Monday 21 November 2016

Q3 Analysis: Fly struggles to spend its cash

Is stiff competition for aviation assets a hallmark of a sellers’ market? In its Q3 earnings results released last week, Fly Leasing (FLY) became another lessor to report it has disposed of all the aircraft it had earmarked for sale at a premium to book value. Yet at the same time revised downward its capex expectations, stating that sufficiently attractive opportunities for aircraft purchases are becoming harder to source.

Eschewing “growth for growth’s sake,” the company says it will focus on enhancing shareholder value through share repurchases even as it seeks to acquire aircraft “opportunistically” and “selectively.” The Ishka view is that disciplined de-risking of the business model by a public lessor is a prudent strategy, especially in a highly active market marked by an apparent imbalance between acquisition and sales opportunities. However, questions remain about the lessor's potential growth. In a seller's market will FLY struggle to expand?

A shrinking lessor

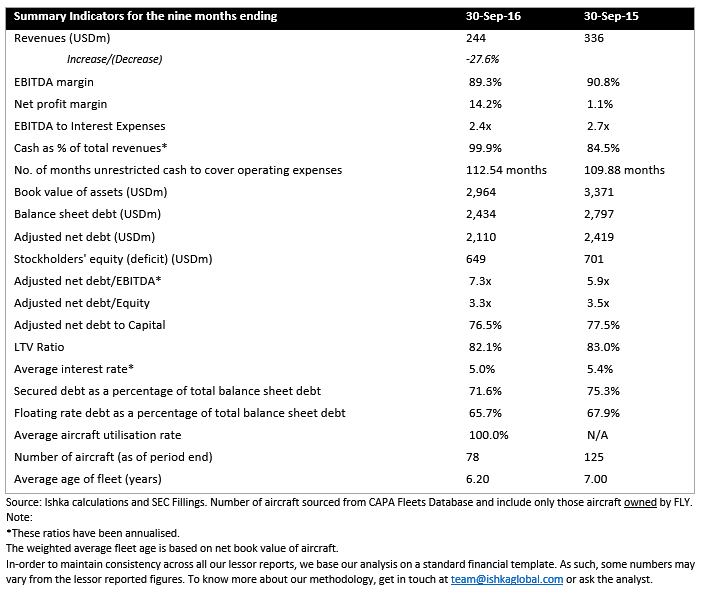

FLY’s fleet optimization is proceeding apace, buoyed by strong demand in the secondary market for middle-aged aircraft and continuing profitability at the lessee level. The lessor posted a 27.6% drop in revenues in the nine months to September 30, 2016, relative to the same period last year, against a smaller asset base. The disposal of 20 mostly older aircraft and purchases of eight new aircraft drove an improvement in the fleet metrics, with the average weighted age of the fleet decreasing from 7 to 6.2 years, the average remaining weighted lease term increasing to 6.7 years, and fleet utilisation registering at 100%, on par or better than the peer group. Nonetheless, return on equity deteriorated from 15.1% to 10.1% year-to-date despite an ambitious share buyback campaign.

The company’s credit profile showed improvement along several metrics. FLY’s liquidity position as measured by unrestricted cash to operating expenses ratio improved (from ca. 110 to ca. 112.5 months), as did net profit margin (from 1.1% to 14.2%). The company’s leverage ratio is higher at 3.3x than the peer group average (ca. 2.5x), and its 72% share of secured debt is higher than it was at the end of the same period last year, implying a high proportion of encumbered assets. The company says as a result of methodical de-risking of its capital structure, average debt maturities currently only marginally exceed average lease term (ca. 7 years vs 6.7 years); it also pursues a “conservative” approach to interest rate hedging in anticipation of interest rate hikes in the U.S.

In its Q3 earnings presentation, FLY largely echoed the bullish views of the peer group. The company says airline profitability underlies strong industry fundamentals, together with favourable trading conditions in the secondary market for mid-age aircraft and “robust” financing environment. The company forecast calls for “continuing strong demand” for FLY’s aircraft “without any sign of weakness,” citing high level of forward placements for 2017 and plans to sell further seven aircraft by year end at a premium to book value.

At the same time, Fly admitted its capex requirement will fall short of the projected $750 million, as the purchase pipeline has been adversely affected both by delays in the 2017 deliveries of the A320neo and a dearth of attractively priced assets.

In a comment on a persistent discount to book value shown by the shares of the publicly traded lessors, FLY management drew attention to what they see as the failure of the market to price in significant improvements in FLY’s credit and operational metrics and, more generally, the underlying value of the operating lessor business model.

Heard on the call

“Airlines appear to be maintaining or growing their fleet and we are noticing that they are making fleet decisions earlier suggesting confidence in future passenger demand.” (Steve Zissis)

“While it's difficult to generalize about lease rates, we have seen stable lease rates for the aircraft we have remarketed this year. And, in some cases, even slight improvements over their prior leases.” (Steve Zissis)

“[A]s the market kind of transitions and digest kind of the new elections, international growth, and higher interest rates and a stronger dollar we expect to see more opportunities in a lot of these emerging markets. So Latin America, Southeast Asia, Russia, even Ukraine and that's probably where you see us doing stuff, it's not going to be in the western markets.” (Steve Zissis)

“[W]e honestly believe that [all publicly traded aircraft lessors are] undervalued in this space especially where you see what aircraft can be traded at.” (Steven Zissis)

“If the dollar gets a lot stronger from here, it will hurt a lot of these low cost carriers that are operating in […] emerging markets. Oddly enough probably will present opportunities for us in our competitors because they will need capital and will be more likely to do sell leasebacks or do other stuff to raise capital.” (Steven Zissis)

The Ishka view

FLY’s fleet has shrunk from 125 aircraft assets to just 78 aircraft in 12 months. The Ishka view is that FLY's efforts to de-risk the fleet and bring its credit metrics closer in line with other listed operating lessors' are moves in the right direction. The lessor reported a drop of 27.6% drop in revenues in the nine months to September 30, 2016, relative to the same period last year, against a smaller asset base but its expenses have only declined slightly.

Its planned share repurchase programme will have a positive effect on ROE. However, the company will need to consider deploying some of the available $2 billion for high-quality capital expenditures to build out a platform supportive of sustained revenue growth. In a sellers’ market, the question is: how easily will FLY achieve this?

Sign in to post a comment. If you don't have an account register here.