However, United remains the only airline to have achieved this feat last year. American Airlines’ (AA) 2016 AA tranches priced between 3.5% -3.2% in 2016 while its single A tranches priced between 4.1%- 3.65%.

There was limited EETC issuance by international borrowers in 2016. The EETC market has been traditionally dominated by US airlines. However, over the last four years there has been a steady increase of EETC-type transactions from non-US airlines including Air Canada, British Airways, Virgin Australia, Turkish Airlines and LATAM. 2016 was notable for the fact that many of these airlines chose to avoid using the EETC market for different reasons. Air Canada did not have the delivery stream of incoming aircraft to justify a EETC. While Turkish Airlines suffered from passenger drop and political uncertainty in Turkey – making the EETC market either untenable or too expensive to pursue. Similarly the decline in GDP and passenger traffic in Brazil in 2016 delayed, or stalled a much anticipated spate of potential EETC issuances from Latin carriers which were focused instead on managing excess capacity and raising fresh equity to manage their crisis.

One notable exception to this rule last year was Norwegian Air Shuttle’s debut EETC. The European airline issued a $349.125 million to fund 10 new 737-800s and was split between two tranches. The $274.315 million 12-year class A certificates had an initial LTV of 55.1% and a coupon of 4.875%. The seven-year $74.81 million class B certificates had an initial LTV of 69.3% and a coupon of 7.500%. Morgan Stanley arranged the deal and Natixis provided the liquidity facility. In a similar vein American Airline succeeded in attracting a broader range of investors for its EETC transaction. The airline issued an approximate total of $2.2 billion worth of EETCs last year according to its SEC filings. The airline issued a $227 million B tranche, which unusually for a US airline, it placed 80% with Asian and European investors, according to deal sources.

Source Morgan Stanley, Boeing, J.P. Morgan as of Jan 13 2017

ABS transactions continue to evolve

Last year saw a slight rise in the number of lessor asset backed securities (ABS). There was $500 million rise in lessor asset backed securities (ABS) deals of 13.5% compared to 2015 to a total of $4.7 billion. Last year there were six aircraft lessors ABS transactions on behalf of Aergen, Aviation Capital Group, Gecas, Air Lease Corporation’s joint venture Blackbird, Apollo Aviation Management, and Castlelake. The ABS market has been used predominantly used to help fund sub-investment grade lessors. Repeat issuers Castlelake, and Apollo have been successful in using the aircraft ABS market to finance older aircraft and the ABS market has become a primary funding tool.

ABS issuers can be split predominantly between those lessors using the ABS as a funding source, and other, generally better rated, lessors, using the ABS market to help achieve a true sale of a portfolio of aircraft. One notable transaction last year was ACG’s $250.8 million ABS Merlin Aviation Holdings. The deal was used to primarily achieve a sale of a portfolio of 18 older narrowbody aircraft to Avenue Capital Group arranged by Credit Suisse. The deal was unusual in that the sale of the portfolio was mostly of older B737-700/800 and A320-200s with an initial weighted average age of approximately 14.3 years. In addition the weighted average remaining term of the initial lease contracts was particularly short compare to other ABS deals at approximately 2.1 years. The deal is evidence of how the aircraft ABS market has been evolving with larger issuances, increased flexibility and a wider acceptance by investors of older aircraft as appropriate collateral.

Another stand out ABS deals for 2016 was the $800 million Blackbird Capital Aircraft Lease Securitization Limited 2016-1. The deal refinance Air Lease Corporation and Napier Park’s leasing joint venture and highlights the appeal of the ABS market for smaller leasing entities to raise debt at attractive levels. It also raises the possibility that other lessors might choose to use the ABS market to fund their sidecars in future.

The Ishka View

Both airlines and lessors are increasingly using the capital market to fund aircraft deliveries. However, the main driver for new issuances has undoubtedly been aircraft lessors. Boeing has forecasted that the capital markets will become the dominant form of debt financing for aircraft lessors in 2017 accounting for 37% of total expected debt issued. Not all lessors are equal and the capital market is increasingly becoming stratified with a group of investment grade, or near investment grade, lessors easily able to issue unsecured debt. Beneath these lessors is a separate group of leasing firms using the ABS market to fund older aircraft.

Both airlines and lessors have access to cheap bank debt. Financiers indicate that margins are now “bottoming” out of the aviation finance market but are still at low levels. Several airlines have chosen bank debt over potential EETCs simply because the market still rewards only the top airline credits with competitive pricing. As a result EETCs have been relatively scarce in 2016. One subtle change that is harder to quantify, is the interest from a wider group of investors. Arrangers state that last year saw renewed interest from new investors from Korea, the UK and the Netherlands as well as a growing pool of increasingly sophisticated US institutional investors.

Sign in to post a comment. If you don't have an account register here.