North American carriers yields hold up but rising fuel and labour costs hit operating profits

Following two record years of profitability, airlines entered 2018 with some significant headwinds and inflationary pressures. Crude oil prices have been climbing since late 2017, new labour contracts mean most airlines will see their employee bills going up and the increasingly testy trade relations between some of the major economies threatens to disrupt economic growth. Ishka reviews the 2018 first quarter performance of major airlines across North America to understand how airlines have fared compared to the same period of 2017 in light of the changing circumstances.

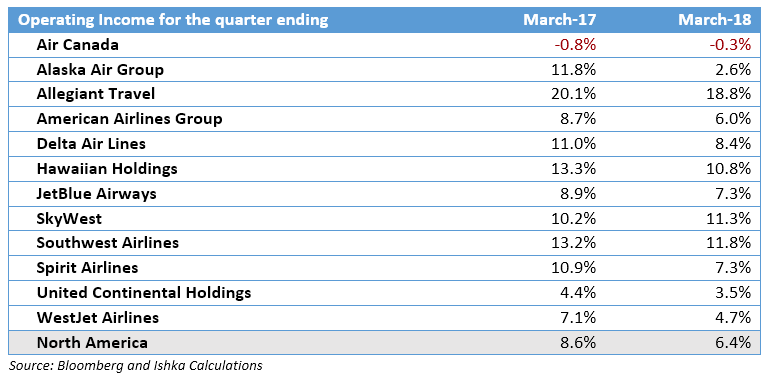

From an operational perspective, data suggests some compression in the operating profits during Q1 2018 compared to the same period a year ago as airlines adjust to the higher crude oil prices and labour expenses. A harsher winter, especially in the Northeast US in 2018 relative to 2017 further compounded the challenges for the quarter.

Among the biggest downward movers was Alaska, which recorded a significantly weaker 2018 quarter compared to 2017. As the integration with Virgin remains in progress, the airline continues to incur merger-related costs which coupled with an all-round increase in most of the other expense line items and falling yields meant the airline witnessed a compression in the operating profit.

Air Canada benefitted from a stronger revenue performance during the quarter. As a result, despite the jump in fuel expenses, the airline managed to shrink its operating loss in Q1 2018 (y-o-y basis). The Canadian flag carrier also enjoyed the favourable impact of a strong Canadian dollar which limited its US dollar outlays.

Most of the other airlines in the table above had to contend with the inflationary pressures of higher crude oil prices and labour expenses which lowered their operating profitability for the quarter.

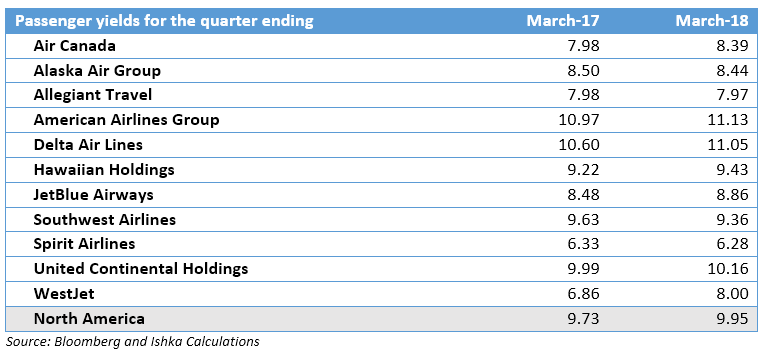

On a positive note though, airline yields continue to climb and recorded an y-o-y improvements during the 2018 first quarter for nearly all the major North American carriers. Yields improved across the board in North America with the only exceptions being some of the LCCs and ULCCs in the study.

As Ishka highlighted in an earlier report on airline yields (Have airline yields recovered for North American carriers?), the Canadian carriers are enjoying strong unit revenue performance on the back of a resurgence in economic conditions and greater demand from higher yielding domestic as well connecting traffic.

Meanwhile, the US network carriers attribute the positive yields to the strong demand conditions and partnerships with carriers in Europe, Latin America and the Pacific.

At the lower end of fare structure, however, the pricing environment remained very competitive. Both, Southwest and Spirit Airlines’ yields were under pressure due to fare wars.

Southwest also had to continue to contend with a number of other factors which further exerted downward pressure over its yields. The airline could not operate its normal schedule as the retirement of the Boeing 737-300 Classic fleet last year led to a temporary shortage of aircraft. Southwest’s yields will continue to remain under pressure until its normal schedule is restored. Finally, Southwest also believes that the Flight 1380 incident also led to some softness in bookings which added to the pressures on yield recovery.

The Ishka View

As expected the upward trend in the two major expense categories for airlines negatively impacted the operating margins of airlines during Q1 2018. However, the damage appears to have been limited by the strong recovery in yields. While there were exceptions, it appears that yields are now on the rise for most North American airlines and the coming quarters should see further improvements across that metric. But the question is whether it will be sufficient to cover the inflationary pressures. With demand likely to be stronger in the summer months and fewer likely weather-related disruptions, the conditions remain favourable for the recovery in the operating margins for the new few months.

.png)

.svg.png)

Sign in to post a comment. If you don't have an account register here.