ICBC Leasing shortlists buyers for 40 aircraft portfolio

Chinese leasing firm ICBC Leasing has shortlisted buyers for a portfolio of 40 leased aircraft as it conducts one of the largest aircraft portfolio sales of recent history. Ishka understands that the lessor began the second, and final, round of bids for the aircraft last Monday.

Ishka has heard from one potential buyer that the Chinese leasing firm has been rumoured to have contacted 100 potential buyers and received more than 85 bids for the leased aircraft.

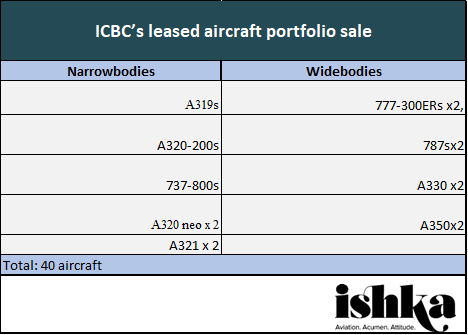

The portfolio is understood to contain eight widebodies and a mixture of narrowbody aircraft including 2016 vintage A320neo aircraft. The aircraft vintages range from 2010 to 2018 with full life return conditions.

“It is a complete mixture of assets, and they seem to have a bit of everything in there. You’re talking well over a $1 billion worth of assets. It is a lot of kit for the market to absorb at once but they are going out to market at a great time. I am not surprised there is a lot of interest,” comments one source.

One big question is how the portfolio may be split between separate buyers. Given the size of the portfolio it is unlikely that one single buyer is likely or willing to acquire the whole portfolio, and sources indicate ICBC Leasing appears to be examining even relatively smaller bids for two or three aircraft in order to achieve the best price for the portfolio.

The Ishka View

The largest leased aircraft portfolio trades, typically conducted by AerCap or GECAS (the two largest leasing companies), tend to include 25 aircraft as a rough maximum. At 40 aircraft, ICBC Leasing’s trade is a $1 billion-plus whopper with a wide range of assets. Buyers speculate that the portfolio may be motivated by ICBC’s wish to take advantage of a vibrant seller’s market to avoid having to remarket some of their older leased aircraft assets or aircraft on short-term leases. Ishka believes that –judging by the sheer range of assets and the fact that the portfolio includes several relatively young leased aircraft –the trade appears to be a widescale exercise by ICBC Leasing to reduce some of its airline credit concentration risk. There is clearly interest among investors and lessors for leased aircraft assets and Ishka believes that ICBC Leasing is likely to attract premiums bids for many assets.

.png)

.svg.png)

Sign in to post a comment. If you don't have an account register here.