Wednesday 16 June 2021

ALC markets Blackbird Capital II aircraft ABS

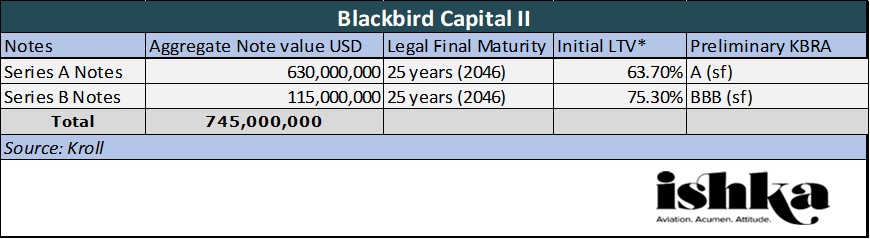

Air Lease Corporation (ALC) is in the market with a $745 million aircraft ABS – Blackbird Capital II.

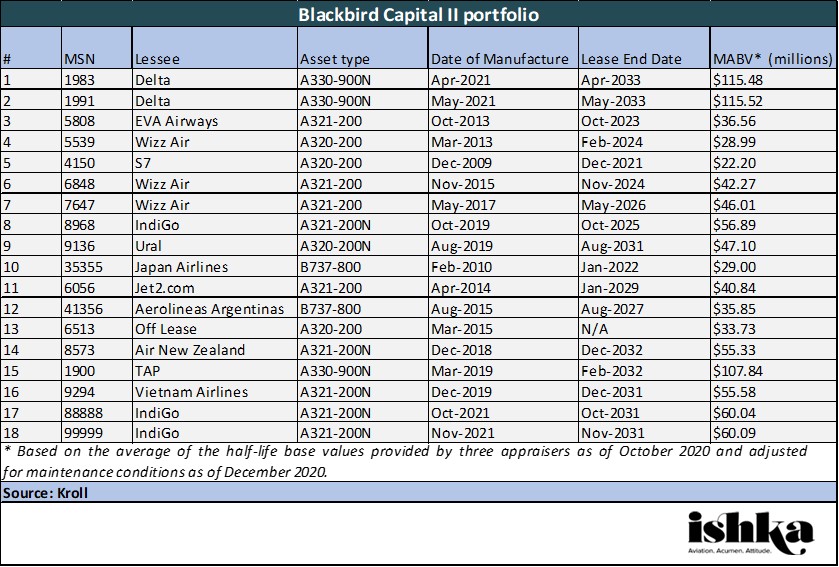

Proceeds from the ABS will be used to acquire a portfolio of 18 aircraft from Blackbird Capital II LLC, a joint venture between Napier Park Global Capital (US) LP and ALC. ALC will be the servicer on the deal.

The ABS, which is currently being marketed to investors, is split between two tranches: a $630 million series A note with an initial LTV of 63.7% and a $115 million series B note with an LTV of 75.3%. The Blackbird Sellers will be retaining the equity at closing.

The weighted average age of the portfolio is 2.9 years while the weighted average remaining lease term is approximately 8.3 years.

Click here to download the data behind the chart.

Blackbird portfolio and the 25% allowance for off-lease, or delinquent aircraft

This portfolio consists of 15 narrowbodies aircraft (65.8% by value) and three A330-900neo widebody aircraft (34.2% by value). Two of the A330-900neos are on lease to Delta with 12 years remaining lease and the other is to TAP with 11 years of lease remaining.

The transaction has an unusual 25% allowance in the portfolio for delinquent, off-lease, or non-delivered assets.

As Kroll highlights, in most aircraft ABS transactions assets need to be either a) on lease or b) less than 30 days past due on rent payment, c) delivered to the lessee at the time they are transferred in the securitization and d) not have any material non-payment defaults; however, in this transaction, there is a 25% allowance (by value) to not have any of these condition precedents to delivery.

This has allowed ALC to include three aircraft which have not yet delivered to two airlines. These include two A321-200neo aircraft on a LOI sale/leaseback with IndiGo which are expected to deliver in December 2021 and one A321-200 set to delivered to Jet2 in September 2021.

It has also allowed the lessor to include one off-lease A320-200 and include two initial lessees, Aerolineas Argentina (3.6% by value) and Vietnam Airlines (5.6% by value), who are more than 30 days late on lease payments.

In addition, three undisclosed aircraft are subject to deferrals (21.3% by value) and one of these is on a power-by-the-hour scheme for a certain term. Kroll notes that both leases are in the repayment phase and are not experiencing any delinquencies.

Click here to download the data behind the chart.

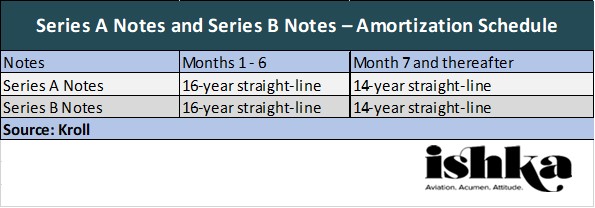

Structural enhancements

In addition to the typical structural features common in aircraft ABS transactions, Blackbird Capital II also includes several structural enhancements informed by Covid-19. These include a three-month DSCR test compared to the six-month DSCR test common to aircraft ABS deals before the pandemic.

In addition, the transaction also includes a security deposit account, which will be funded with the cash security deposits associated with the initial leases that expire prior to the anticipated refinance date (ARD). According to Kroll, any excess amounts on deposit will be used to cover senior expenses and interest on the Series A Notes and Series B Notes, and cannot be leaked to equity.

According to Kroll the deal has a nine-month liquidity facility and a debt service coverage ratio (DSCR) of 1.15x and early amortisation trigger in which the excess cash will be used to pay down the Series A notes and then the Series B notes if the DSCR is less than 1.15x or the utilisation of the portfolio falls below 75% within a three-month period.

Rapid amortisation will also be triggered if the issuer collectively owns less than six aircraft at the end of the delivery period. Similarly, a DSCR Cash Trap Event will occur after the third payment date, if the DSCR falls below 1.20x but can be cured if it is at or above 1.20x for three consecutive payment dates.

The Ishka View

At just under three years, Blackbird Capital II (Blackbird II) is the second youngest aircraft ABS portfolio Ishka is aware of to have come to market. It also boasts a long-weighted average remaining lease term of roughly 8.3 years – easily exceeding the anticipated refinancing date.Ishka notes that recent ABS portfolios have skewed to predominantly younger narrowbodies given the dislocation happening to long-haul travel which is disproportionately impacting twin-aisle aircraft. Blackbird Capital II contains three twin-aisle assets, all A330-900neos, however, the long leases attached (11-12 years lease remaining), and the strong credit quality of the lessees attached, Delta and TAP, is an effective risk mitigant.

ALC has inserted an unusual 25% allowance in the portfolio for delinquent, off-lease or non-delivered assets. This has allowed the ABS portfolio to contain undelivered aircraft from sale/leasebacks which helps bring the average age down, but it also permits the inclusion of a couple of late-payers as well as three aircraft under deferred payment arrangements – which are a common issue for lessors as a result of the Covid-19 pandemic.

It has been a busy month for the ABS market following the successful pricing of Merx Aviation’ MAPS 2021-1and Sky Leasing’s SLAM 2021-1. ALC is a known servicer, and a hot ABS market suggests that investors are likely to warm to the overall metrics of the portfolio, but investors might seek a premium for allowing ALC more flexibility in crafting this portfolio.

Sign in to post a comment. If you don't have an account register here.