in Capital Markets , Aviation Banks and Lenders

Wednesday 26 April 2017

Investor’s guide: What is Schuldschein?

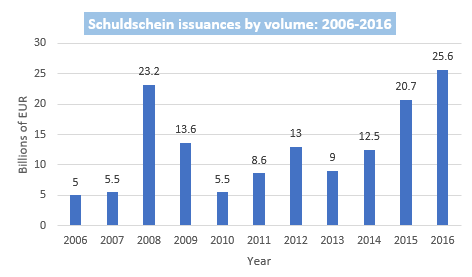

Corporate Schuldschein, a type of European private placement, and a traditional feature of the German corporate debt market enjoyed a record year in 2016 with issuances reaching €25.6 billion, topping its previous peak of €23.2 billion in 2008. Its features include lean documentation, low issuance costs, a diversified investor base, and is increasingly popular across Europe and internationally.

The instrument has also begun to draw the interest of aviation financiers, with two notable deals. Lufthansa returned to the Schuldschein market in 2016 with a €475 million ($540 million) issuance while Goshawk is the first leasing company to tap the growing market with a pioneering $95 million deal.

“All the indicators point to a pretty high level of Schuldschein issuances in 2017, though records are always hard to predict,” says Christian Wolff, director of corporate finance at Helaba.

The first of a two-part series on the Schuldschein market, Ishka looks at why corporate Schuldschein have become so popular with investors.

Source: Thomson Reuters

What is a Schuldschein?

A corporate Schuldschein (CSD) is the German equivalent of a private placement that shares many characteristic of a loan. Legally speaking, a CSD is a collection of bilateral loan contracts, as opposed to a syndicated loan which is a collective agreement. The centuries-old instrument has been around in its current format for around 25 years and has become increasingly popular since the financial crisis as a way for corporates in Germany and across Europe to borrow money.

“From a legal perspective, the basic Schuldschein documentation is much simpler than in the bond format,” says Wolff. “If you translate it from the German it means something like an ‘IOU’.”

Schuldschein products have a typical maturity of between three and 10 years, and generally range between €50 million and €500 million. Unlike a syndicated loan which has one tenor, the Schuldschein offers variable maturities to suit different investors.

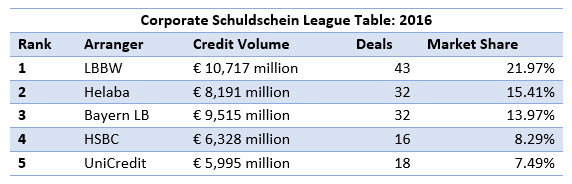

Source: Thomson Reuters

Why is the Schuldschein so popular with investors?

The traditional investors in Schuldschein products are German landesbanks and savings banks (see table above). However, Schuldschein’s profile as a uniquely German product is changing with larger corporate issuers across Europe drawing in a wider range of investors than traditional bonds, including pension funds, debt funds and insurance companies. This is in marked contrast to the French Euro Private Placement which remains mostly a domestic product. Investors, both domestic and international, are attracted by lean documentation, good pricing, accounting benefits, and a strong historical performance compared to public bonds.

Simplicity and lean documentation

Investors are primarily attracted by the speed and simplicity of corporate Schuldschein issuances. Unlike bonds, there is no requirement for them to be assessed by a ratings agency which helps to reduce costs, and as private placements they don’t have to be registered with an exchange and no prospectuses must be issued.

The loan format of the instrument means its legal documentation is relatively straightforward. According to Wolff, a Section 144A US bond for example, could have attendant documents running to 300 pages. By contrast, a typical unsecured Schuldschein will have between 15 and 40 pages in documentation and will have correspondingly lower legal fees too.

Pricing: Schuldschein investors sacrifice liquidity for yield

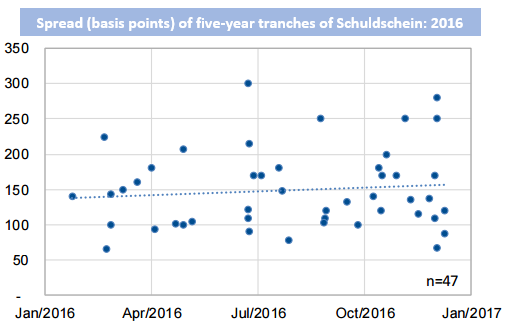

Schuldschein pricing is tight but generally higher than public bonds. According to Scope Ratings, the median spread for five-year corporate Schuldschein tranches placed in 2016 stands at just 138 basis points (see graph below). Unlike bond buyers, institutional investors are likely to buy and hold. They therefore do not mind sacrificing liquidity in exchange for higher yields.

Bonds are highly liquid and have plenty of investors which will typically make them cheaper. But the continued corporate bond buying scheme by the European Central Bank has further depressed pricing. This should make Schuldschein uncompetitive, but its qualitative advantages in a highly-oversubscribed market has kept pricing competitive for issuers, but still high enough to attract a wider range of investors.

In some instances, high demand has led to pricing that is cheaper than the bond market. But this downward trend – attractive as it is for issuers – may not be sustainable in the long term.

“Going forward, interest spreads should increase because for some transactions we don’t think the pricing is right, says Sebastian Zank, director of corporate ratings at Scope. “But it will be some time before we see more credit events. Investors will have to see evidence of this before they demand higher pricing.”

Source: Scope Ratings, Bloomberg and Thomson Reuters

Accounting advantages

In accounting terms, Schuldschein products are not mark-to-market which means that its value will remain constant on the balance sheet instead of fluctuating in line with the current market price, something that is appreciated by institutional investors. “The Schuldschein is a pretty benign way to keep a constant book value and reduce volatility on your balance sheet,” says Wolff.

Schuldschein outperforms the capital markets in times of stress

Unlike the public bond market, Schuldschein are insulated from geopolitical risk events and often outperform public bonds in times of stress. In 2008, global capital markets froze. Bond issuance volumes fell by as much as 50% in some asset classes. While Schuldschein reached around 180% of its former volume. For example, in 2016 Lufthansa’s deteriorating credit rating meant the bond market was partly closed to the carrier but the Schuldschein market remained open.

Light documentation could be a liability in case of default

As a private debt instrument, Schuldschein is a necessarily opaque market. Lenders often rely on their own internal credit analyses and there is an implicit recognition that it is an investment grade product. But this may be diluting the credit quality of issuers. Assessing credit risk is easier for German banks some of whom are only mandated to invest in German corporates, so the issuer base is well known and mostly German. But it is more difficult for overseas investors – who are increasingly attracted to Schuldschein – to accurately assess credit risk, especially with international issuers. There were 60 international Schuldschein deals in 2016, equalling 48% of the total market. As yield hungry international investors drive down pricing on in-demand Schuldschein products, the returns on lower rated credits begin to look more attractive. As a result the very competitive pricing on offer may not accurately reflect true credit risk.

Moody’s has warned that poor transparency and sparse documentation standards increase risks for investors as credit quality deteriorates. So far, the corporate Schuldschein market has been relatively free of defaults. But this might not always be the case. There is little protection in the German civil code in case of issuer insolvency, though investors are not perturbed by the light documentation. However, Schuldschein products can be very hard to restructure when things go wrong. Having many different investors means potentially dozens of separate bilateral negotiations when an issuer breaches a debt covenant or defaults. Syndicated loans may come with extensive documentation, but it is a collective agreement so negotiations are multilateral and relatively straightforward.

Ishka view

The Schuldschein market has undergone something of a boom in recent years as it attracts corporate issuers across Europe and an increasingly global investor base. It is now the favoured private placement product in the European market. The instrument is also beginning to attract players in the aviation sector. In 2016, Lufthansa returned to the market. And Goshawk became the first aircraft leasing company to issue a Schuldschein.

Investors are attracted to the structural and legal simplicity of the Schuldschein, lean documentation relative to traditional bonds, attractive pricing for investors, accounting advantages and strong historical performance in times of stress in the capital markets.

However, high demand and aggressive pricing from issuers is leading to some concern that the rush to sign Schuldschein deals is leading to a dilution of credit risk, especially for new international issuers.

Sign in to post a comment. If you don't have an account register here.