Get total visibility

Airline Credit Profiles delivers a unique evaluation of the world’s leading airlines, all in one integrated solution

Powered by analysis from Ishka’s experienced team, Airline Credit Profiles (ACP) is the industry’s trusted benchmark on which the market can compare, measure risk and trade with confidence.

Delivering so much more than airline financials, discover ACP’s Vulnerability Matrix, Airlines On Watch, Consolidated Airline Scores, Airline Comparison Tool and Historical Airline Data.

Watch our platform in action and how it can benefit you in our 2-min highlights video

What sets Ishka ACP apart?

Exclusive, intuitive and customisable data dashboards

Interactive Dashboard

Access and customise dynamic data and exclusive analytics, simply unavailable from other sources, including in-depth airline reviews, key metrics, and consolidated scores.

Our upgraded intuitive layout ensures faster navigation to the intelligence you need.

Vulnerability Matrix

We’ve launched a new Airline Vulnerability Matrix, based on the Ishka Macro Risk Profile.

Discover our unique snapshot of airline credit risk, continuously updated as conditions shift, and check the performance of airlines that matter to your business.

Comparison Tool

Track trends and monitor concerns whilst evaluating your own portfolio side by side or against peers with our exclusive Airline Comparison Tool.

Create and save portfolios and analyse multiple airlines in an instant.

Consolidated Scores and Historical Data

Customise your own personalised score sheet of the world’s leading airlines and access critical data metrics.

Full data history at your fingertips: ACP also includes comprehensive historical data to export into your own internal models, reports and presentations.

Airline Profile Reviews

Our airline profiles intelligence feed keeps you informed via regular flash analysis and timely updates. Airlines are constantly monitored for any change in circumstances, including capital raising activities, capacity and traffic trends.

Expanded financial summary: now includes more detailed fields for deeper credit insights, providing a richer view of airline financials.

Interactive Data

Our enhanced Data & Analytics tab, powered by Power BI, offers a dynamic, fully interactive fleet overview table – including fleet types, key lessors, and ownership details – alongside a new route network dashboard where you can analyse recent trends in the airline’s competitive positioning and visualise network strength across the airline’s entire operation.

Designed to keep you ahead in a fast-changing market

Lessors, asset managers and investors alike depend on Ishka’s Airline Credit Profiles to analyse multiple airlines, benchmark ABS deals and fast track due diligence. For airlines, it's the ultimate resource to conduct powerful competitive peer reviews.

EXCLUSIVE

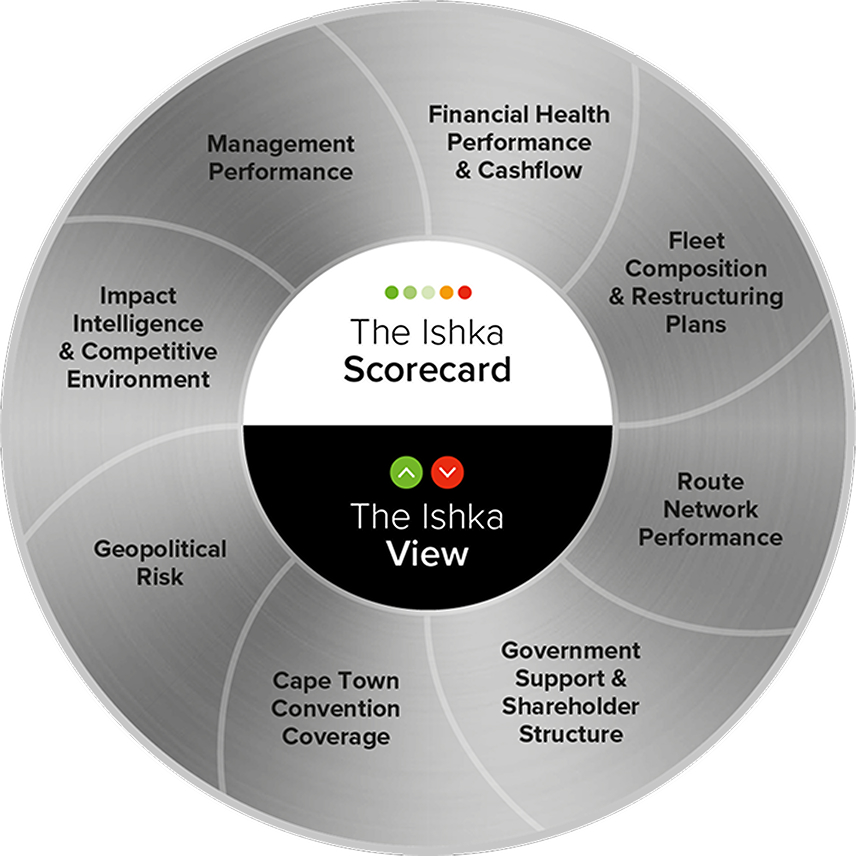

Get the Ishka View and Ishka Scorecard

At the heart of an Airline Credit Profile is the Ishka Credit Score and The Ishka View - our team’s expert opinion on an airline’s key strengths versus its challenges.

The exclusive credit score on an individual airline is generated with six critical measures at its core: liquidity, leverage, gearing, average fleet age, load factors and EBITDAR margin. The final credit score is underpinned by expert analysis and commentary from our team of global analysts, taking into consideration a holistic view of an airline’s financials, management and shareholders, route network, fleet order book and the impact of recent events utilising multiple, trusted data sources including Bloomberg, OAG and airline financial statements.

Discover first hand the wealth of intelligence available for:

Banks & Investors

Identify viable airline investment opportunities and formulate lending strategies

Benchmark internal analysis when dealing directly with an airline or via a lessor and broaden understanding of the wider competitive environment

Compare and contrast a target airline’s financial and operational performance against its peers

Measure and supplement in-house risk analysis when moving down the credit curve and compile transaction documentation material for approval by credit committee

Airlines & Operators

Save valuable time and in-house resource to conduct robust peer reviews and analysis as and when required

Receive flash analysis and independent updates to better understand the strategic competitive environment and respond quickly and successfully to competitive threats

Stay ahead of market trends and developments and monitor changes in the regulatory environment

Continuous monitoring of the global aviation landscape enables airlines to rapidly and proactively manage risk and capitalise on emerging opportunities

Lessors

Validate and benchmark credit analysis on existing lessees and airline RFPs at a click of a button

Save weeks of work and in-house resource to produce instant airline due diligence reports ahead of your competitors

Confidently identify, monitor and track viable opportunities to place and remarket aircraft with airline operators

Target marketing activity towards operators of particular aircraft types and assess and understand short and long term liquidity pressures

In a highly competitive market, take your analysis to a deeper level with Ishka Airline Credit Profiles

Contact our team now to discuss ACP subscriptions or get started with a free demo.