Thursday 10 December 2020

Is China an exception to domestic traffic recovery?

With the virus originating in China, Chinese airlines were the first to be impacted as domestic and international travel restrictions reduced demand for air travel in the country. The outbreak coincided with a busy travel period and Chinese New Year celebrations and as a result the impact was severe. In January 2020, traffic (as measured by RPKs) on the domestic segment in China was down by 6.8% (year-on-year) and by 84% in February, the peak of the restrictions and lockdowns in the country.

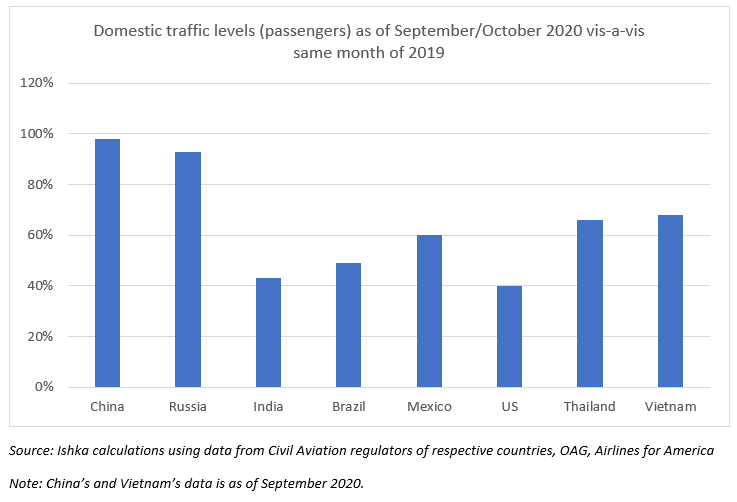

However, the country has also been the first to emerge out of the crisis and has posted strong recovery since the peak of the crisis early on in 2020. In September 2020, Chinese airlines collectively transported about 47.75m domestic passengers - just 2% less than the same month of 2019 and higher than the 44m passengers transported in January 2020 immediately before the peak of COVID disruption in the country. The holiday season in early October, as expected, led to further growth in domestic air traffic movements. While the month-on-month growth was not as strong as in September and August, it was still an improvement over September’s figures.

Elsewhere in Asia Pacific, in India, the recovery has been relatively gradual and modest so far. By October 2020, domestic traffic was around 43% of the last year’s levels. While November traffic data was unavailable at the time of publishing, there is expected to be a further improvement in passenger numbers as it coincides with the major holiday season. In India, the government is continuing to regulate how airlines reinstate capacity with limits imposed on how many flights can be operated (the most recent government directive published in early December 2020, sets the upper limit at 80% capacity).

In Southeast Asia, while the domestic sector in Thailand has seen some encouraging recovery it continues to be affected by the absence of international in-bound travellers. As of October 2020, domestic passenger numbers across the six major airports in Thailand had recovered to 66% of last year’s levels. However, the total including international was only around 28% of October 2019’s level highlighting the importance of international traffic to the country’s civil aviation sector. While up-to-date traffic statistics for Vietnam are unavailable, estimates from OAG suggests that the domestic sector had recovered to ca. 68% by September 2020, (vis-à-vis the same month of 2019. Vietnam stands out in terms of managing the COVID-19 crisis better than most other jurisdictions. Although there have been subsequent waves which temporarily affected recovery of air traffic in the country, in general, a major prolonged disruption has largely been avoided.

Russia has demonstrated similar trends to China. Domestic passenger traffic in the country had recovered to 93% of last year’s levels by October 2020. In contrast, traffic on the international segment was ca. 20% of last year’s levels. Overall, traffic levels in the country were about 50% of October 2019’s levels.

The Americas have been significantly affected by the COVID-19 crisis with most jurisdictions continuing to remain pandemic hotspots eight months since the start of the crisis. This has had an impact on how air traffic has recovered in the region. In the US, the world’s largest aviation market, domestic traffic averaged around 40% of last year’s levels in October 2020 as per data from Airlines for America, a local trade association. However, following a sharp rise in COVID-19 cases, US passenger volumes had once again begun to trend downwards from late November onwards averaging around 34% in the first week of December of the traffic recorded the same time last year.

The situation is, however, more optimistic further south. In Mexico, by October 2020, domestic air traffic had recovered to ca. 60% of last year’s levels. While in Brazil, the largest market in Latin America, the recovery in domestic aviation sector has been relatively modest it has been encouraging nonetheless since emerging from the peak of lockdowns in April and May. As of October 2020, domestic passenger had recovered to around 50% of pre-pandemic levels (October 2019). The Brazilian market is on track to continue recovering as the local market enters into the peak summer travel season (provided there are no major subsequent waves of COVID-19 cases in the country). The major airlines from both markets (Brazil and Mexico), mainly LCCs, are currently planning a return to a near 100% of domestic pre-pandemic capacity by end of 2020 or early 2021.

The Ishka View

The recovery seen in the domestic markets is not only encouraging but also suggests that if the pandemic is under control, air traffic can return. It reaffirms the view that domestic markets will continue to lead to recovery in the post COVID environment as the international segment remains vulnerable to cross-border travel restrictions which by nature would be stricter than domestic travel regulations. As such, airlines that have access to a large domestic market, particularly LCCs, remain in a relatively favourable position as VFR and leisure segments drive the demand recovery. Nevertheless, the situation remains fragile as the pandemic is an active and evolving situation. Until the vaccine becomes widely available, the risk of new clusters and subsequent waves of coronavirus remains ever present which have the potential to quickly disrupt the recovery as seen in several markets.

Sign in to post a comment. If you don't have an account register here.