in Airline trends & analysis , Aviation financings , Lessor finances , Capital Markets

Friday 11 November 2016

AerCap: right size, not big size

Two years on from the purchase of ILFC, AerCap continues to take methodical steps to streamline the business while capitalizing on the reach and size of the combined platform to maintain a significant market share in global aircraft leasing. Its business model is based on a combination of lease placements for newly delivered aircraft, strong remarketing capability for used aircraft (including many out-of-production models) and an active trading strategy, positioning the company well to take advantage of both current high demand for lessors’ delivery slots and a bustling secondary market for used aviation assets.

The Ishka view is that AerCap’s focus on maximizing shareholder returns is justifiable by definition, and that a short-term deterioration in some of the elements of the company’s credit profile appear acceptable as part of long-term efforts to optimize the platform for all stakeholders. The company’s operational parameters are healthy, its customer base sufficiently diversified and pipeline for future deliveries dominated by popular, liquid types.

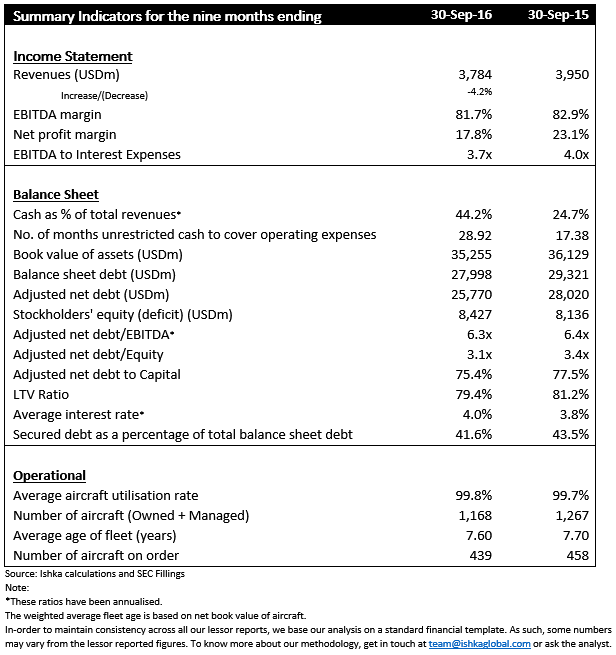

Nonetheless, the company’s Q3 2016 earnings report shows a deterioration in some of the primary credit metrics, such revenues, EBITDA and net interest margin relative to the same period in 2015, driven primarily by the company’s strategic decision to dispose of a large number of older aircraft, thus crystallizing lower gains on sale and effectively shrinking the lease asset base. The company’s metrics were also hit by higher composite interest rate on debt (4% vs 3.8% previously) and non-recurrent items relating to a strategic decision to wind down AerCap’s engine business, AeroTurbine.

The company’s adjusted ROE, at 11%, was also lower than in the previous reporting period. At the same time, AerCap has improved its liquidity position to $9 billion (including undrawn lines of credit, unrestricted cash and contracted asset sales), building up to 1.5x coverage of the next 12 months’ cash requirements, and brought its leverage ratio—from 3.1 down to 2.7—closer in line to those of its peers.

AerCap’s operational base remains solid, with 99.8% utilisation rate and the average remaining lease term of more than 6 years, for a fleet of 1,168 aircraft (including managed aircraft). In Q3 2016, the company purchased seven aircraft (including 1 x A320neo delivered to a North American operator) and leased or sold 143 aircraft (of those 20 were wide bodies). AerCap now placed 95% of new aircraft deliveries through 2018, all reportedly on 12-year leases. The company states that “the vast majority” of lease revenues for the next three years has now been contracted.

The seemingly mixed picture emerging from AerCap’s Q3 earnings report belies the uplift given to the company’s shareholders through an expansive share buyback programme over the past 18 months. The company repurchased more than 36 million shares at below-book levels with the approximate total of $1.5 billion and is earmarking further $250 million for another round of share repurchase. The cumulative effect of the buyback campaign has been a sought-after drop in leverage levels and an injection into the cash reserves, both of which provide a boost to the company’s creditworthiness.

Persistent appetite for assets in the secondary market has allowed the company to dispose of 103 older, legacy aircraft, with a total value of $2.3 billion in the nine months to September 30, 2016; this brings the total value of all AerCap’s aircraft sales since the ILFC acquisition to ca. $5 billion. In Q3 2016 alone, the company sold off 36 aircraft with an average age of 12 years, of which more than 40% were wide bodies (4 x A330s, 1x A340, 4 x 777-200ERs). On the delivery side, AerCap will join competitors in expecting some delays in 2017 deliveries of A320neo equipped with Pratt and Whitney engines; this should bring down the capex requirement.

Heard on the call

“[W]e have seen lease rates for new aircraft decline pro rata with interest rates, but that is nothing to be concerned about. If you are hedged correctly, your margin will hold up.”—Aengus Kelly

“[W]hat we are seeing is normal course of business. The deferrals [requested this year by Thai, GOL, Avianca, Delta, Southwest, American, LATAM for new aircraft deliveries from Boeing and Airbus] … are from public entities, but this is ongoing all the time with Boeing and Airbus and the customer base.”—Aengus Kelly

The Ishka View

Photo: Kurt Haubrich

Sign in to post a comment. If you don't have an account register here.