in Lessors & Asset managers , Capital Markets

Friday 17 July 2020

Lessor bond issuances plummet in Q2 2020

New bond issuances by aircraft leasing companies fell 40% year-on-year (YOY) in Q2 2020.

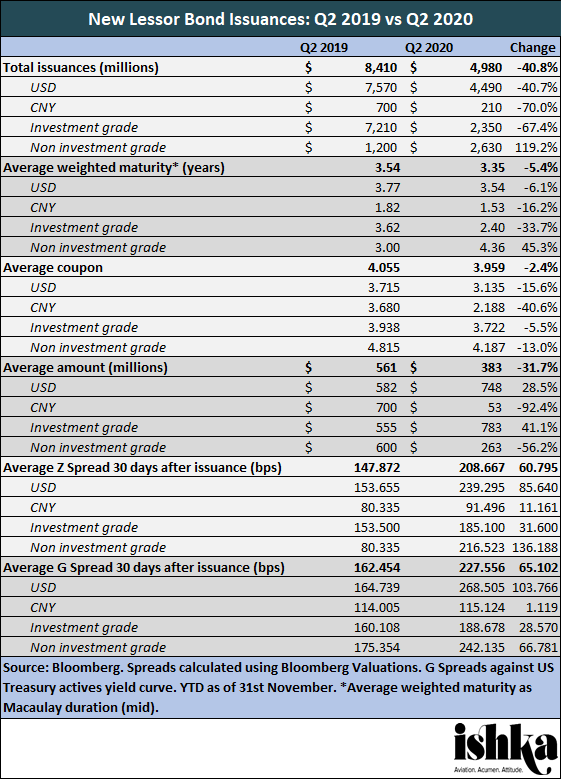

An analysis of a sample of bonds issued by aircraft leasing companies in 2019 Q2 versus 2020 Q2 shows that lessors issued, overall, fewer bonds (by 40.8%) and of smaller amounts (by 31.7%). This drop in average size was driven by CNY issuances, which dropped 92.5% in size where USD notes in fact increased 28.5%.

The slower rate of issuance in Q2 2020 continues a trend from Q1 2020 (see Insight: ‘Lessor bonds: Ratings agencies bearish on lessors, while new issuances drop’), where fresh issuances dropped 19.3% YOY in Ishka’s sample. The volume of non-investment grade (IG) notes, however, increased nearly 120% YOY in Q2, perhaps as rated leasing companies held back from a troubled market. Thus far, rating agencies have held back on mass downgrades for aircraft lessor and their bond offerings. Mostly, agencies have placed lessors on negative outlooks, rather than strip them of IG status altogether.

Meanwhile, both G spreads and Z spreads 30 days after issuance blew around 60bps wide YOY, with the largest increase seen in USD and non-IG notes (see Insight: ‘Lessor bonds: Spreads stay wide as ratings agencies mull downgrade’). This could be explained by greater liquidity in the USD bonds and a greater sense of risk perception from investors in the non-IG bonds.

Meanwhile, Avation repurchased $1.0 million of 6.5% senior notes due 2021 in early June. The notes were purchased at a price of 76.25% and “will be cancelled”, the company announced. Aviation Capital Group (ACG) also bought back $204 million of its $600 million 7.125% notes (34.08% of the Notes outstanding) due 15th October 2020 in June. JP Morgan Securities acted as dealer manager for ACG’s tender offer, while D.F. King & Co served as tender agent.

Looking beyond bonds, revolving credit facilities remained popular with lessors in Q2 2020. Chorus Aviation executed a letter of offer with Export Development Canada for a $100 million revolver, while both BOC Aviation and ACG went to their parent companies (Bank of China and Tokyo Century respectively) for further funding. BOC Aviation signed a $2 billion “backstop” revolver, as CEO Robert Martin put it, while ACG closed a $600 million unsecured three-year revolver. ACG also closed a $650 million secured debt facility structured by Credit Agricole in Q2; the loan included an accordion option to provide up to $1 billion in funding.

ALC’s “opportunistic” bond outprices AerCap’s

ALC priced its $850 million 3.375% bond (BK128986 Corp) at half the coupon of AerCap’s $1.25 billion 6.5% note (BJ845056 Corp), despite both being senior unsecured issuances issued within two weeks of one another. AerCap is rated BBB-, while ALC is rated BBB.

ALC issued its $850 million of senior unsecured medium-term notes on 24th June after originally planning a $500 million issuance. The five-year bond was upsized due to the six times oversubscription. One person with knowledge of the matter described ALC’s bond as essentially “opportunistic”. Given issues including delivery delays from Boeing, ALC’s capex has roughly halved in 2020, leaving the lessor with plentiful liquidity. “We could have done a deal a couple of weeks ago, [but] we weren’t happy with the price,” they said, explaining that holding off drove the pricing down from 375bps to 325bps.

Melvine and Myers provided legal counsel for ALC, while legal counsel for the joint book-runners – Bank of America Securities, JP Morgan, Wells Fargo and MUFG – was Simpson Batcher. Barclays Capital, Bank of American Securities, J.P. Morgan Securities, Santander Investment Securities and Wells Fargo Securities served as joint book-running managers on AerCap’s bond.

The Ishka View

Leasing companies shied away from the turbulent bond market in Q2 2020, issuing on average smaller, shorter-term bonds. This finding is somewhat at odds with the more general bond market, which has seen record issuances since the US Federal Reserve announced its bond-buying programme. Lessor USD issuances did see the smallest decline, however, and the Fed programme only found its feet in June; perhaps lessors will be freer with their issuances in Q3. Lessors who have been placed on negative outlook also might be holding back from issuing until their ratings improve.

The spread between ALC’s and AerCap’s bonds is a reminder of the importance of rating; lessors will be keenly focused on maintaining their investment-grade ratings where applicable. While both companies are IG, ALC can get downgraded and remain so. AerCap and ALC also comprise different investor bases due to their different investment ratings, with AerCap drawing in a combination of IG and high-yield investors. What's more, AerCap, even by virtue of its size alone, has greater exposure to bankruptcy-risk airlines.

Sign in to post a comment. If you don't have an account register here.