Ishka Investival: Korean investors explore more ABS e-notes

South Korean equity investors are open to more aviation deals including aircraft ABS e-notes, according to aviation financiers and lessors speaking at Ishka’s Hong Kong Investival last week.

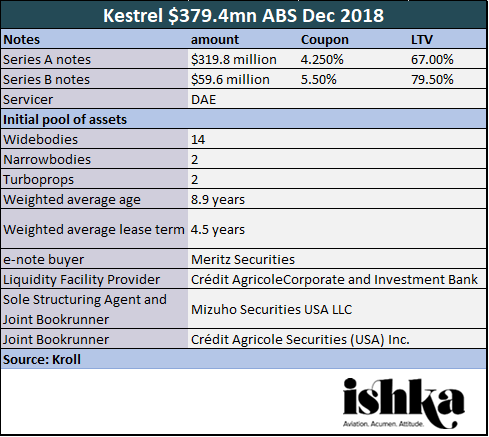

In December 2018 Meritz Securities (Meritz) acquired the e-note in a securitised portfolio of 18 used aircraft from Dubai Aerospace Enterprise (DAE) Capital, named Kestrel Aircraft Funding Limited (Kestrel 2018-1) which issued $379.4 million of class A and B notes.

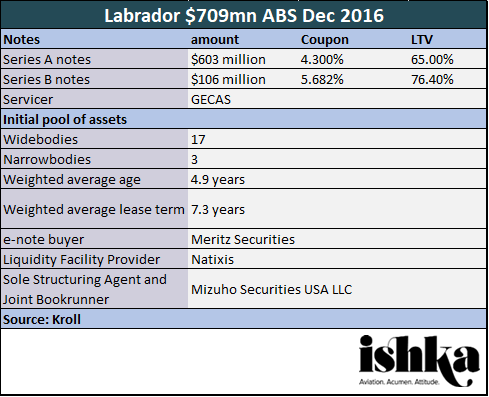

Financiers indicated that Korea was an active market for aviation assets and that Korean equity investors were looking at a range of deals including ABS e-notes. Korean security houses have been active in aircraft ABS deals before. Ishka understands that Meritz acquired the e-note in GECAS’ $709 million Labrador Aviation Finance ABS back in 2016. Kestrel 2018-1 marks a return of Korean equity appetite for aircraft ABS e-notes. According to the Kroll pre-sale report, DAE also retained a small portion of the equity in the Kestrel ABS. ABS that have sold into the Korean equity market have typically involved the issuers retaining at least 5% equity stake as “skin in the game”, a trend, sources state, that is likely to continue for both public and private aviation deals with Korean equity investors.

Typically, leasing firms that issue an ABS are motivated by either raising debt or achieving a portfolio sale. Finding e-note buyers has not always been easy, so an active Korean ABS investor market is welcome news for some of the larger lessors with aircraft to sell.

Twin-aisle aircraft returns

Korean investors have chosen a variety of debt and equity structures in aviation beyond just ABS. Unlike Japanese JOL/JOLOC investors, who have stuck to investing in narrowbodies, Korean debt and equity investors have preferred to invest in widebodies, particularly in 777-300ERs and A330s.

Financiers indicated that while Korean debt and equity investors were active in aviation they had become more “discerning” about the types of widebody aircraft assets they were likely to consider.

“I think Korean investors now have woken up to the illiquidity of widebodies,” commented one arranger, who added that Korean investors were shying away from larger twin-aisle aircraft such as 777s and A380s, but were still looking to fund widebody assets. “They are now looking at the middle end of the widebody segment rather than regional jets. Fewer A380s and 777s and more A330s or 787s.”

Arrangers and lessors confirmed that Korean investors were still investing in widebodies to achieve scale and returns. According to a poll conducted at the Ishka event, half the audience believed that unlevered equity returns for single-aisle aircraft were between 5%-8%. The results were in keeping with an earlier survey conducted by Ishka on expected equity returns (see earlier Ishka Insight).

Arrangers stated that a 6% unlevered equity returns for narrowbody aircraft was “broadly accurate” but indicated that Korean investors were seeking to achieve at least 6% to 9% equity returns. As a consequence, Korean debt investors were seeking mezzanine and junior loan positions to meet those return hurdles.

“The drive behind these deal expectations is driven by the alternatives they have in energy or infrastructure,” said one arranger. “Expectations are there for 6%-9% equity returns or probably a bit higher. 9% or 10% is what they are aiming for when they are looking at junior and mezzanine tranches. The challenge they have is that the yield expectation is in Korean Won and there is a hedging cost of around 1.5%, which eats into their yields.”

Another arranger stated that Korean investors’ historical appetite for widebodies has been driven by their preference for mezzanine or coupon-paid equity components in larger deals involving flag-ship carriers with new aircraft.

As a result, Korean investors have stuck to investing in large widebodies such as 777-300s for Middle Eastern carriers such as Emirates or Qatar Airways. “They are interested in larger deals, and better credit and newer aircraft. You cannot wedge that capital structure into a model that works for narrowbodies but for widebodies you can.”

Many of these deals are private and appetite among Korean investors for bespoke aviation deals remain strong. This week Korea’s KEB Hana Bank was reported to have signed an agreement with Netherlands-based Arena Aviation Capital to manage its acquisition of leased aircraft. KEB Hana Bank will become a shareholder in Arena Aviation as the bank embarks on an aircraft leasing programme worth approximately a $1 billion.

The Ishka View

The success of the Kestrel ABS in December marks the return of Korean appetite for ABS deals after an absence of the best part of two years. Ishka understands the delay was due to the length of time that Meritz Securities took to sell the equity portion down to other investors, most of whom would have been unfamiliar with the asset class at the time. With the Kestrel ABS deal Ishka understands that, unlike the Labrador ABS, Meritz had secured many of the investors before the deal closed. Ishka understands that Meritz has already managed to successfully sell the equity down to investors. These investors are now much more familiar with aviation and the selling points associated with investing in a portfolio of single-aisle aircraft over investing in a single widebody, including a more diversified risk profile across multiple credits and the ability to invest in more liquid asset types. Meritz stands out as the sole South Korean aircraft e-note buyer to date but the success of it two forays in the ABS market could prompt further appetite for both public and private aviation deals in future.

.png)

.svg.png)

Sign in to post a comment. If you don't have an account register here.