in Capital Markets , Aviation Banks and Lenders

Thursday 5 December 2019

Aircraft ABS: GECAS prices STARR 2019-2

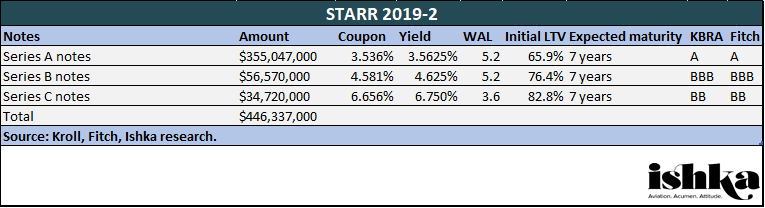

GECAS has priced a $446.337 million ABS, STARR 2019-2 (START III) which will be used to acquire a portfolio of 20 narrowbody aircraft.

The debt notes are split between the $355 million Series A notes which achieved a coupon of 3.536% and a yield of 3.5625%; $56.5 million Series B notes with a coupon of 4.581% and a yield of 4.625%; and $34.7 million Series C notes with a coupon of 6.656% and a yield of 6.75%.

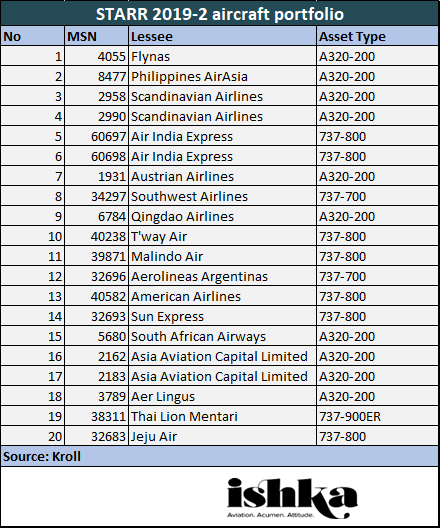

The portfolio consists of 20 narrowbody aircraft: 10 A320-200s, 7 737-800s, 2 737-700s and 1 737-900ER.

The deal also includes a $87.531 million e-note. Sculptor Capital LP (previously known as OZ Management) is the anchor investor and asset manager and is buying 19.5% of the e-certificates. A GECAS-controlled entity is purchasing 9.5% of the e-note with a two-year lock-up. The remaining 71.0% of the e-certificates are being offered to investors with a 19.6% IRR, the highest to date among the START ABS e-notes. START II offers investors an IRR return of 17.5%, while START I offered IRR returns “closer to 18%” according to sources.

The portfolio

Air India Express, Scandinavian Airlines and Philippines AirAsia are the three largest lessees by aircraft value and account for 32.6% in total by value, according to Kroll. Fitch states that roughly 35.7% of the portfolio is unrated and assumed to have a CCC rating. Only one aircraft, an A320-200 operated by South African Airways, is leased to an airline on Ishka’s watch list which is low compared to several recent ABS deals.

Structure and fees

The Series A and B notes amortise on a 14-year straight-line schedule while the series C Notes amortize on a 7-year straight-line schedule.

The ABS includes several standard structural features for recent aircraft ABS deals including rapid amortisation for the Series A and B notes after seven years, a nine-month liquidity facility, a debt service coverage ratio (DSCR) of 1.20x and an early amortisation trigger in which the excess cash will be used to pay down the Series A notes and then the Series B notes if the DSCR is less than 1.15x or the utilisation of the portfolio falls below 75%.

GECAS will receive roughly 3% in monthly servicing fees which will be paid ahead of either debt or equity holders and is calculated as 1.5% of the rents collected plus 1.5% of rents payable on a monthly basis. In addition, GECAS will also receive a sales fee of 1.5% of gross sales proceeds “in a senior position” in the waterfall according to Fitch. The lessor will also receive end-of-life compensation fees equal to 1.5% of the net EOL proceeds paid by lessees.

According to Fitch the annual fees and the expenses, costs of the trustees, operating bank, and managing agent, liquidity facility provider commitment fees and the e certificate trust are expected to be $837,960 per year and will be payable at the top of the waterfall.

STARR 2019-2 has a 360-day delivery period, which as Kroll notes is longer than the 270-day delivery period typical of most ABS deals and raises the possibility that the composition of the portfolio could be altered by the time the aircraft is acquired, but KBRA states that this risk is lessened by the fact that all of the aircraft in the portfolio are already owned by GECAS.

The transaction includes a $5.4 million reserve account.

The Ishka View

START III has priced quite tightly as investors have rewarded a portfolio of 100% narrowbodies with a serial ABS issuer that is managing its 16th serviced ABS.

STARR 2019-2 or START III is a continuation of GECAS’ START ABS programme, which invigorated equity participation in aircraft ABS by having 144a/ Reg S tradeable e-notes. Accordingly, the deal closely resembles START II. Sculptor Capital LP (formerly known as OZ Management) is again the anchor investor. One change has been in the appraiser line up with Collateral Verifications being included instead of, arguably the more conservative, Avitas. The e-note also priced slightly wider at 19.5%. Ishka understands that the deal attracted approximately 10 equity investors.

Ultimately, this is a relatively attractive portfolio of narrowbodies leased to some fairly well-known credits including Aer Lingus and American Airlines. Ishka notes that unlike some other recent ABS deals, most notably Raptor 2019-1 (see earlier Insight) only one aircraft, an A320-200 operated by South African Airways, is leased to an airline on Ishka’s watch list.

Sign in to post a comment. If you don't have an account register here.