in ESG & Regulation , Aviation Banks and Lenders

Sunday 11 December 2016

Two opportunities to reopen US Ex-Im

Plans to make US Ex-Im fully operational again were dealt a blow this week when Congress rejected an amendment to a short-term spending bill that would allow the bank to function without a full board.

Exactly a year after it was re-authorised by President Obama, the North American export credit agency (ECA), remains unable to approve loans greater than $10 million - preventing it from supporting aircraft deliveries. The bank remains hamstrung by the refusal of the Senate banking committee chairman, Richard Shelby, to confirm the President’s nomination to the board.

However, not all hope is lost for US Ex-Im. Ishka examines two opportunities to reopen the bank. The first involves a new Senate banking committee chairman, while the second involves the next US budget.

The Ishka View is that US Ex-Im is unlikely to become fully operational during this lame-duck Congress. However, given Trump’s emphasis on protecting American jobs, Ishka believes that the President-elect will swing behind the bank in the New Year.

Lawmakers reject Ex-Im clause

US Ex-Im is invaluable tool for Boeing to ensure financing for its commercial aircraft is competitive with other aircraft manufacturers, principally through the use of state guarantees for banks financing Boeing aircraft deliveries.

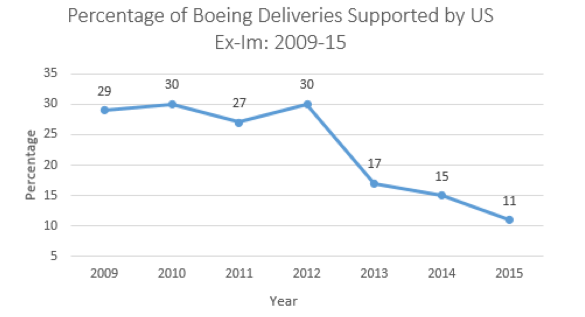

As the graph below indicates, Boeing’s reliance on the bank to support aircraft deliveries has declined since the financial crisis thanks to the relatively abundant liquidity. But if the Basel III accords are implemented in its current form then export credit is likely to become more attractive, and Ex-Im correspondingly more important, relative to other types of aircraft-backed financing. As it stands, bank lending by volume is down 60% on 2015 and is at its lowest level since 1971.

US Ex-Im is the victim of partisan US politics which has, so far, prevented the bank from being able to perform its normal functions.

At core is the need for the bank to find a way of operating without a full quorum of board members. Under current law, at least three members are needed on the five-member board for the agency to approve loans of more than $10 million, something that rules out almost all aircraft deals. By refusing to confirm the President’s nomination to the board, the current Republican Senate banking committee chairman, Richard Shelby, has managed to frustrate the bank’s normal approval process while it only has two board members.

An amendment or ‘anomaly’ containing language that would allow the board to temporarily function without a full quorum did make it into the last Continuing Resolution (a stop-gap funding measure) at the end of September, but was removed before it was passed. That CR will fund the US government until 9 December 2016. A Second attempt to amend the Continuing Resolution, led by senator Lindsey Graham, was thrown out by Congress on 6 December. Ex-Im supporters will now focus on full budget negotiations.

Next steps: pass a full budget

US Ex-Im’s submission to Congress for its $110 million administrative budget for financial year 2017, presents another chance to re-authorise the bank.

“So, the next question is whether they are going to vote new budget legislation in December or not – the so called omnibus bill,” says da Silva. “If they do vote and the language [amending the quorum rules] is in there, and remains in there, then that is another opportunity.”

Interestingly the bank is not requesting funds for export credit, which could be seized upon by opponents. The submission also states that it has $10 billion worth of deals held up in the pipeline. But, “If neither of these things happen in December, then we have a new Senate banking committee chairman in January, and we will see how prone he is to doing his job,” adds da Silva.

Wait and see

The incoming chair of the Senate Banking Committee, Mike Crapo, has a mixed record on supporting the bank. Crapo has voted against the bank’s reauthorisation three times in the past four years. And has previously argues that the best way to support US exports is through tax incentives. But the senator also supported a bipartisan measure that led to the bank’s reauthorisation in 2006. For the time being, Crapo is waiting on President-elect Trump for his line on this issue. But this should give some hope to the bank’s supporters.

Trump may back the bank

Trump’s campaign rhetoric has been broadly negative about US Ex-Im. In August 2015, he said the bank was “excess baggage” and “not really free enterprise.” But his instinct for protecting American jobs may win out, after all Boeing is the largest exporter in the United States.

Trump’s vocal support for United Technologies, the parent of air conditioner and furnace maker manufacturer Carrier, is a rare example of consistency between pre and post-election Trump. The company was due to outsource production to Mexico but has since reversed course in a state deal brokered in Trump Tower. Incidentally, the company also makes engines for Pratt and Whitney who are the second largest user of US Ex-Im after Boeing.

The shutdown is already hurting manufacturing jobs in Boeing’s supply chain. In 2015, Boeing passed on $48 billion in business to 15,600 different suppliers across the US. As senator Lindsey Graham, a prominent supporter of the bank tweeted: “President-elect Trump can save thousands of American jobs by getting #EXIM Bank up and fully operating.” When job losses become acute, President Trump is likely to take note.

According to Boeing, the company sells 80% of its products abroad, but generates 80% of its content within the US. “Trump has talked very persuasively about supporting more jobs here at home, good-paying jobs here at home, making sure that we can compete globally,” said Fred Hochberg, Ex-Im’s president. “That’s what this agency does.” What’s more, Hochberg added, with five upcoming board vacancies and a position as inspector general opening, Trump will be free to mould the agency in his administration’s image.”

The Ishka View

Time is running out to get the US Ex-Im Bank operation by the end of the year. The same issues that have stymied the bank all year have not gone away. Senator Richard Shelby remains opposed to allowing a vote on President Obama’s nominations to the board and is unlikely to change his mind any time soon. On the other hand, the United States has only passed one full budget in the last six years. Waiting for the new Senate banking committee chairman, Mike Crapo, to take his seat in the new Congress is the final and most promising option for supporters of the bank. Crapo will probably follow the lead of President-elect Trump. Trump’s outspoken support for US jobs means that Ishka believes he is likely to be agreeable to proposals to reopen the bank.

Please Note: The views expressed do not constitute investment advice. We accept no liability to recipients acting independently on its contents in respect of any losses, including, but not limited to profits, income, revenue or commercial opportunities.

Photo: The Center for American Progress

Sign in to post a comment. If you don't have an account register here.