Thursday 11 January 2018

North American airlines’ liquidity and their near-term obligations

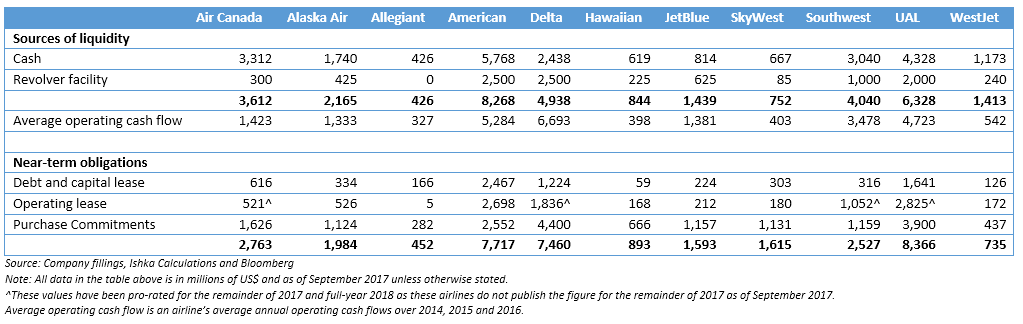

In a previous Insight, Ishka studied the liquidity levels of airlines as a percentage of its annual revenues. In this week’s Insight, Ishka studies liquidity management in the context of the airlines’ near-term obligations. This includes debt obligations, lease obligations and aircraft purchase commitments which are typically the largest applications of funds. As mentioned previously, airlines finance their obligations through a variety of ways which includes their internal cash reserves, revolving credit facilities, operating cash flows and external borrowings.

In this report, Ishka focusses on some of the major North American carriers. In the table below, the airlines’ liquidity position as of September 2017 (the latest available date for which financial data is available) including any undrawn revolving credit facilities is compared to their near-term obligations (remainder of 2017 through to end of 2018) as of the same date. Operating cash flows form a major component of sources of funding and even primary for some airlines. As such, including the airline’s average cash flows over 2014, 2015 and 2016 also helps to understand typically how much the airline generates through its operations and how that compares to its commitments. The stronger the airline’s operating cash flows and internal cash reserves the less its reliance on debt funding.

As can be seen from the table, most airlines seem to have adequate liquidity for near-term obligations. In most cases, the airlines’ sources of liquidity cover their short-term obligations. And if operating cash flows are included, nearly all of them appear to be in a relatively comfortable position. This is true especially in Delta Air Lines. As seen in the previous Insight on liquidity, Delta stands out as an exception with one of the lowest liquidity levels (measured by cash as a percentage of annual revenues) among major carriers globally. The airline relies to a great extent on its operating cash flows to fund its obligations. A look at its average operating cash flows over the past three years reveals just how strong its cash flows have been. As a consequence, Delta also has one of the strongest balance sheets with extremely low levels of leverage. The other exception is SkyWest. The company has historically relied on long-term debt financing to finance aircraft purchases which explains the sizeable gap between its sources of liquidity and obligations.

Fleet renewal programme

Among all the regions globally, North American airlines, on average, have maintained relatively stable liquidity positions over the past few years. The region also benefitted significantly from the lower crude oil prices as most North American airlines posted healthy operating margins that helped to bolster their cash reserves. But these airlines, especially UAL and Delta, have been relatively pragmatic at fleet upgradation/renewal compared to some of the other airlines across the globe. Nevertheless, North American airlines too have a sizeable number of aircraft delivering over the coming two years. Below is a summary of the anticipated fleet additions at these airlines in the coming year.

Alaska has around 20 to 23 737s scheduled for delivery till 2019, similar number of E175s and between five to seven A320 Family aircraft.

American has around 16 to 20 B737 MAX Family aircraft scheduled for delivery in 2018, along with six to nine 787s. It was also scheduled to take delivery of around five 737NGs and four E175s during the last quarter of 2017.

Air Canada has so far used JOLCOs to finance some of the aircraft that were delivered in 2017, particularly the four 787s. It has said that it plans to use EETCs to finance some of the aircraft delivering in 2018.

Allegiant has commitments to purchase around 20 A320 Family aircraft between 2018 and 2020. In addition, it also has around 10 to 13 A320s to be acquired under lease.

Delta has sizeable aircraft capex lined up for 2018 with deliveries of around 60 aircraft. This is part of its fleet renewal strategy that seeks to refleet around 30% of mainline fleet by 2020. Delta also hopes that induction of new aircraft will help it drive further cost efficiencies.

Hawaiian Holdings is committed to take delivery of eight to 10 A321NEO aircraft in 2018.

Between September 2017 and December 2018, JetBlue Airways will take delivery of around 15 to 17 A321s.

SkyWest, Inc. has around 40 to 45 E175s scheduled for delivery till the end of 2018. The company intends to finance these deliveries 85% through debt and the remaining with cash in-line with its historical policy.

Southwest Airlines will take delivery of all of its remaining 25 to 30 737NGs in 2018 in addition to 13 737MAX8s. The airline has around 200 aircraft on order from the 737MAX family with options for an equivalent figure.

United has adjusted downwards its growth plans for 2018 compared to 2017. Its US$3 billion of capex is a billion dollar less than 2017. United has realigned its growth plans and in the process deferred some A350s and 737MAXs that were earlier scheduled for 2018. The airline now plans to take the first of MAXs in 2019 while pushing back the A350s to beyond 2022 while also downgauging from A350-1000 to A350-900s. United is likely to focus on taking deliveries of its remaining 787s and 777-300ERs in 2018.

Finally, WestJet’s modest growth plan will see it add around seven 737MAX8s and two Q400s to its fleet in 2018. Interestingly, the airline also has around 10 787-9s which will start entering the fleet in 2019 as the carrier embarks on expanding its long-haul ambitions.

The Ishka View

In-line with Ishka’s understanding on previous assessments of airline liquidity, it appears most North American carriers are in a reasonably comfortable position with respect to their near-term obligations. Putting liquidity directly in the context of the airline’s obligations helps to understand how they are positioned vis-à-vis their some of their key near-term commitments. Airlines cannot use all the liquidity that is available on balance sheet as they may be required to maintain a minimum level of liquidity as part of debt covenants. As such the difference has to be financed through external sources. The greater the buffer between cash & operating cash flows and obligations, the lower the reliance on borrowings and consequently, the healthier the balance sheet.

Photo: Jörg Schubert

Sign in to post a comment. If you don't have an account register here.