There's a market of opportunities for both new and existing investors looking to acquire assets at more attractive prices.

It’s a complex environment and financiers and investors need to understand the volatile levers and different dynamics in the search for decent yield.

Ishka’s experienced advisory team is working hand-in-hand with seasoned and new-entrant financiers and investors alike to understand:

Changes in supply and demand and how passenger and freight traffic will translate into aircraft requirements

Liquidity and the financial and operational health of the world’s airlines

Residual value analysis, identifying aircraft types that match specific investment criteria and the size and shape of value and lease rate volatility

Our combined services support you at every stage of the transaction lifecycle to achieve superior returns

Stage 1: Define your aviation investment strategy

Stage 2: Identify and target opportunities which meet your objectives

Stage 3: Evaluate and execute transactions

Stage 4: Monitor your exposure and manage risk

Contact our Advisory team to discover how we can apply this to your business

ENQUIRE

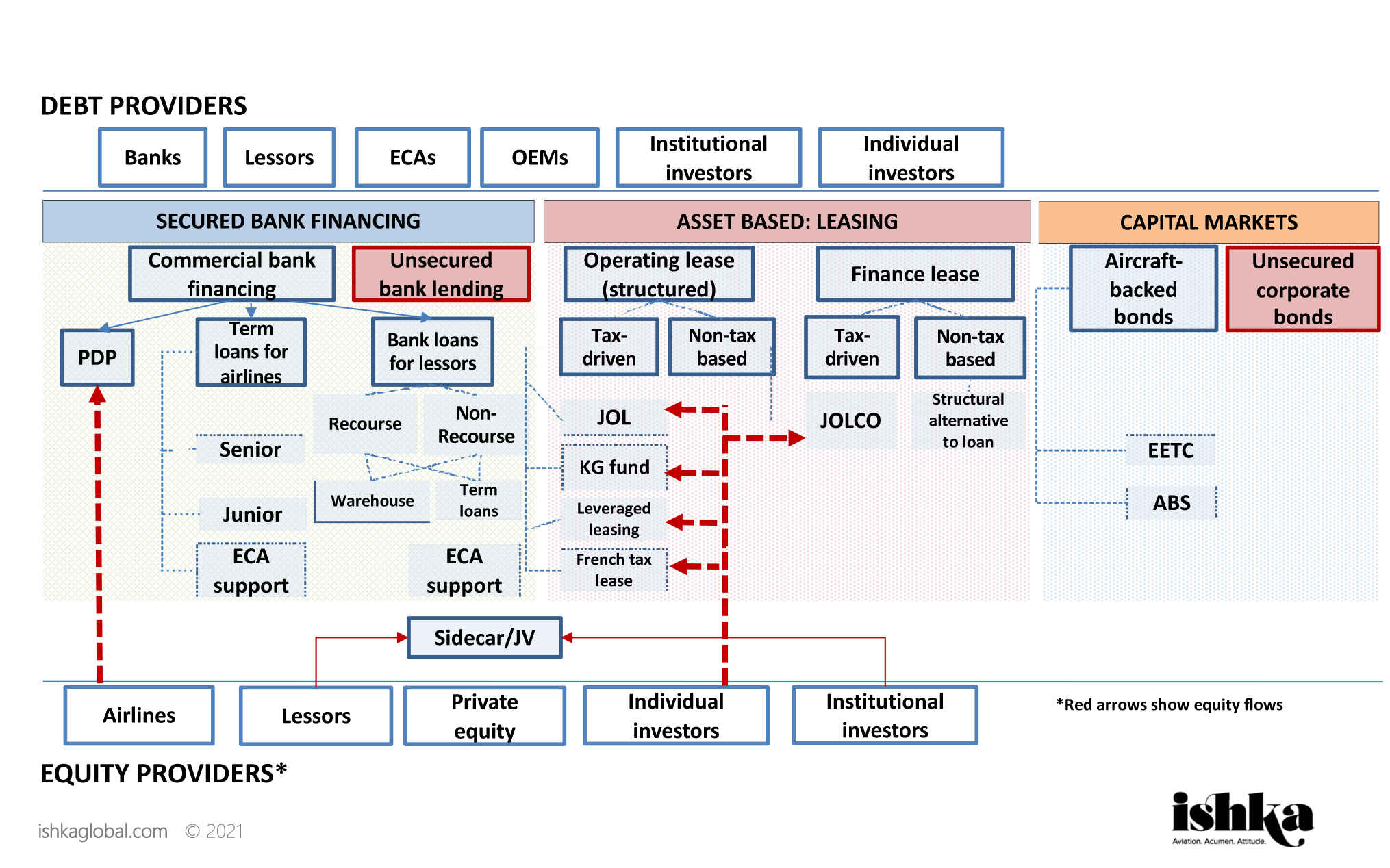

The demand for new financing has led to new entrants, including private and tax equity, hedge funds and insurance companies, joining established US, Canadian, Japanese and European investors and South Korean and Chinese investors. All new investors and financiers face opaqueness in the market, which Ishka successfully addresses through our advisory services and proprietary data platforms. Multiple financing models and an increasing number of entry points exist through equity, debt and structured financial products. Ishka advises on defining and structuring successful investments to suit specific objectives and create short, medium and long-term value

The collective expertise and proven track record of our global team delivers first class services. We can:

Analyse the market and define new opportunities for the future market environment

Determine investment strategies that meet specific investment criteria

Perform commercial due diligence services for acquisitions or investments in airlines and operators, lessors and suppliers

Achieve superior risk and reward profiles in accordance with specific investment objectives

Understand risk and reward to effectively monitor exposure and actively manage risk in a turbulent global market

The Ishka Advisory team serves:

To find out how our expertise can benefit your business

Call +44 (0)20 3468 2202

Email advisory@ishkaglobal.com