Friday 3 February 2017

Indian carriers’ fleet debt strategies reviewed

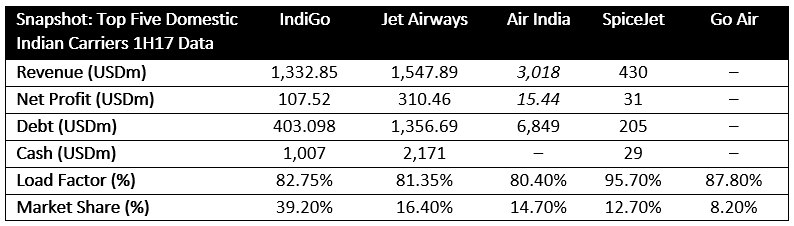

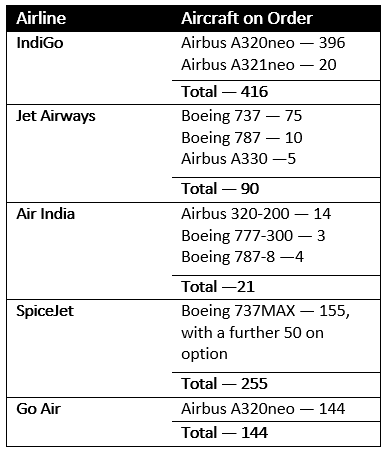

Ishka reviews how Indian carriers intend to fund their incoming aircraft. The top five domestic carriers by market share: IndiGo, Jet Airways, SpiceJet, Air India and Go Air, have firm orders for 876 aircraft as of January, 2017

India is set to overtake Japan as the world’s third largest in the next two years if current traffic growth is maintained. The domestic market grew by 23% in 2016, the third year of growth above 20%. Indian carriers have responded with a flurry of new aircraft orders in January.

The top five domestic carriers by market share: IndiGo, Jet Airways, SpiceJet, Air India and Go Air, have firm orders for 876 aircraft as of January, 2017. In this report, Ishka looks at the how they intend to finance these incoming deliveries and the considerable opportunities for financiers and lessors in the next few years.

The Ishka View is that lessors and lenders will continue to be attracted to Indian carrier’s strong airline profitability and heavy orderbooks. Indian carriers can boast of strong profits, robust load factors and, with the exception of flag carrier Air India, relatively low debt. There is plenty of demand for financing. Indian airlines are looking to raise a mixture of debt and equity as they seek assets to help them fight for market share in a highly competitive domestic market

Source: IndiGo, Jet Airways, SpiceJet, DGCA, and Ishka calculations

Italics = data for FY2016

Air India favours debt-funded deliveries

The nation’s flag-carrier has recently inducted 23 Boeing 787s into its fleet. Of these 21 were financed via a sale and lease-back transaction. The airline has another four 787s to be delivered. It plans to finance these, plus two that are already in service, by raising new debt. Air India also has 3 Boeing 777 aircraft due for delivery in 2018 and intends to continue its pivot away from costly leases.

Traditionally, Air India has opted for full purchases of its aircraft and has often made use of government guaranteed loans. Its existing fleet of 22 Boeing 787 aircraft made use of sale and leaseback transactions as part of the state-directed turnaround plan to improve cash levels and reduce losses.

Air India has approached government ministers with a plan to raise a 25-year loan from the Life Insurance Corporation, with a five-year moratorium, to fund the aircraft and may tap state banks for funds.

The airline posted its first full-year profit of $15.4 million in almost a decade for full year 2016. But the state-owned company continues to struggle under a very large (and growing) debt pile of $6.8 billion and is said to have posted a loss of $103.9 million in 1H17.

Consistent losses are likely to put off private lenders even as the carrier remains state owned. Instead it is likely to rely on state banks. However, Air India may have to restructure some of its debt to make it more attractive as it clearly needs cash to fund deliveries. The airline is said to be considering cash for equity under the government’s sustainable structuring of stressed assets scheme which would apply to around half of Air India’s current debt pile and would effectively open the door to privatisation.

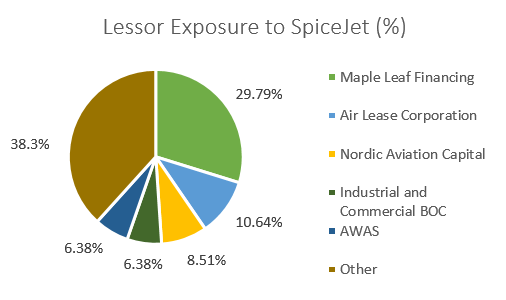

Sale and lease back ‘most preferred option’ for SpiceJet

SpiceJet is a de facto debt-free company with industry leading load factors of 95.7% for 1H17. See Ishka Insight: SpiceJet poised for explosive growth. For the time being, the airline has ruled out more debt or equity to finance its order for 155 Boeing 737MAX aircraft. Company founder and chairman, Ajay Singh says that sale and lease back is “the most preferred option” and has several offers already in place.

But as SpiceJet’s financial position continues to improve, the airline would ultimately like to own its fleet outright. “Going forward, we will also look at financing some of these planes and putting them on our books, backed by Ex-Im guarantees and other such mechanisms,” says Singh. More opportunities may arise as the airline has 50 options that can be converted to widebodies. An indication that the LCC may be targeting low-cost long-haul soon.

Source: CAPA

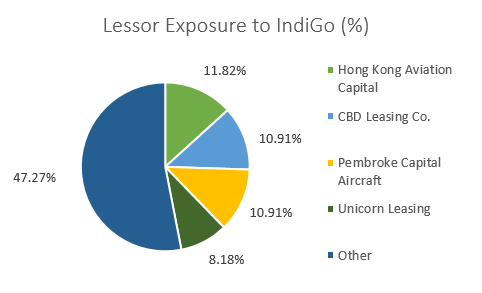

IndiGo phases out old fleet with sale and leasebacks

The airline predominantly uses the sale and lease back to fund its deliveries. Only 16 of 126 aircraft in its fleet are owned by the airline. It has a huge narrow body order for 396 Airbus A320neo aircraft and 20 Airbus A321neos. Despite delays to A320neo deliveries due to engine issues, IngiGo’s fleet is still expected to grow to 136 aircrafts by the end of March 2017, up from 126 in December 2016 and will grow by two aircraft a month through to March 2018.

The airline has agreed relatively short-term leases of about three years, for the new engine option (neo) aircraft it has taken delivery of. In the last quarter, IndiGo agreed a sale and leaseback on four aircraft in its existing fleet that are already owned by the airline. Vineet Mittal, VP Finance at IndiGo said: “The cash flow impact was really significant. It also helps us to phase out the older aircraft over the next seven years.” So, not only does IndiGo present leasing opportunities for incoming aircraft, but also for its current fleet of current engine option (ceo) aircraft.

Asked during a 2Q17 earnings call about the effect of increasing competition from Chinese lessors, Mittal said: “We have been using Chinese lessors to finance our fleet for a long time now [see chart above].” And agreed that it had made lease rates more favourable. “There has been a lot of competition which has been good for us.”

IndiGo is the Indian aviation leader in terms of domestic market share at 39.2% and is expected to grow to at least 50% in the next two years, and a has strong available cash positions at $1 billion. The airline the proceeds of its 2015 IPO to repay debt for eight out of 22 aircraft it had on finance lease. This reduced the carrier’s finance cost by 23.5%. The airline now has a stock market capitalisation of $5 billion. Currently the entire debt of IndiGo is aircraft related, and it has no working capital or capex loans

Source: CAPA

Go Air may use IPO cash to fund purchases

Go air may follow the example set by IndiGo and use proceeds from an IPO to fund incoming aircraft deliveries. Go Air remains a private company after delaying its IPO on the Mumbai Stock Exchange. The airline planned a $150 million flotation for a 23% stake. The IPO has been postponed with no scheduled timetable for resumption as yet.

The carrier has 144 Airbus A320neo aircraft on order. The company is said to want to achieve critical mass before floating on the stock exchange. It is currently the smallest airline in the top five by market share.

“Companies like us must look at funds to finance this [fleet expansion], as the airline will be four-five times bigger than today, says CEO Wolfgang Prock-Schauer. “There are many possible ways of doing this. It can be an IPO, or other ways of capital injection. All options are open and we are not in any rush.”

Jet Airways sitting on $2 billion cash pile

Jet Airways is unusual in India in having a majority Boeing fleet - a trend that it has continued in its order book. The carrier has 75 Boeing 737s, 10 Boeing 787s, and five Airbus A330 aircraft on order. Demonstrating that it is returning to long-haul operations

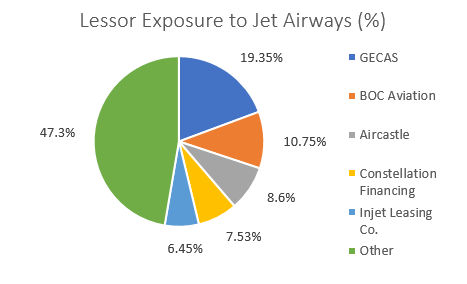

The airline plans to raise $100 million by March 2017 to refinance existing rupee-denominated debt. This will put the carrier in a better position to fund its incoming orders. In the past, aircraft acquisitions have been overwhelmingly financed through sale and leaseback transactions, which may partly explain the airline’s very strong cash position of around $2 billion. Of the 103 aircraft in Jet Airways’ current fleet, only ten are fully owned by the airline.

All the carrier’s recent overseas loans have been provided by Etihad Airways which holds a 24% stake in the airline, and has made no indication of a need to seek other sources of commercial debt.

Source: CAPA

Ishka View

Go Air, SpiceJet and IndiGo and Jet Airways have substantial financing needs in the short-term. .All three are seeking either commercial debt or sale and leaseback transactions to fund their incoming deliveries. Between them they have 815 aircraft on order. By contrast, state-owned Air India is likely to rely on state institutions for financing after turning away from the sale and leaseback market.

Increasing competition from Chinese lessors will help Indian airlines receive cheaper lease rates. Lenders may still be cautious about funding aircraft into India. Memories of the failure of Kingfisher Airlines has left some western lessors reticent about the risks in a market where the Cape Town Convention has not yet been fully incorporated into domestic law. Many of the aircraft repossessed from Kingfisher had been stripped of key parts, including engines.

The main constraint on traffic growth, and therefore airline profitability, is likely to be weak infrastructure. Airlines themselves will be fighting to ensure access to a range of aircraft assets to help them serve new routes as they seek to navigate around airport bottlenecks.

Sign in to post a comment. If you don't have an account register here.