in Aviation financings , Other

Tuesday 14 November 2017

European aircraft deliveries update: Airbus and Boeing

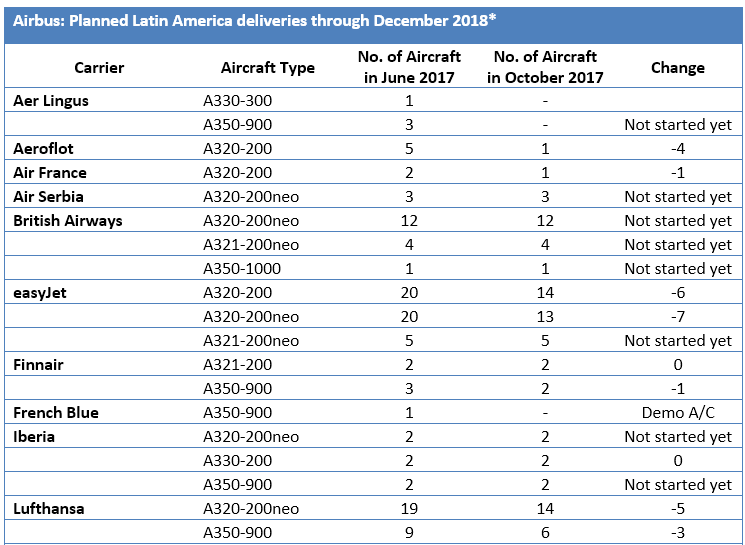

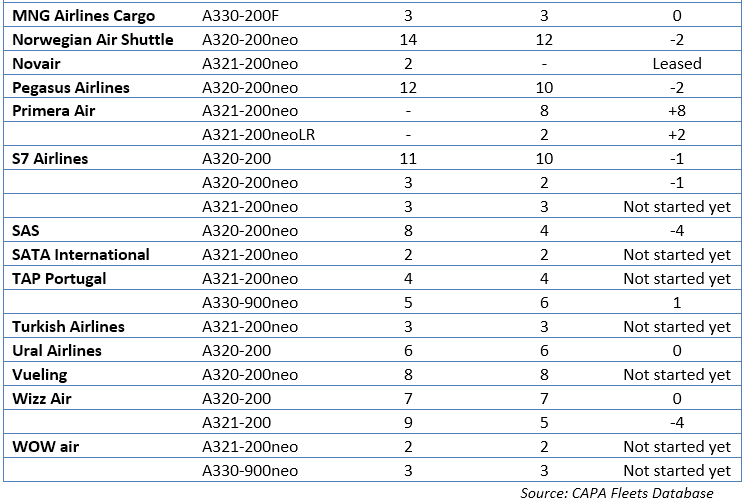

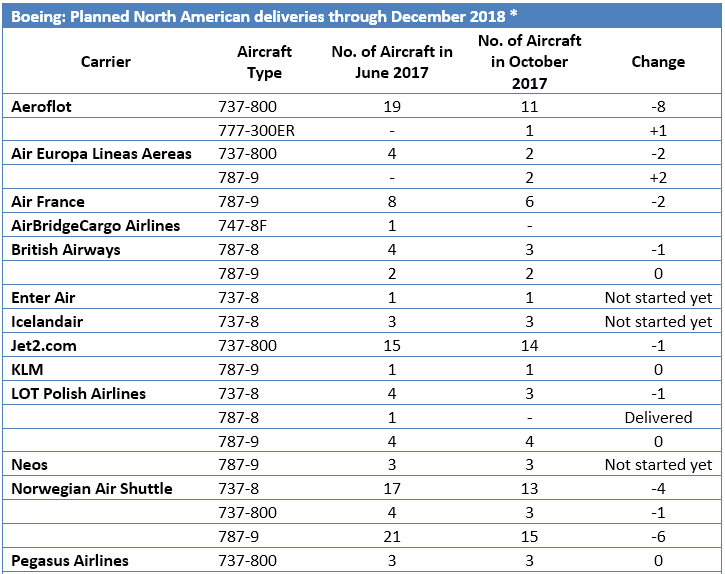

The proportion of aircraft scheduled to go to European airlines by the end of 2018 has crept up, partly owing to the fact that a larger proportion of aircraft are due for delivery in 2018. Indeed, for many of the airlines listed in the following tables, the backlog remains static as they await acceptance of both newer technology single- and twin-aisle aircraft. According to Ishka calculations based on CAPA Fleets data, around 24% of direct Airbus deliveries are scheduled to be delivered to European airlines, while for Boeing it is slightly lower - at 21%.

As with similar Insight reports, it is worth reminding the reader that recreating skyline deliveries is an inexact science as certain slots can be reassigned as the result of deferrals and, in certain instances, airline failures. Further, it considers directly delivered aircraft, rather than those being accepted indirectly through lessors.

Both of Aer Lingus’ A330 and A350 aircraft seem to have disappeared from the list, although it is thought that they are still due to start receiving A350s during 2018. Aeroflot have been taking a stream of A320ceo (and A321ceo) through Aerospace Trading Holdings Limited. One aircraft is still listed but research suggests this has already been accepted as well. Air France accepted one further A320ceo into its fleet in October 2017. It now has one further example of the type due for delivery.

There are a number of airlines awaiting delivery of existing technology aircraft or are scheduled to induct newer generation into their fleets by the end of 2018, and the acceptance of these has not changed over the last few months. This includes Air Serbia, which is due to take delivery of its first A320neo in the second half of 2018, although there remains a question mark over these as a result of the airline’s new business model, which is meant to make more use of its existing fleet. British Airways has a stream of A320neo, A321neo and A350-1000s all scheduled to begin, although the A350s are believed to now start in 2019. Staying within IAG, Iberia awaits its first A320neo and A350 deliveries; while it is due to take the last of its A330-200s. Vueling also has a stream of A320neo aircraft due to start in 2018 as part of the IAG order.

Other airlines in the same position include MNG Cargo Airlines, SATA International, TAP Portugal, THY, Ural Airlines and WOW Air.

Easyjet continues to take the delivery of A320ceo aircraft and is predicted to round-out the acceptance of these by the end of 2018. In the meantime, it began taking delivery of its first of 100 A320neo aircraft - with one aircraft in June 2017 and a second in July 2017. The flow of these continues throughout 2018, although the airline looks to have adjusted this number down slightly. Coupled with that, the airline is due to receive the first of 30 A321neo aircraft in summer 2018, having converted these from the A320neo.

Finnair is due to receive the last of its A321-200 aircraft by the end of 2018. The airline is due to phase out some of its oldest examples by 2022. It continues to receive deliveries of A350s which should be completed by 2023.

Lufthansa is maintaining a slow intake of A320neo aircraft, as it averages about one aircraft a month through 2018. The airline also has further A350 deliveries scheduled for 2018, having taken 5 of the type already.

The Norwegian Air Shuttle’s A320neo aircraft are being taken by its lessor subsidiary Arctic Aviation Assets for onward lease to other airlines.

The first of two A321neo’s to Novair were leased through ALC in June and August 2017 respectively. Latvian carrier Primera Air has appeared on the list and is scheduled to take A321neo aircraft having announced plans to begin transatlantic flights in 2018.

Also, SAS continues to take delivery of A320neo aircraft. Some of the aircraft are to be delivered to Scandinavian Airlines (Ireland) starting in late 2017, as it complements its production with a new air operator certificate (AOC) and bases outside Scandinavia.

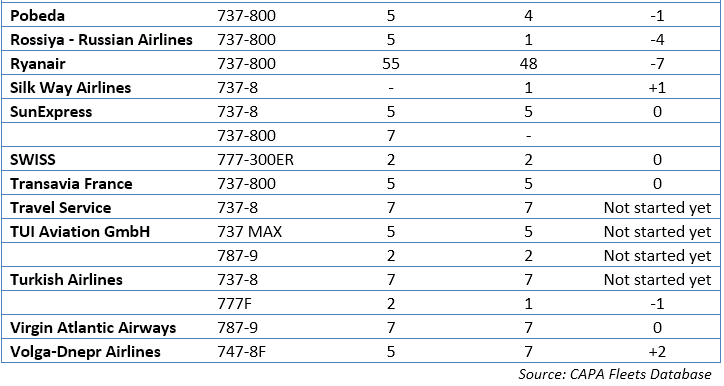

In a similar vein to the Airbus delivery horizon, there are a number of carriers where the figures have remained static as airlines await the acceptance of newer generation equipment. This applies to the likes of Enter Air, Icelandair, LOT Polish Airlines, Neos, Silk Way Airlines, SunExpress, Travel Service, TUI Aviation and THY, all of which are scheduled to begin taking delivery of the 737MAX going into 2018.

Outside of these, Aeroflot continues to receive 737-800s, which have been through Avia Capital Services and SB Leasing Ireland Limited, a subsidiary of Sberbank Leasing. It also has an additional 777-300ER earmarked for delivery in 2018. Air Europa has an order stream of 737-800s that continue to arrive at the airline. Having fulfilled its 787-8 order, the airline is due to begin receiving the first 787-9 variant in 2018 with the full complement due through to 2022. Out of a total of 18 aircraft, four are due to arrive through BOC Aviation.

The pace of deliveries to Air France for the 787 look set to pick up as the airlines add to the two existing -9s in its fleet. On the other side of ‘La Manche’ British Airways is likely to accept the remainder of its -8 and -9 variants of the 787. The airline also has twelve of the -10 on backlog, which have deliveries further out.

Jet2.com looks set to accept the remainder of its orders for the 737-800 by the end of 2018, maybe into 1H 2019. The airline topped-up its order for 30 aircraft with a further four examples in December 2016; with this batch being delivered from August 2018.

Norwegian Air Shuttle continues to be busy expanding its fleet apace with the arrival of further 737s (both the -800 and -8) and 787-9s

Pegasus Airlines, Pobeda, Rossiya - Russian Airlines, Ryanair and Transavia France all have 737-800s flowing into their respective fleets during 2018. The latter airline has a whole stack of aircraft due before it transfers to the MAX 200 – the first of which are scheduled to begin in 2019. The Irish airline took its first -800 in March 1999.

SWISS is due to take its final two 777-300ERs in 2018 from its order of ten aircraft; these having replaced the airlines A340-300s.

The Ishka View

Due to the geographical area and diversity of countries encompassing the European area, there is a whole variety of activity taking place throughout the region. A combination of legacy, low-cost and charter airlines also provides a range of opportunities from those airlines still growing their fleets with both ‘current’, and ‘newer’ technology aircraft; contrasting that with more established airlines in the process of inducting new aircraft type as part of their fleet renewal plans.

Sign in to post a comment. If you don't have an account register here.