in Airline trends & analysis , Aviation Banks and Lenders

Thursday 18 March 2021

Czech Airlines files for bankruptcy, LATAM and Norwegian EETC aircraft to be auctioned

In this week’s On Watch report, Ishka provides updates on airlines from Ishka’s Restructuring list.

Czech Airlines files for bankruptcy

Czech Airlines (ČSA) was declared bankrupt by the Prague City Court on 10th March, following a request by the carrier, according to Business Recorder. ČSA creditors are being urged to submit claims within two months ahead of a court hearing and creditors' meeting in June. The insolvency administrator is reportedly awaiting a decision on whether the carrier should continue to operate or sell its assets.

According to the petition, the Czech carrier has around 266 creditors, including two lessors. The airline owes CZK 800 million ($36.4 million) to suppliers and CSK 1 billion ($45.5 million) to passengers. According to CAPA, the lessors exposed are Eastwest Aircraft Leasing Ltd with one A319-100 (MSN 4713) and Babcock & Brown Aircraft Management (BBAM) with one A320-200 (MSN 1885).

The carrier's parent company, fellow Czech carrier Smartwings, has reportedly joined the list of creditors, Zdopravy reported on 17th March. Smartwings sent two unpaid invoices to the list of receivables for the sub-lease of one Boeing 737-800, OK-TST, MSN 37884. In 2019 Smartwings agreed to sub-lease the aircraft for$275,000 in basic monthly rent. The aircraft’s last flight took place on 10th March.

LATAM’s EETC trustee to auction 11 aircraft

SkyWorks Leasing announced on 15th March it has been mandated to advise and remarket 17 aircraft consisting of 11 A321-200s, 4 787-9s, and 2 A350-900s on behalf of Wilmington Trust Company as trustee for the LATAM 2015-1A EETC bondholders. The aircraft are to be sold as a complete lot on an “as-is, where-is” basis via a public auction to be held on 14th April 2021.

LATAM on 9th March reported a net loss of $4.55 billion in its 2020 annual results. The carrier’s operations were hard-hit by the pandemic with passenger numbers down 61.9% in 2020 compared to 2019. The company ended the year with $1.7 billion in cash and equivalents and available DIP Financing for $1.3 billion, totalling $3.0 billion in liquidity.

Norwegian ends 25 leases, EETC bought out

Norwegian Air Shuttle received approval from an Irish judge on 5th March to end lease contracts for 25 aircraft with four creditors who had decided not to terminate the agreements voluntarily. The creditors include: the Bank of Utah with eight Boeing 737s; Citibank with six 737s; Credit Agricole with nine 737s, and PK AirFinance with two 737s.

Separately, on 11th March, Norwegian’s restructuring plan was sent to its creditors and shareholders. If the plan is approved by the Irish and Norwegian courts the company can continue the processes and initiate a capital raise in April to be completed by May.

Additionally, on 12th March the carrier filed for Chapter 15 bankruptcy protection in New York, which will protect its US assets from litigation while restructuring continues in other jurisdictions, including aircraft on the ground in US airports. This is the same protection against creditors sought by Virgin Atlantic Airways in August last year.

Separately, Norwegian’s 2016-1 EETC Class A certificates were recently bought out by a holder of the subordinate class B certificates, FitchRatings reported on 16th March. Norwegian has rejected 10 737-800s that formed part of the collateral on its 2016-1 EETC as part of its examinership process. The carrier made an offer on reduced terms to keep the aircraft that would have been sufficient to avoid a default for the Class A certificates but would likely have impaired the Class B certificates. The trustee for the certificate holders will hold a public auction to sell the aircraft by the end of March.

Other updates

- Thai Airways faces a possible delisting from the Stock Exchange of Thailand, as 2020 financial statements showed that the company’s equity is at negative 128.74 billion baht (negative $4.2 billion), the carrier said in a filing to the stock exchange on 8th March 2021. Separately, the carrier has put on sale on its trading website two of its A380s Rolls-Royce Trent 900-powered superjumbos.

- EasyFly reportedly managed to reconcile with its creditors and closed a reorganisation agreement that will allow it to continue operating in Colombia, El Espectador reported on 12th March.

- Thailand’s Central Bankruptcy Court has granted Nok Air a one-month extension to its debt rehabilitation plan deadline to 15th April 2021, the airline announced in a stock exchange filing on 15th March.

- A court in the Chinese city of Hainan gave the go-ahead to the merger of 321 firms related to the HNA Group conglomerate, Reuters reported on 15th March. The court stated that because all of the firms are effectively controlled by HNA Group it would need to merge the various entities, and arrange its outstanding debt in a unified way, to ensure fair compensations to all creditors.

- Namibian public enterprises minister Leon Jooste has said the government will pay a promised salary reimbursement equivalent to 12 month's salary to each employee of Air Namibia in a single lump sum by the end of March, New Era reported on 12th March.

Click here to download the complete tables with the latest updates.

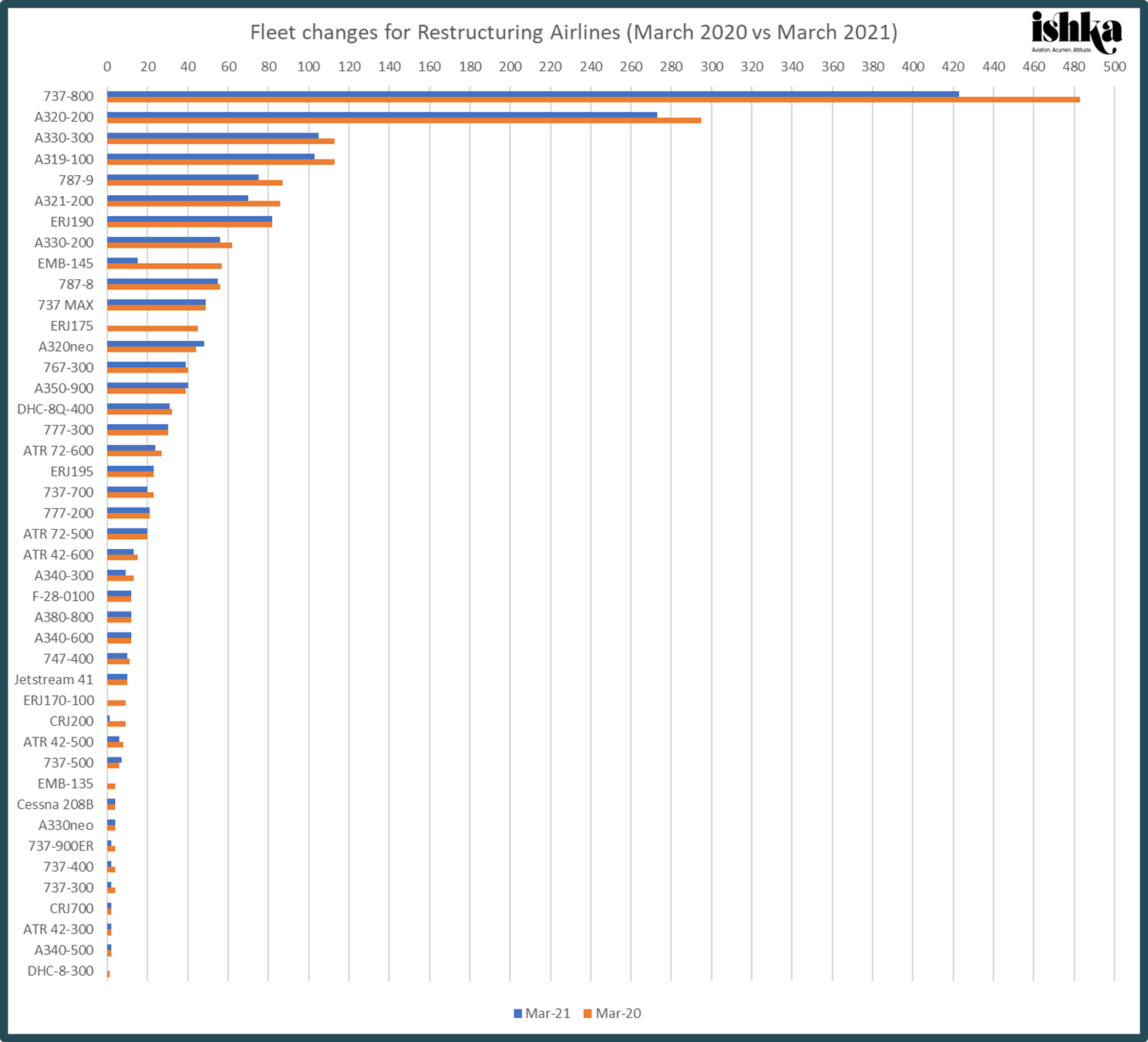

Source: CAPA Fleets

Note to the reader: The Net Aircraft change calculations will now exclude airlines that have emerged from court-led restructuring processes (Ravn Air, Braathens Regional Airlines, Miami Air International, Virgin Australia, CityJet, Comair, Virgin Atlantic Airways).

Click here to download the complete tables with the latest updates.

The Ishka View

The pandemic has shown no mercy to the fifth oldest airline in the world. The Czech Republic’s flag carrier joins a growing list of European carriers that have recently filed for bankruptcy including LEVEL Europe, SunExpress, and Virgin Atlantic Airways.

ČSA’s bankruptcy is unlikely to be a surprise to creditors. The Czech carrier reported a CZK1.6b ($73.7m) net loss for 2020, an 80% decrease YoY, and last month announced it would be dismissing its entire 430-strong workforce. The carrier’s total debt currently stands at about $82 million, and its future will be clearer in June 2021, after the creditors' meeting takes place. The carrier recently phased out all of its ATR aircraft and now operates just two aircraft, an A319-100, and an A320-200.

Meanwhile, LATAM’s trustee SkyWorks Leasing is auctioning 17 aircraft after the South American carrier rejected certain aircraft in July as it continues its Chapter 11 bankruptcy process (see Insight: ‘Lessons in rejection: LATAM’s decision to drop its EETC aircraft’). SkyWorks is choosing to sell 11 A321-200s via an auction process. These are likely to be desirable assets for many airlines but auctioning that many aircraft in one go is highly unusual. It is a further sign of the challenges that creditors currently face when selling distressed and naked aircraft.

Click here to download the complete tables with the latest updates.

Sign in to post a comment. If you don't have an account register here.