Tuesday 12 April 2022

Financing survey: Aviation banks confirm rising funding costs

Several European aviation bankers confirm to Ishka that their funding costs increased in the first quarter of 2022 in the wake of rising interest rates and general market volatility in the capital markets following the Russian invasion of Ukraine.

Lenders warn that rising funding costs are placing pressure on bank risk-adjusted margins but most believed that margins will continue to plateau in the short-term, especially for the top-tier airlines, according to lenders surveyed by Ishka last week. Some top-tier airlines, responders said, are already able to command pre-pandemic rates.

"There are relatively few data points because there really haven't been that many aircraft deliveries, so it is hard to give a definitive view of where margins will stay. Many airlines are using the sale/leaseback channel for new aircraft so not all of them are being funded with commercial debt," explained one banker on the sidelines of the Ishka London conference.

Aviation bank costs rise

Speaking with Ishka, four European-based lenders confide that internal funding costs for ten-year secured loans rose for themselves and rivals by between 10 to 25 basis points over SOFR during the first quarter of 2022, with one lender stating he is aware of at least one bank which has seen a 45bp hike since the start of the year.

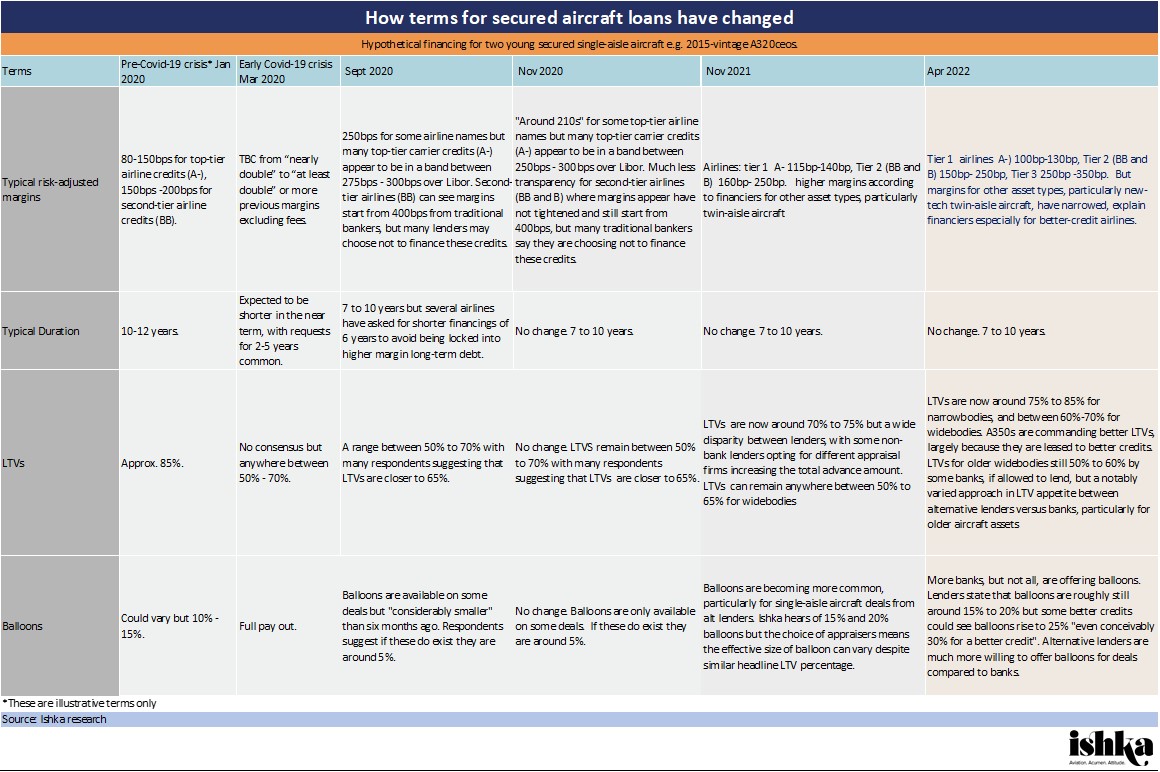

Borrowers saw the total cost of bank debt for secured aviation deals increase automatically in March on the back of rising interest rates (see Insight: 'Lease rate ‘lag’ caused by rising rates likely to squeeze lessor returns’). However, aviation risk-adjusted margins, the premium banks place on debt based on internal risk assessments, steadily decreased in late 2020 and 2021 after spiking in the immediate aftermath of the Covid-19 pandemic in March 2020 (see Insight: ‘Aviation banks retreat to top airlines and say margins have doubled’).

Some aviation lenders stated that risk-adjusted margins remained “largely flat” over the last six months, while three other lenders stated risk-adjusted margins have only remained stagnant since the start of the year.

Margins dip to pre-pandemic levels for top airlines

Lenders stress that risk-adjusted margins have stayed stationary since the start of the year, but Ishka understands that for a small group of elite top-tier legacy and low-cost European airlines (such as Lufthansa, IAG and EasyJet), margins had already dipped to pre-pandemic levels by January 2022.

"When I look at the pricing indicators now versus what we had in the beginning of 2020, it is very similar. For some of the best airline-asset combinations, it is actually even better today than it was in 2019,” explained one banker.

“There is too much liquidity chasing that top 20%,” explained another banker. Others confirmed that banks are still somewhat cautious about funding weaker second and third-tier carriers, in contrast to a large number of alternative aviation lenders, several of which launched during the pandemic (see Insight: ‘PE firms move into the aviation lending ‘gap’, Apollo mulls second CLO’). One lender stated that several Chinese banks with access to cheap funding had been able to offer slightly lower terms to some top-tier airline names compared to European bank rivals.

Lenders also cautioned that there is no “linear curve” between “extremely low” risk-adjusted margins for top airlines and lessors, and higher-margin second and third-tier airlines. “It is not a linear curve. The more you go down the credit quality of airline and vintage of aircraft the higher the pricing will be, and the harder it will be to find lenders to finance that.”

Lenders loosen LTVs

Ishka research indicates that while risk-adjusted margins appear to have barely moved since the last Ishka financing survey (see Insight: ‘Aviation banks cautiously return for new deals’) lenders appear to have a more robust view of asset residual values, judging by the increasing loan-to-value ratios (LTVs) lenders are quoting on new deals, particularly for widebodies.

It is important to stress that LTV ratios vary widely based on the appraisals used in loans, but it appears that LTVs for both narrowbodies and widebodies have increased in the last six months – indicating more confidence among lenders in long-term aircraft residual values (see table).

Ishka hears that appetite among lenders is particularly robust for the Airbus A350 where LTVs are between 70% to 75% for the better airline names. However, even other widebody types have benefited from a more relaxed approach to LTVs from lenders. Responders stated that more banks are also offering balloons to top-tier credits, but Ishka understands that a few banks are still insistent on fully-amortising deals for secured aircraft loans.

The Ishka View

It is interesting to watch how quickly risk-adjusted margins, an effective barometer of risk for lenders, have dropped for the best aviation credits over the past 18 months. This is impressive given that many aviation banks’ internal risk committees imposed strict lending limits through most of 2020 and 2021.

This has eased somewhat since September last year as more banks resumed lending in earnest, but there is no doubt that the recent launch of new alternative aviation lenders during the pandemic helped introduce some pricing tension among borrowers. The market is still bifurcated between extremely favourable terms for the best credits and a steep increase in pricing for weaker airline names and/ or less liquid asset types. But borrowers also have a much wider choice of lenders, several of which have more risk appetite for older aircraft compared to traditional aviation banks.

Banks appear crowded around a relatively small group of top tier airlines. These carriers have been able to access the unsecured bond market on favourable terms (see Insight: ‘Unsecured debt data sheets: Q1 QTD lessor and airline bond issuances’) which has also placed pressure on banks to offer competitive terms for secured loans.

Since then, rising interest rates and, more recently, capital market volatility appears to have increased funding costs for many aviation banks. Rising interest rates will force lenders to adjust all-in pricing quotes, and lessors will already have seen a price increase for swaps quoted for new deals, but, for the short-term at least, risk-adjusted margins appear to remain flat as lenders look eager to win deals amid relatively scarce supply of new aircraft deliveries.

Sign in to post a comment. If you don't have an account register here.