Tuesday 21 July 2020

Aircraft ABS: START III winds down portfolio, further ABS downgrades

In its monthly aircraft ABS round up, Ishka summarises some of the recent trends and transaction highlights over the past month.

START III winds down portfolio

Fitch Ratings downgraded all notes of the START III Ltd (START III) ABS this week after all the remaining aircraft sales to the aircraft ABS were terminated in late June, leaving just two aircraft in the portfolio. GECAS is the servicer on the transaction and the two narrowbodies left in the transaction – a 737-800 (MSN 40582) on lease to American Airlines and a 737-700 (MSN 34297) on lease to Southwest Airlines – are set to be sold.

On 20th July, Fitch downgraded the series A, B and C notes for START III to B, B, B from A, BB, BB respectively and maintained the Rating Watch Negative for the notes.

All notes were paid down according to their allocable debt amounts associated with each asset. Fitch states the Rating Watch Negative is due to concerns over the sale of assets and ultimate paydown of the remaining notes.

Fitch forecasts that all of the A, B and C notes could be paid in full even if the realised residual value of the two 737 aircraft falls to 15% below appraised value, if the aircraft are sold within six months with leases still being paid. However, the agency warned that under the same scenario – and if values fall 30% below adjusted appraised values – then only the A notes will be paid in full, with principal shortfalls in the series B and C notes.

Separately, Fitch also placed the outstanding class A, B and C notes of Lunar Aircraft 2020-1 Limited (Lunar) on Rating Watch Negative after the asset manager, Sculptor Asset Management (Sculptor), announced it had terminated the purchase agreements to buy and novate six aircraft into the portfolio.

These aircraft included an A330-300 leased to Finnair; a 737-800 leased to SunExpress; an A320-200 leased to S7; an A320-200 leased to JetSMART; a 737-800 leased to Comair; and a 737-800 leased to Nordwind Airlines.

It is not clear if Lunar will decide to renegotiate or extend the purchase agreements, substitute aircraft or simply not include any additional aircraft into the portfolio. If it does decide on the last option, Sculptor will use the applicable amount to each undelivered aircraft to prepay the notes without premium, consistent with other aircraft ABS transactions. Fitch has warned that this last option could lead to further negative rating actions due to the potential higher asset and airline concentration limits.

DVB Aircraft Asset Management (DVB AAM) is the servicer of Lunar. DVB confirmed that the sale of DVB AAM and DVB Aviation Investment Management (DVB AIM) to MUFG, originally announced back in March 2019 as part of a wider acquisition by MUFG and BOT Lease of DVB's entire aviation division, had not occurred due to regulatory issues, but Fitch stated that DVB AAM was still deemed an “adequate” servicer.

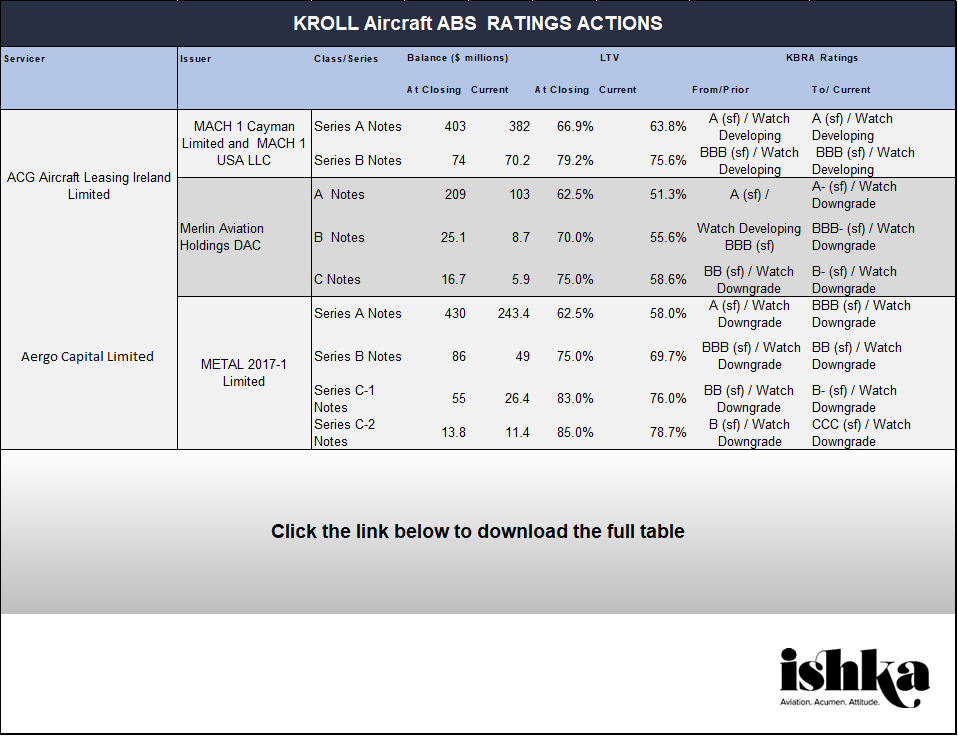

Kroll downgrades deals following June remittance notes

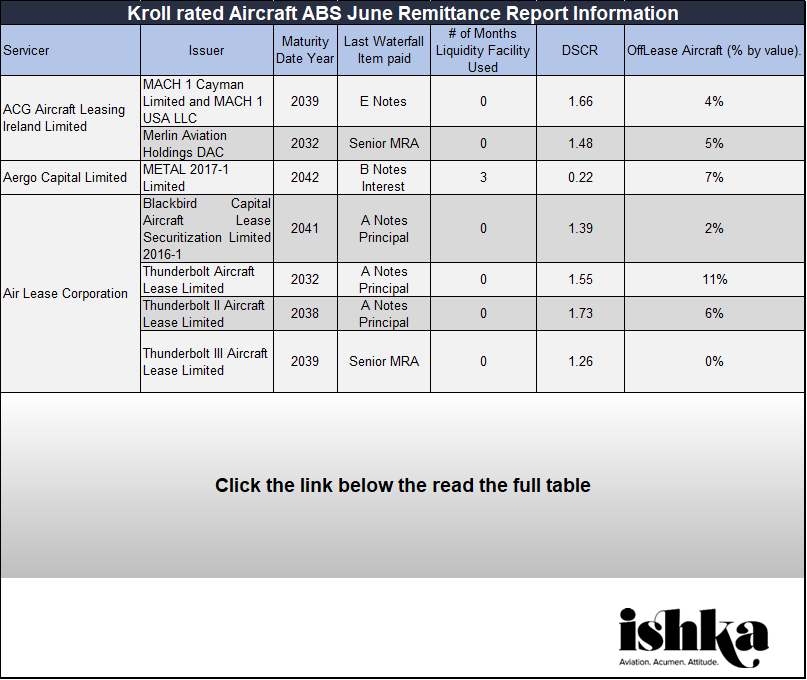

Rating agency Kroll downgraded 138 aviation ABS securities from 48 transactions in early July, citing performance deterioration, and declining cash flows as reduced air travel continues to impact aircraft securitisations (see table below).

The agency has also changed the Watch Placement Status for 73 public securities from Developing to Downgrade. 157 securities from 56 transactions remain “on watch” since early April 2020. The agency did, however, affirm the rating for one security in early July: Blackbird Capital Aircraft Lease Securitization Limited 2016-1 series AA notes.

Kroll stated that 19 transactions reported delinquent lease payments, which ranged between 24% to 85%, while two transactions needed to draw upon the available liquidity facilities to maintain timely interest on the senior securities. Roughly half (24 of 51) of the available junior notes did not receive any cash flow and are experiencing interest deferrals ranging from one to six months in 2020.

Kroll warned that 17 transactions breached debt service coverage ratio (DSCR) triggers, causing rapid amortization events (RAE). Furthermore, three transactions breached the DSCR trigger, causing a cash trap event and are close to breaching the DSCR trigger which would cause a RAE in the future.

Kroll also added that it will review the On Watch notes in the next 90 days, as it reviews rent deferrals, airline bankruptcies, aircraft valuation trends and information from transaction servicer reports.

Click here to download the data behind the chart.

Click here to download the data behind the chart.

Other recent ratings actions

Fitch Ratings has downgraded the ratings on the outstanding series A and B fixed rate notes issued by Willis Engine Structured Trust III (WEST III) from A to A- and from BBB to BBB-. The notes are serviced by engine lessor Willis Lease. Fitch, however, affirmed the outstanding series A and B fixed rate notes issued by Willis Engine Structured Trust IV (WEST IV), and Willis Engine Structured Trust V (WEST V) and maintained the Rating Outlook Negative on all series of notes.

Fitch stated that a softening in engine values could lead to downward rating action and warned that cash flows for the WEST ABS transactions would be impacted by a decline in engine asset values.

Fitch also affirmed the ratings of Mach 1 Cayman Limited (Mach 1) on the 14th of July, but the rating outlook on each series of notes issued remains negative. ACG is the servicer for the transaction. Fitch reported that while lease collections and cash flows have trended down since March 2020 (the portfolio generated $3.7 million in June 2020 compared to a $7.6 million peak in December 2019). Unlike many ABS transactions, E noteholders have received minimal payments – this is viewed as a positive by Fitch, as series A and B scheduled principal has been consistently paid. The debt-service coverage ratio (DSCR) is at 1.66x, remaining well above the cash trap and early amortization event triggers.

Fitch Ratings also affirmed the ratings for AASET 2019-2 Trust (AASET 2019-2) and AASET 2020-1 Trust (AASET 2020-1) aircraft ABS transactions in early July. Fitch affirmed the A, BBB, BB ratings for both series of notes with the rating outlooks for all securities for both transactions remaining on Negative. Both transactions are serviced by Carlyle Aviation Management Limited (Carlyle).

Fitch Ratings also affirmed the outstanding ratings of Pioneer Aircraft Finance Limited (Pioneer), rated A, BBB and BB by Fitch, with the rating outlook on each series of notes issued remaining Negative. Goshawk Management is the servicer for the transaction.

The Ishka View

There is little good news this month with regards to aircraft ABS, with reduced lease cash flow impairing performance across practically all aircraft ABS portfolios. While agencies have issued a number of downgrades in June and July, several deals have seen their ratings affirmed.

A large number of rental deferrals now in place for many airlines are continuing to impact cash flows and it is not clear how long these may be in place. Ishka understands that many lessors are in talks with airlines over a second wave of rent deferrals which, if agreed upon, will mean rental collections will remain reduced and which could see more aircraft ABS debt service coverage ratios (DSCR) triggers breached.

Rating agencies are also responding to the rising number of airline bankruptcies, including Avianca and Virgin Australia, among others. Fitch has also cited the growing list of newly-assumed 'CCC' credit airlines within a range of transactions. Azul, Croatia Airlines, Go Airlines, GOL, IndiGo, Jetstar Japan, Lion Air, Vietjet, SAS, Shanghai Airlines and Air Transat have all been labelled 'CCC' credit airlines by Fitch.

Click here to download the data behind the chart.

Click here to download the data behind the chart.

Sign in to post a comment. If you don't have an account register here.