Thursday 6 October 2016

How vital are subsidies for Russia’s regional carriers?

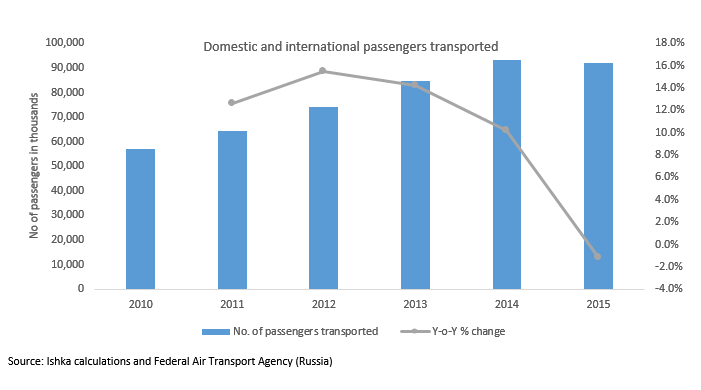

The Russian aviation sector has been impacted by an on-going Russian recession. At one point Russia’s aviation sector was growing at a CAGR of around 12-13% (as per Aeroflot’s estimates). However, the pace of growth in the total number of passengers transported by all airlines in Russia has shrunk each year since 2012 before finally contracting in 2015. The fall in crude oil prices and the subsequent weakening of the RUB has also aggravated the slowdown in passenger traffic.

The Russian government has helped stimulate local passenger demand through a series of subsidy programmes aimed to help local carriers and support intra regional travel. The government subsidies around 140 domestic routes covering 12 domestic airports in-order to stimulate more air travel.

The current subsidy programme covering the Russian Federation was introduced in late 2013, however, the Russian government had been supporting the regional aviation sector in some form or the other even prior to that. At present, the subsidies amount to three-four billion RUB each year on average.

Aviation sources have indicated that some of this municipal support could be removed as Russia deals with reduced revenues as it battles an on-going recession.

The Ishka View is that some government aviation subsidies could be at risk, but since the subsidies support a small percentage of domestic traffic their removal will have a negligible impact for domestic airlines. Russian carriers still benefit from an active domestic market but if passenger traffic continues to decline it is possible that more Russian airlines could consolidate.

Russia’s recession continues and the impact on aviation

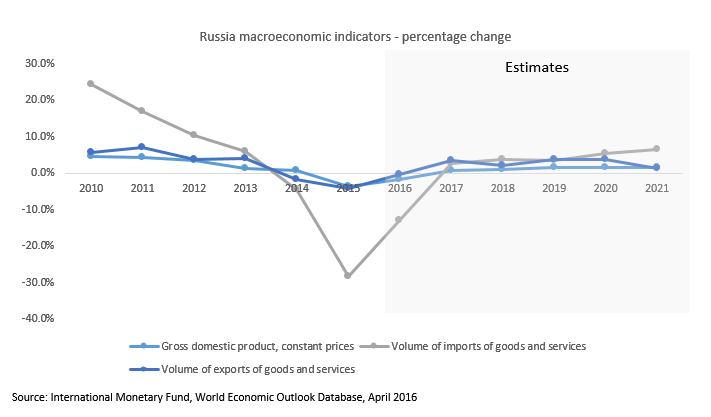

Russia’s recession shows some signs of easing but the fact remains that Russia’s GDP has contracted significantly, its exports and imports have fallen and government revenues are down. All major macroeconomic indicators are on a downward spiral – as per the IMF Russia’s GDP growth slumped to just 1.2% in 2013, falling further to 0.7% in 2014 and finally contracting 3.7% in 2015.

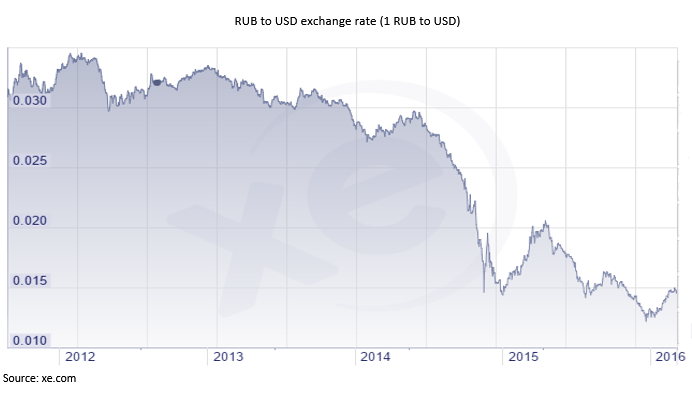

In addition, the fall in crude oil has also inflicted additional wounds on the Russian economy, the severest being the weakening of RUB. The value of the RUB has tumbled against most major currencies since 2014 and this has made outbound flights more expensive for Russian travellers. As a result, passenger traffic has slowed down.

Subsidy cuts unlikely to significantly impact domestic aviation

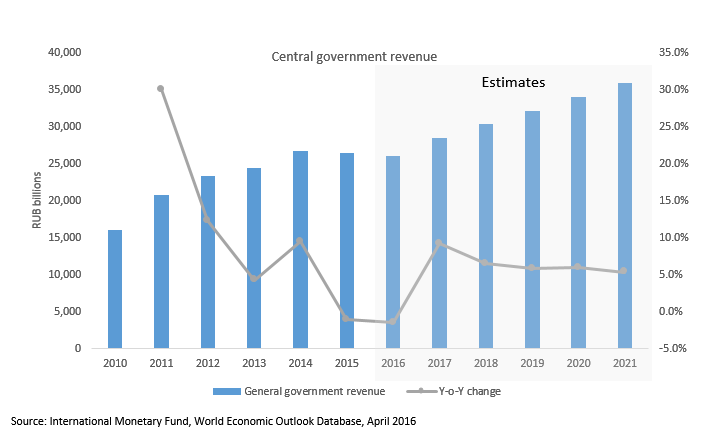

The Russian government has, on average, been spending around three-four billion RUB each year on its regional aviation programme. Ishka sources have stated that some of these regional aviation programmes could be cut or reduced. The Russian economy is heavily reliant on oil & gas and therefore the fall in crude oil prices negatively impacted government revenues as demonstrated in the chart below.

According to the Moscow Times Russia has already instructed other government departments ranging from science, energy, sports and transport to implement cuts in their spending corroborating rumours that the aviation subsidy schemes are also at risk.

Despite this, Ishka does not foresee the withdrawal or limit in subsidies to have any significant negative impact on regional airlines. On the contrary, our research suggests that regional airlines are not heavily reliant on the subsidy programme. In the first eight months of 2016 (till August 2016), data from the Federal Air Transport Agency (Russia) shows that less than 2% of the nearly 38 million domestic passengers were served under the various subsidy programmes.

Russian airlines that could be impacted by the cuts

The delicate situation of Russia’s civil aviation heightens the risk of airline closure or default. While most of Russia’s leased aircraft remain with Aeroflot or the other major Russian airlines, there are several other airlines that operate with leased aircraft. Ishka understands that among the lessors, AerCap, Aviation Capital Group, GECAS, CDB Leasing, SMBC Aviation Capital are most exposed to the Tier 2 regional Russian airlines.

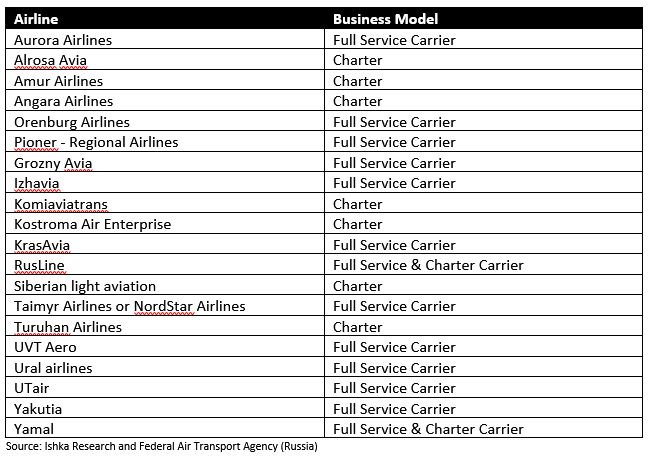

Some of the airlines participating in the subsidised regional air transportation programme are listed below

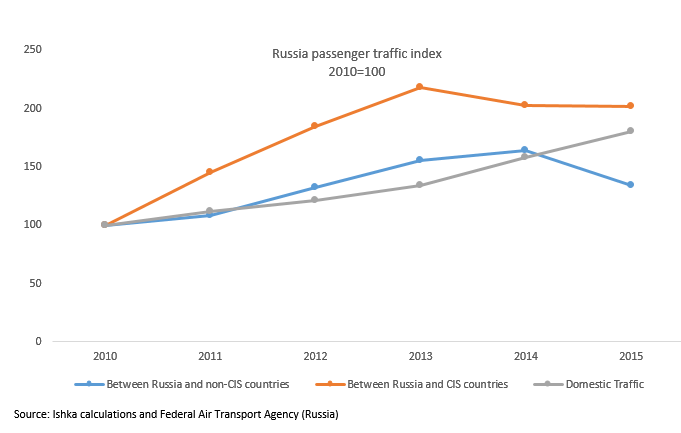

The good news for these lessors is that domestic Russian aviation travel has remained stable as can be seen from the chart below.

The Ishka View

The combination of geopolitical and macroeconomic events has pushed Russia’s civil aviation industry into recession much like the entire economy. Several airlines have already gone bust including Transaero Airlines, which was at one point the second largest airline in Russia which was badly impacted by a weakened RUB.

The government is supporting the domestic industry through subsidised fares, however, in reality, not many domestic passengers are reliant on these programmes. Even if the government does cut these subsidies regional airlines are unlikely to be dramatically impacted. The Russian aviation sector has been a shrinking market internationally but domestic travel has remained stable so far. The concern is that if the recession continues and domestic travel does decrease then this could lead to further airline consolidation.

Sign in to post a comment. If you don't have an account register here.