in Aircraft values, Lease Rates & Returns

Thursday 11 November 2021

SLBs push A320neo and 737 MAXs to above ‘pre-pandemic’ prices

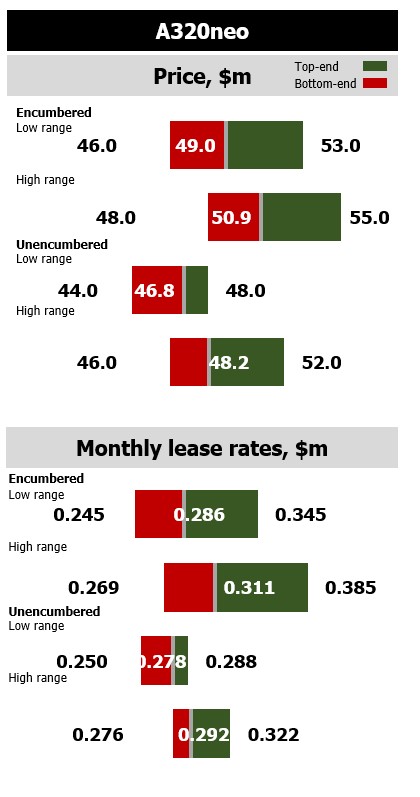

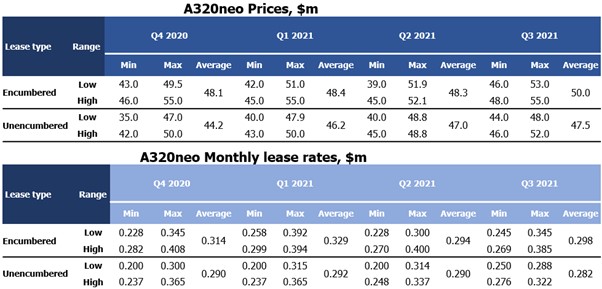

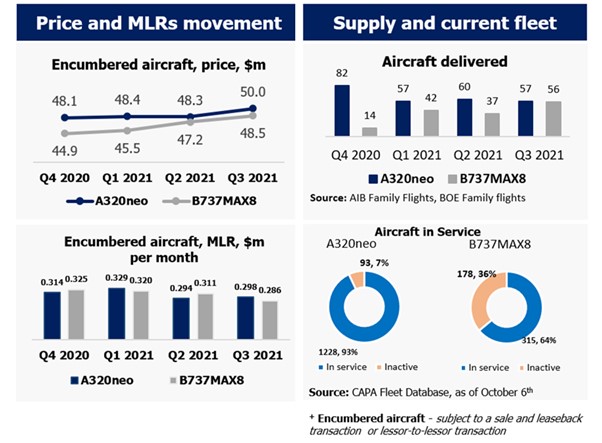

A competitive sale/leaseback market (SLB) is driving up prices for new Airbus A320neos and Boeing 737 MAXs as well as depressing lease rates, according to Ishka’s Aircraft Pricing Benchmark (APB) research. The market reports average prices for an encumbered A320neo during Q3 2021 stood at $50m (up 3.5% from Q2 2021), while a 737 MAX 8s averaged $48.5m (up 2.7% from Q2 2021).

Several Pricing Benchmark contributors lost out on deals, citing extremely fierce competition to acquire aircraft, with one contributor stating that the market seems “like a bloodbath”. Many contributors were questioning the sustainability of the current market given rising prices and falling lease rates. Some said that both prices and leases are, for the best credits, “better than pre-pandemic” with lease rate factors lowering, especially for the larger LCCs in regions where travel is more rapidly recovering (USA and also Europe, led by Russia and Turkey).

Contributors to the APB stated that SLBs are still skewed towards the top tier credits, but some reported that some second and third-tier lessees were seeing improved conditions.

A320neo outlook remains stable

APB market contributors expect the three-month outlook on prices and lease rates to remain stable for the A320neo. Although A320neo prices are up 3.5% quarter-on-quarter, most contributors expect the MAX price trends for the next quarter to be more positive than for neos, which are expected to remain stable for the next quarter.

B737 MAX 8 prices pick up, but uncertainty still present

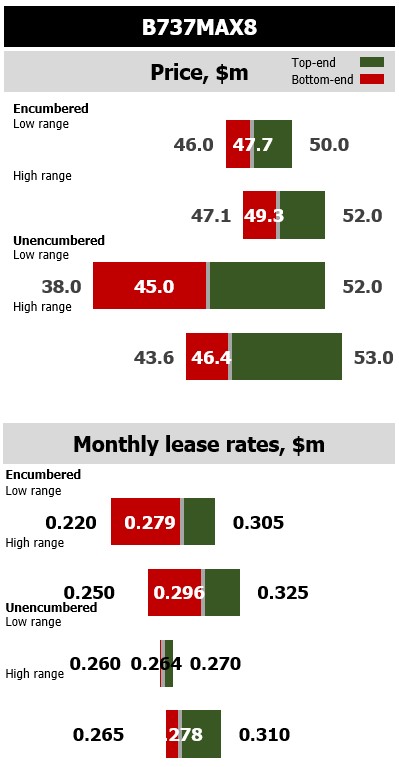

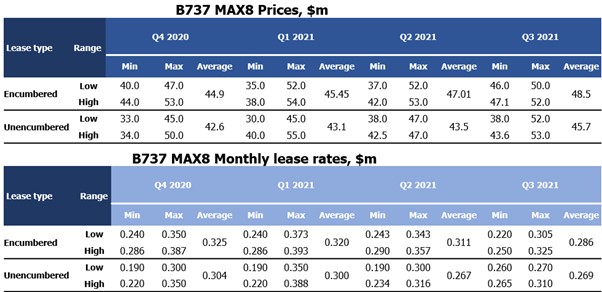

Pricing for the 737 MAX 8 has been improving over the past few quarters, and now averages $48.5 million for encumbered aircraft deals, while for unencumbered aircraft prices are also recovering, in Q3 2021 reaching an average of $45.7m

Lease rates have continued to soften, with average MLRs for the 737 MAX8 in Q3 2021 now at $0.286m, while for unencumbered aircraft the MLRs have stabilized at $0.269m (vs. $0.267m)

Most of the contributors to the APB see a positive three-month outlook on prices for the MAX, albeit recovering from a low base in Q4 2020. Another signal of price recovery for the MAX comes from Ryanair’s public negotiation with Boeing, with Ryanair’s CEO noting that "Boeing are looking for a price increase while many of their customers are moving to Airbus“.

Although Boeing is upbeat on the future of the aircraft, some uncertainty stems from select markets, with some contributors mentioning that Japanese regional banks are still not interested in the MAX, whilst some banks from other regions are also not considering the MAX at the moment.

Other contributors expect a shift in market dynamics once the MAX is ungrounded in China.

The Ishka View

Confidence and activity appear to be slowly returning to the market, particularly for new-technology narrowbodies. Compared with past quarters, contributors say they are seeing more activity, both from airlines planning for summer 2022 but also from lessors participating in more portfolio trading.

OEMs have also been busy. During Q3 2021, both Airbus and Boeing delivered approximately the same number of comparable aircraft (57 A320neos for Airbus and 56 737 MAX 8s for Boeing), another signal that Boeing has been improving its ability to ramp up its output

In September 2021, Boeing produced (measured by first flight dates) 21 B737 MAX 8s while Airbus produced in total 30 A320neo aircraft, according to the CAPA fleet database. Both OEMs are looking towards increasing their production rates.

Sign in to post a comment. If you don't have an account register here.