Wednesday 30 September 2020

Lessors explore ECA support for new aircraft deliveries

Aircraft lessors are in discussions with financiers about using export credit agency (ECA) backed debt and supported financing for new aircraft deliveries as debt markets become increasingly selective for aviation credits.

Aircraft lessors have not used ECAs to help finance their aircraft deliveries in any substantial volume for over a decade due to the cheap and available source of liquidity in the commercial banking market and capital markets. Several large aircraft lessors such as ILFC and CIT, which were later acquired by AerCap and Avolon respectively, were active historic users of ECA debt to fund aircraft.

Many lessors have benefited from relatively easy access to unsecured bond facilities which offer more flexibility in how to finance aircraft portfolios. But financiers talking to Ishka indicate that financing for both airlines and lessors have become harder to source, while terms have become more stringent on new facilities (see Insight: ‘Rising airline debt margins attract hedge fund interest’). Several lessors and asset managers have indicated that sourcing bank debt for new aircraft transactions has become increasingly difficult (See Insight: ‘High debt costs eat into aircraft lessor returns’). To help diversify their funding options many lessors with near-term aircraft deliveries are talking to bankers about the possibilities of ECA-backed debt. In contrast to commercial banks loans, ECA-backed debt typically takes longer to arrange, but represents a more stable, albeit more restrictive, potential source of debt for lessors.

AFIC to offer limited recourse aircraft lessor support

Lessors are not just looking at ECA support to ensure they have necessary debt facilities in place. Ishka understands that the Aircraft Finance Insurance Consortium (AFIC), the aircraft financing offering developed by insurance broker Marsh and airframer Boeing, is now offering limited recourse financing support aimed at aircraft lessors for new or “almost new” aircraft. Under OECD rules, ECA-backed financing is typically full recourse to the underlying credit. The new AFIC product, in contrast, will under specific circumstances offer debt financing insurance on a limited recourse basis to help fund aircraft for lessors.

The insurance product will look to the cash flows generated by the underlying lease to an airline to repay the debt and will ultimately have access to the aircraft as collateral. However, the equity owner of the aircraft, which in many cases would be the lessor, would not have the legal obligation to repay the debt in an airline default scenario – although the equity owner or lease manager may have an economic incentive or reputational incentive to keep the debt payments current.

Sources familiar with the new offering state that AFIC will only offer this type of cover for the “right opportunity” which would include the “right asset combined with the right airline lessee via the right lessor platform at the right terms”.

In practice, even in an airline default scenario an equity holder with the limited recourse AFIC cover might choose to help repay the debt to the creditors in order to protect the uncovered equity portion in their aircraft, which would be at risk if the AFIC Insurers foreclosed on the aircraft as collateral.

“It’s a different risk profile,” explains one source familiar with the product, “and getting an experienced lessor manager is key to help deal with any balloon risk in the transaction. But I think it could be a very busy time for supported finance for the leasing platforms.”

Higher pricing for ECA and supported financing

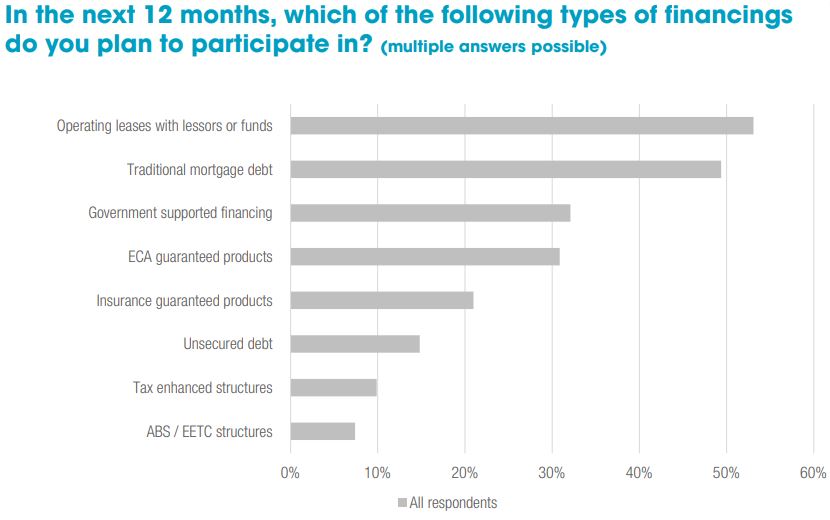

A July aviation financing survey by ATOZ, a financial consultancy, reveals there is a widespread assumption among airline and financiers that ECAs will play a bigger role for future aircraft deliveries (see chart). Export credit agencies have certainly been active this year as they manage their existing portfolios given a number of airline bankruptcies (see insight: ‘AFIC honours Norwegian claim, ECAs “busy” with airline restructuring requests’) and working with lenders to restructure ECA debt.

However, because of a severe reduction in the number of aircraft deliveries, ECAs and supported financing providers have only supported a handful of deals. US EXIM agreed a $498 million loan guarantee for Turkish Airlines in July – its first new aircraft financing guarantee in years. ECA sources tell Ishka they are in talks with lessors and airlines about new financing mandates in anticipation of near-term deliveries.

Financiers have indicated that like commercial bank loans, risk-adjusted margins are also rising for ECA-supported debt, albeit much more slowly.

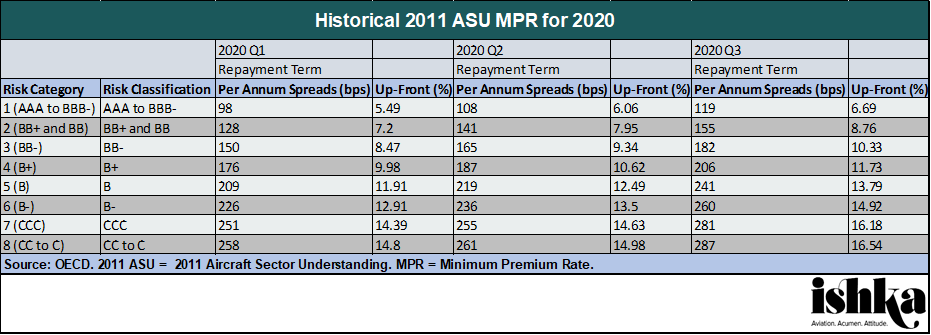

The OECD pricing benchmark indicates a steady hike since the start of the year for the ASU minimum premium rate, a measure designed to ensure that all-in costs for ECA-covered debt do not under-price the commercial bank market. The ASU minimum premium rate has increased by 21% for each of the top three credit classifications since January 2020. These figures are due to be updated in mid-October and, because this is a market-based metric derived partly from how the commercial bank market quotes debt, it could easily increase further in the October update.

Because of the severely reduced number of aircraft deliveries, however, there are fewer data points, which financiers state makes an accurate picture of ECA pricing harder to determine. One banker indicates that risk-adjusted margins for new ECAs and supported financing deals increased in the immediate aftermath of the Covid-19 outbreak in April but pricing subsequently contracted since the summer as more banks bid to win ECA debt mandates. Risk-adjusted bank margins for most new deals appear to continue to be below 80 basis points for ECA-covered debt, but financiers indicate there is a range based on credit quality and asset type. Bankers indicated there is also a currency distinction with one financier indicating that Euro-denominated debt is roughly 10-15 basis points inside of USD-denominated debt.

But banking sources add that the market is still far from normal and warn that exact pricing trends are likely to remain extremely uncertain until more aircraft deliveries happen.

The Ishka View

Several of the large lessors like AerCap, and ALC have been able to successfully tap the unsecured bond market this summer. But lessors are sensibly talking to ECAs about potential mandates as the debt market continues to be shaken by the Covid-19 crisis. Many banks continue to be skittish about doing new deals for aviation credits and some are still shoring up liquidity. Some banks, for instance, are reluctant to participate in deals even with ECA-support for airlines that are not existing customers.

Because of the strength of the underlying guarantee by the state risk-adjusted margins for ECA-backed debt is still fairly competitive. Ishka understands that bank margins for AFIC-covered debt are slightly higher because banks look to the credit quality of the insurer behind the non-payment insurance or guarantee, which will always be slightly weaker than a sovereign credit. The tight margins on some ECAs deals are, however, also deterring some banks from agreeing to do large volumes of ECA-covered debt because of the limited potential to generate revenue. “It’s a safe thing to take to your credit committee and it is good because it allows you to do some deals but it is hard to generate large revenues off this because the margins are so slim,” confides one banker.

Click here to download the data behind the chart.

Sign in to post a comment. If you don't have an account register here.