Tuesday 30 August 2016

Aircraft lessors continue to perform despite being highly leveraged

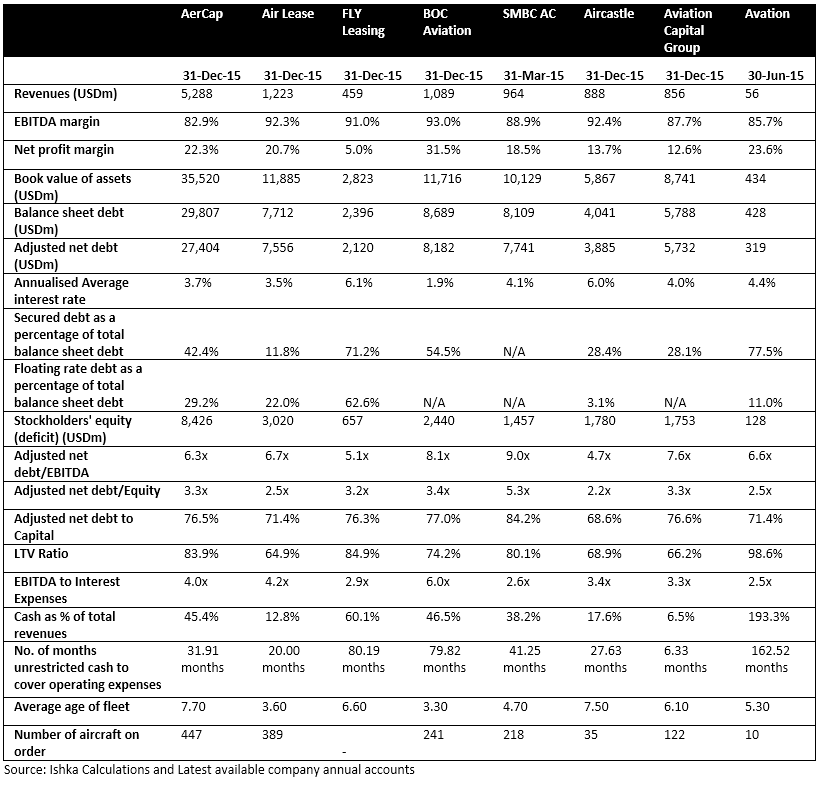

Aircraft leasing is a capital-intensive business and aircraft lessors remain highly leveraged. However, the larger lessors can boast enviable operating margins. Several lessors have become listed which has also helped optimise their capital structures. Ishka compares the public financials of AerCap, Air Lease Corporation, Aircastle, Aviation Capital Group, Avation, BOC Aviation, FLY Leasing and SMBC AC to assess their performance.

Key Financial Indicators (Latest available annual accounts)

A common theme across all lessors is the high level of debt. In addition, all the lessors reviewed operate with extremely enviable operating margins. They also had extremely high net profit margins, barring for FLY Leasing which had a 5% net profit margin - considerably lower than the rest of the group.

Most of the lessors have access to liquidity but compared to the very robust liquidity position of the whole group, Air Lease, Aircastle and Aviation Capital Group (ACG) have slightly modest cash reserves; particularly ACG with cash balances of just 6% of the trailing 12 months’ revenues.

From a coverage standpoint, unsurprisingly, all the above lessors appear to be on solid ground. With operating (EBITDA) margins above 80% for all the lessors reviewed, Ishka does not see any of the above lessors facing immediate difficulties with servicing their interest payments.

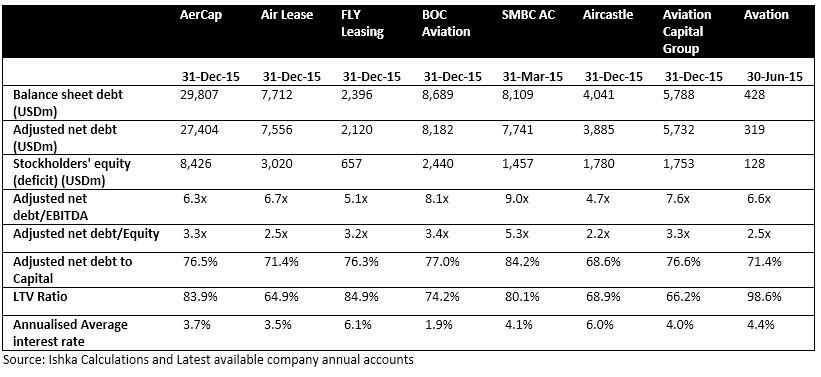

In terms of the proportion of secured debt within total balance sheet debt, a significant portion of total debt at FLY, BOC Aviation and Avation is backed by collateral. On the other hand, Air Lease, Aircastle and Aviation Capital Group have a greater proportion of unsecured debt. However, these three lessors are not as highly leveraged compared to other lessors mentioned above.

High leverage

All the lessors reviewed have relied substantially on debt to fund their asset acquisition. The average leverage for the above group is more than 4 times the equity, which, as Deloitte has highlighted recently, is among the highest for the financial services industry.

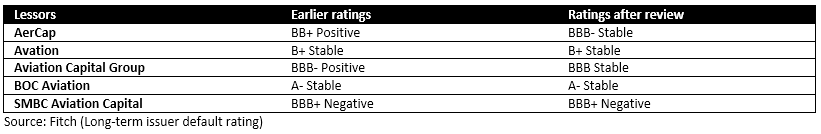

Ratings Upgrades

Ishka’s view is corroborated by the recently completed lessor review by Fitch. The credit rating agency upgraded two lessors and affirmed the ratings of the other three. While Fitch, too, highlights the high leverage of these lessors, it also identifies an improving trend in the leverage ratio of lessors during 2015 and 2016. Favourable market conditions, improvement in airline’s financial health and lower oil prices all contributed to ratings upgrades for AerCap and Aviation Capital Group and ratings affirmation for Avation, SMBC Aviation Capital and BOC Aviation Capital. However, Fitch also notes that some external challenges such as reliance on wholesale funding, the cyclical nature of the aviation business, growing competition in the aircraft leasing space and the residual value risk related to aircraft, all serve to limit further strengthening of their credit ratings.

Regulatory challenges

There are two impending regulatory changes that could have a negative impact on the aircraft leasing industry. The first is the new financial reporting standard that will change the way airlines report off-balance sheet financing. One of the attractions of leasing for airlines is that they could keep leased aircraft off balance sheet. It remains to be seen if the regulatory rule change will impact on the overall airline appetite for leasing.

Another regulatory change that could impact lessors is the Base Erosion and Profit Sharing (BEPS) project proposed by the OECD that aims to remove the loopholes in international taxation and minimise cases of tax avoidance. Among the multiple action points within this project, one proposed action point seeks to ensure that multinational firms with intra-group funding do not claim tax deductions on interest payments of such loans. As per Deloitte, this has the potential to impact the aircraft leasing industry as several of the lessors are institutionally supported and operate as subsidiaries of large financial services firms relying on intra-group funding. However, it is important to note that these proposals are in a discussion phase and still a couple of years away, consequently it is difficult at this stage to clearly pinpoint the negative impact of such regulations.

The Ishka View

Fundamentally, aircraft lessors are in as strong a position as they have even been. Both, margins and liquidity are extremely robust and with the market conditions still supportive, Ishka foresees a positive outlook overall for the aircraft leasing industry. The high leverage of aircraft lessors is a reflection of the nature of the industry and is not an immediate concern for investors while all other financial metrics appear solid. The proposed regulatory changes could have a substantial negative impact on lessor financials, however, with those changes being some years away, lessors have time to prepare.

Sign in to post a comment. If you don't have an account register here.