in Airline trends & analysis , Aviation Banks and Lenders

Friday 5 June 2020

Covid-19 bailouts: Austrian inches towards aid after Lufthansa deal

This is the twelfth updated summary of airline demands for state support and bailout proposals by governments around the world.

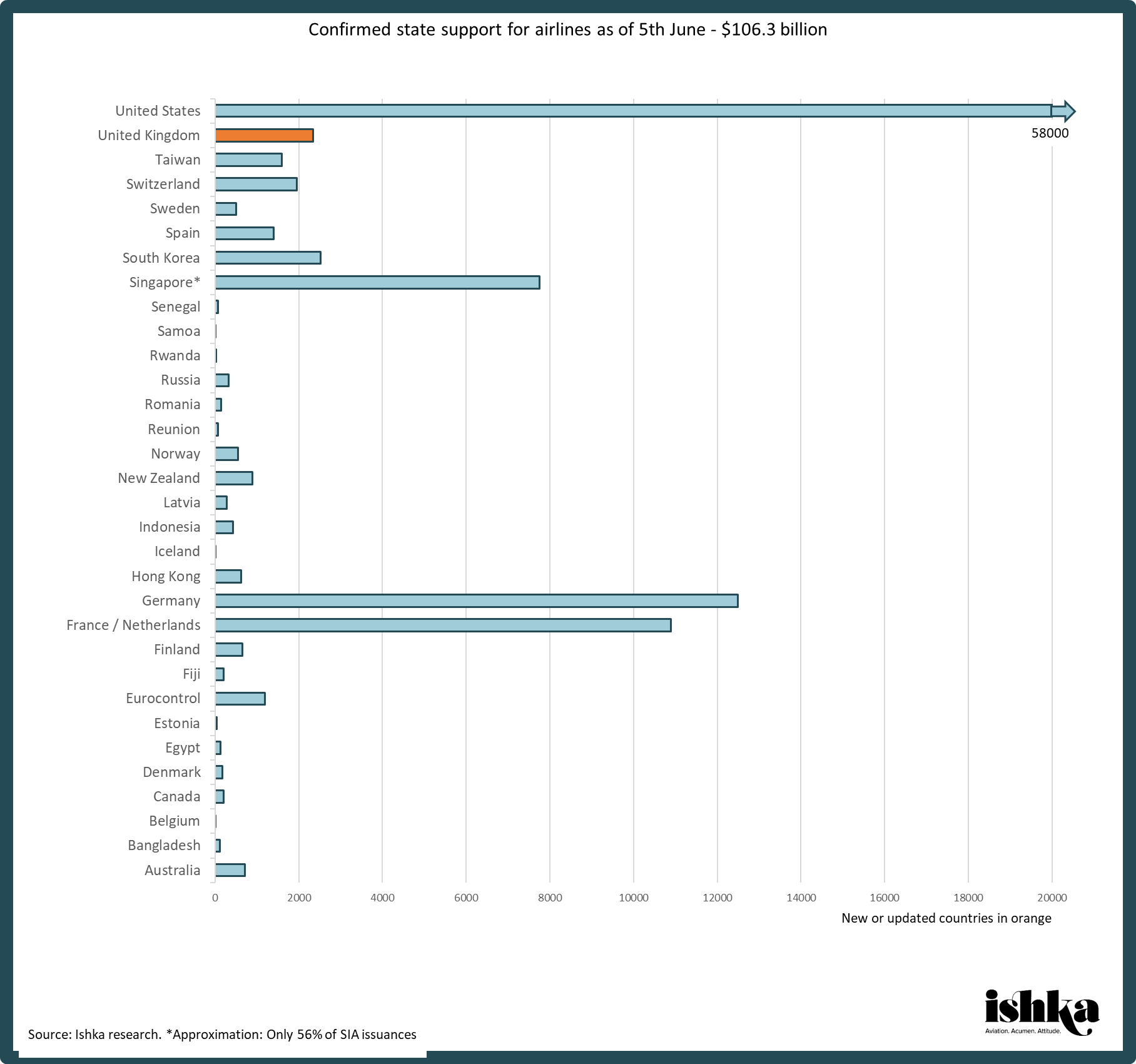

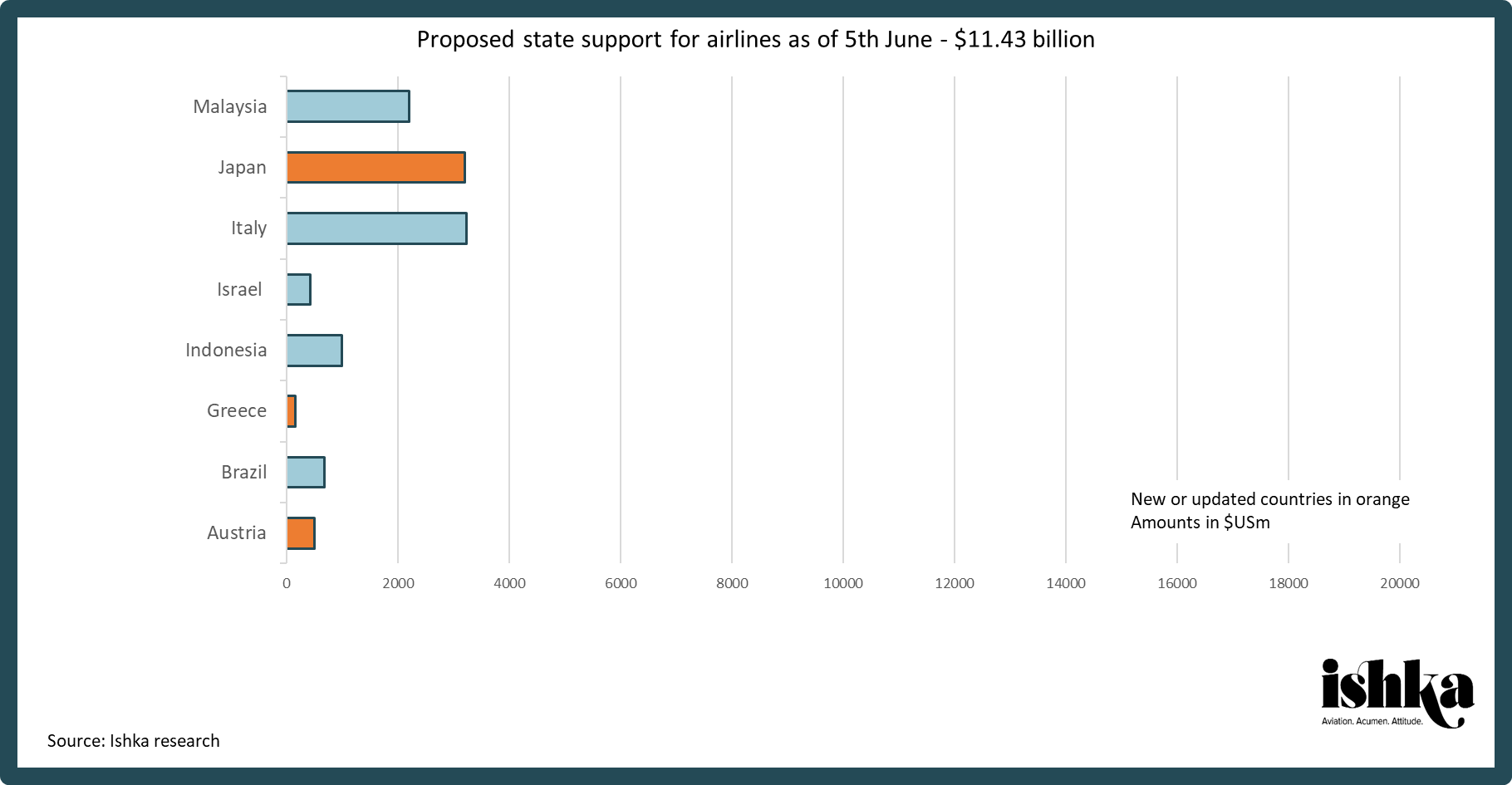

The tables attached contain the demands or stakeholder approaches to date of 131 carriers (including airline subsidiaries inside holding groups) and 25 industry associations, as well as the policies or proposed measures of 68 countries and EU-level entities. Ishka estimates that as of 5th June governments are preparing or executing $106.3 billion in confirmed bailouts or assistance measures for airlines globally. Unconfirmed reports suggest the total tally could be as high as $117.73 billion, $3.46 billion higher than last week as Japanese airline ANA announced it intends to borrow 350 billion yen ($3.2 billion) from the state-owned Development Bank of Japan (DBJ).

Ishka’s definition of government support for airlines encompasses any monetarily quantified relief measure provided by states or state-backed entities, including deferrals of taxes or operational charges, state-backed commercial loans and the nationalisation of airlines.

The tally of confirmed bailouts grew by $0.43 billion since the last update with the following small additions:

- According to a report by Sudinfo on 3rd June, Air Belgium has received a €2.5 million ($2.8 million) "contribution" from Walloon investment fund Sogepa, which is owned by the region of Wallonia;

- Samoa on 26th May announced a payment of $5 million tala ($1.87 million) for some land purchased from Samoa Airways, which local reports said it was intended to help the airline weather the Covid-19 crisis;

- Wizz Air confirmed on 3rd June it raised £300 million ($379.5 million) from the Bank of England's Coronavirus Corporate Finance Facility (CCFF) after obtaining confirmation of eligibility in April.

The tally of bailouts still in the works (those yet to be confirmed) grew by $3.04 billion, the bulk of which is made up by the 350 billion yen ($3.2 billion) which ANA intends to borrow from the state-owned Development Bank of Japan (DBJ) and €150 million ($168 million) which Aegean Airlines intends to borrow from a Greek State Guaranteed Fund for strategic enterprises. In other news, Austrian Airlines is reportedly set to receive €450 million ($510 million) in government assistance, lower than the €767 million ($833 million) it had applied for in April.

The Ishka View

The finalisation of the Lufthansa bailout appears to have cleared the way for bailouts under negotiation for other airlines in the group to progress. Lufthansa CEO Carsten Spohr was reportedly set to meet Austrian Chancellor Sebastian Kurz yesterday (4th June) and according to local reports a bailout package for Austrian Airlines will be announced next week. Austrian daily Der Standard reported that the Vienna-based carrier will receive €600 million ($680 million) comprising €150 million ($170 million) from parent Lufthansa and €450 million ($510 million) in government assistance (a €300 million state-guaranteed bank loan and €150 million in subsidies). The details of the deal are not yet known but, conforming with the demands of some members of the cabinet, the Austrian government appears to have included some environmental goals.

Elsewhere in the world, the past week saw some airlines inch closer to new government funding (Aegean, ANA, LOT Polish Airlines) while others continued to see their requests for funding reportedly rebuffed or put on hold (El Al Israel Airlines, Smartwings, Tunisair). As previously highlighted, factors influencing a country’s decision to help its airlines appear to be their strategic importance to the national economy, the state of national finances, the pre-Covid profitability of the airline in question and, perhaps to some degree, the approach taken by neighbouring countries.

Much will be learned in the coming months about the potential shape of the recovery, as airlines test reduced schedules during the northern hemisphere summer. This experience, if positive, may send the message that some airlines are worth bailing out in their current size or, for those with better financial prospects, encouraged to explore commercial financing options (Virgin Atlantic, for instance, is in talks with banks and private equity firms to raise funds). On the contrary, a negative recovery outlook after June or July could push some airlines to request further aid – some for the second time – and force others intro restructuring processes and even liquidation.

State support tally

The charts below tally financial support for airlines (converted to US dollars) confirmed by 33 nations or public entities and, separately, proposed or unconfirmed financial assistance by eight other states. For a detailed table: Click here to download the tables.

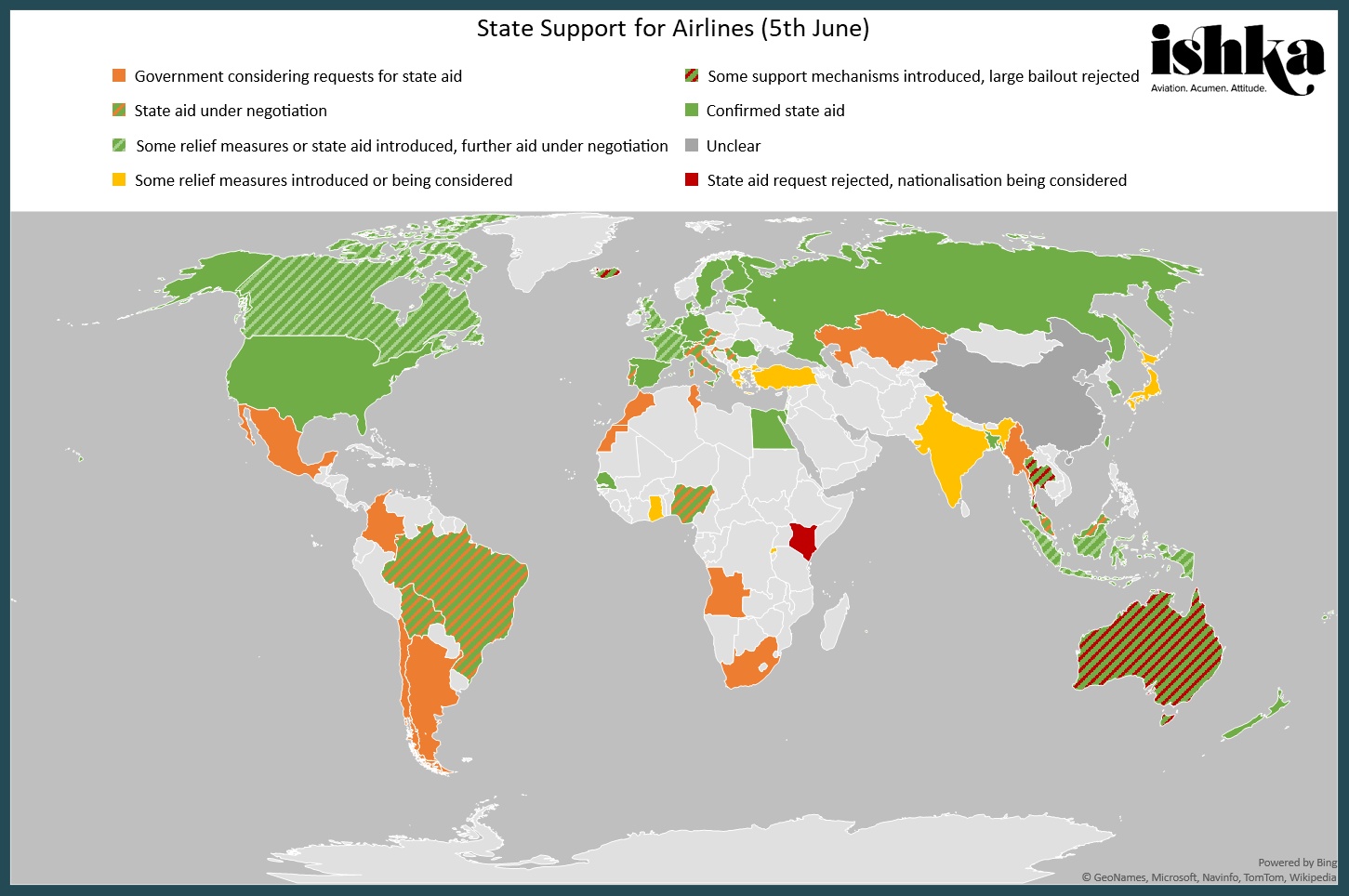

State Support

To view the latest table containing policies or proposed measures of 68 countries and EU-level entities: Click here to download the tables.

Airline requests

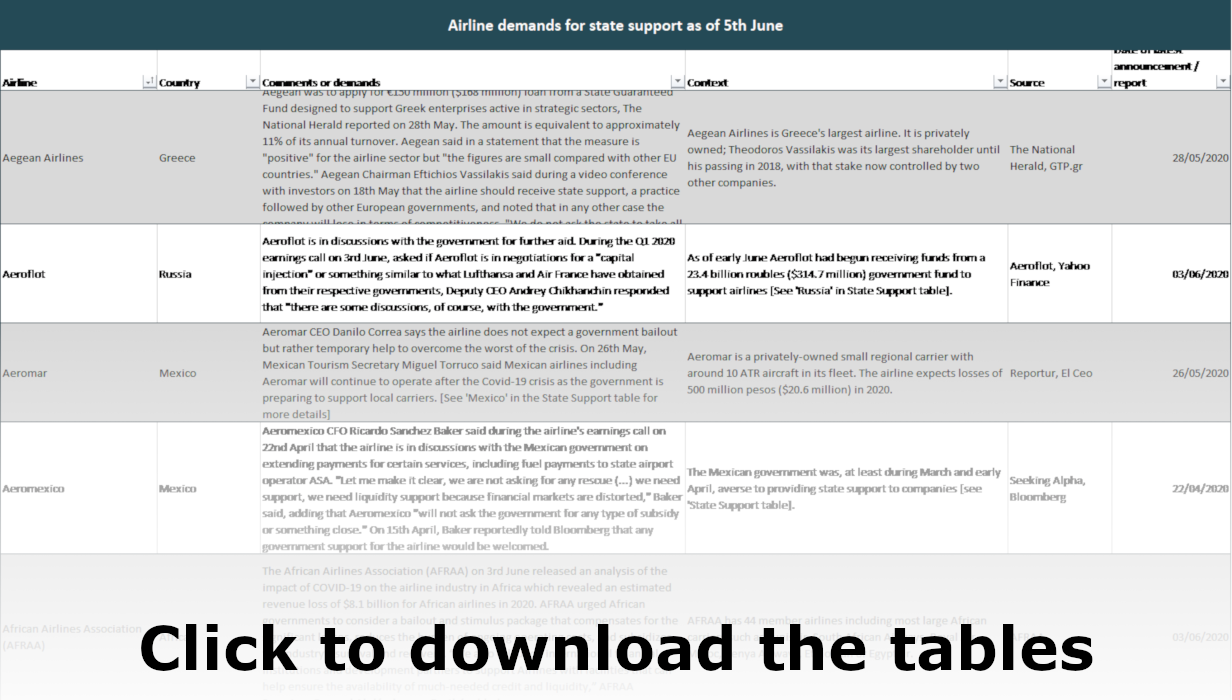

To view the latest table containing demands or stakeholder approaches of 131 carriers (including airline subsidiaries inside holding groups) and 25 industry associations: Click here to download the tables.

Sign in to post a comment. If you don't have an account register here.