in Aircraft values, Lease Rates & Returns , Lessors & Asset managers

Wednesday 16 November 2016

Predicting the next wave of lessor impairments

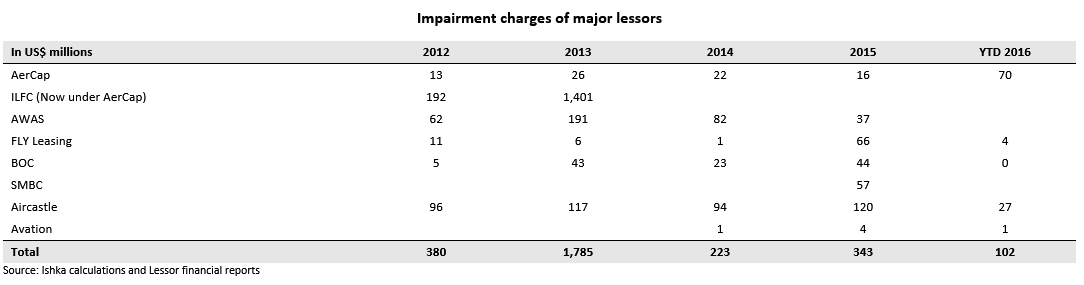

The public lessors have recorded approximately at least $3 billion of aircraft impairments to date since 2012, and the real figure is likely to be higher. Impairments are an inevitable risk of owning depreciating assets and lessors have taken advantage of a robust secondary market to sell many of their older aircraft assets to mitigate that risk. However, many lessors still have a considerable number of assets in their portfolio that Ishka has identified as having a high-risk of possible impairments within the next three years.

The Ishka View is that several 15-20 year old aircraft currently in many lessors’ fleets are at risk of being impaired over the next three years. Rising fuel prices, a weak revenue environment, the introduction of new aircraft technology, and increasing signs of over capacity among airlines are putting pressure on aircraft values. It is this pressure on aircraft values that Ishka believes will prompt further lessor impairments.

Lessors' historical impairments

Based on the data sourced from lessors who report their financial results publicly, since 2012-until now, the following major lessors have collectively recorded impairment charges just short of $3 billion. However, the impairments are far from over. As mentioned earlier and heighted in the tables below, a number of lessors still have a sizeable number of older aircraft in their portfolios that remain susceptible to impairments on account of any recovery in oil prices combined with a weak revenue environment, and possible overcapacity due to the number of new aircraft entering service.

An analysis by Ishka of historical lessor impairments reveal that lessors have been forced to impair a range of different aircraft types. Back in 2013, ILFC (now part of AerCap) had to recognise several large impairment charges related to A340s and 747-400s. AWAS had to impair its fleet of older 737 Classics, 767s, 757s and some freighter aircraft, while rival lessor Aircastle had to take a hit on its older A330s, 757-200s, several A320 family and most of its converted freighters.

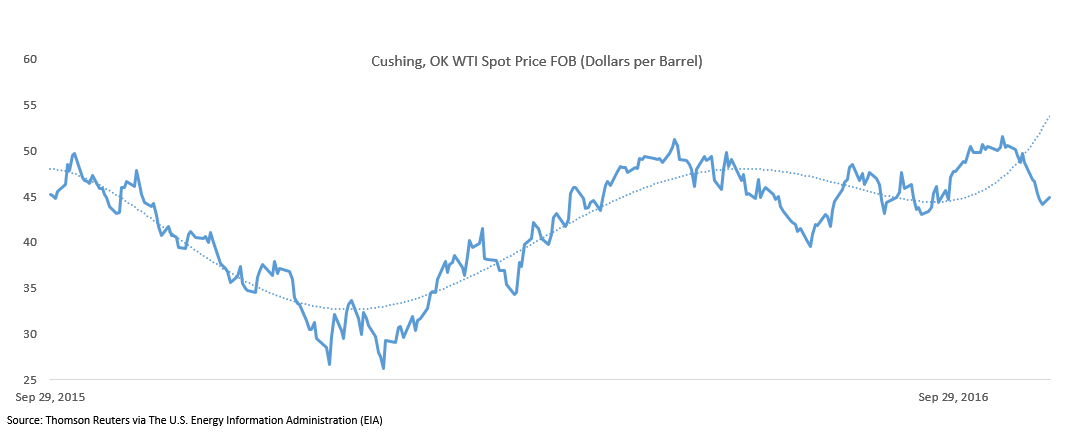

One of the biggest pressures on aircraft values is fuel price. While fuel prices are unlikely to reach the peak levels seen in 2008, oil prices are forecasted to rise over, or hover around, the $50 per barrel mark. The Ishka view is that rising oil prices combined with a weak revenue environment for many airlines will force carriers to minimise their fuel expenditure and optimise capacity. An easy way to achieve that will be to shed older technologically obsolete, less fuel-efficient aircraft from the fleet. The low fuel price environment experienced since 2015 has breathed life into used aircraft. With fuel prices at historically low levels, it became economical for airlines to lease, or extend the lease, on some older less fuel-efficient aircraft. And as such there has been an increased demand for older aircraft seen in terms of a more robust secondary market and lease extensions. While the lower fuel price is extending the life of some assets, this is not always seen in values. If oil prices continue to rise then airlines, even if they embrace deferrals in the near-term, will be exiting these aircraft out of their fleet.

Aircraft at risk of impairment?

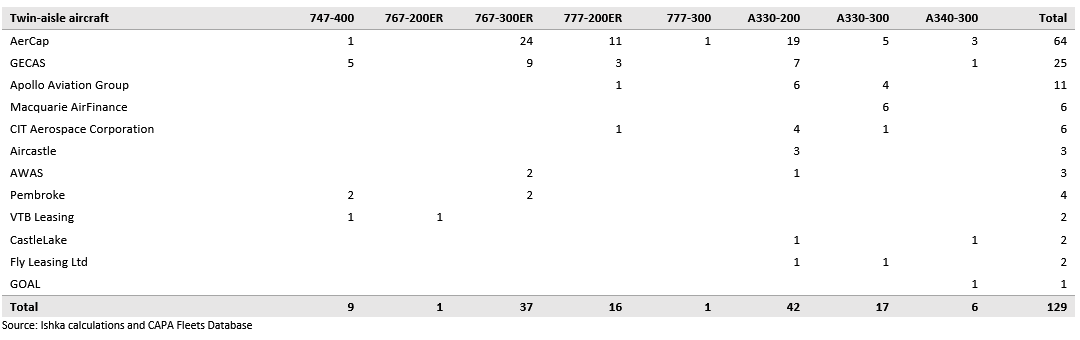

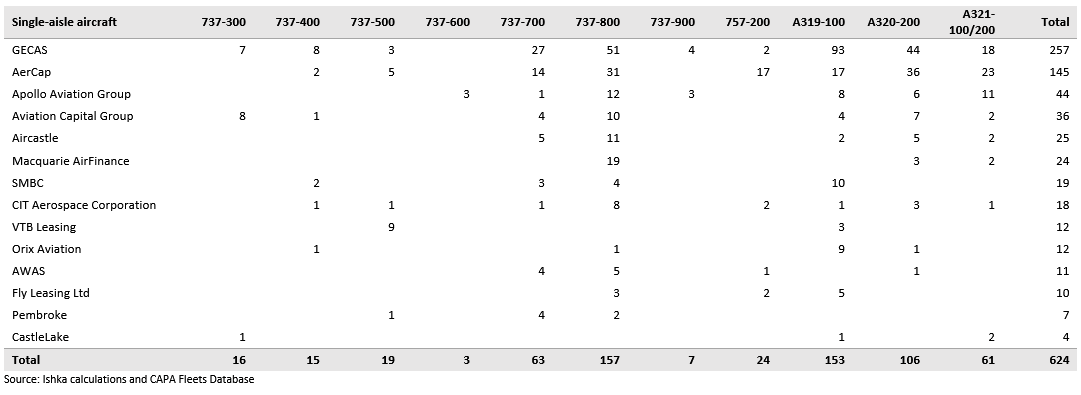

Lessors have been aggressively selling older aircraft and have strategically attempted to reduce their stock of older types. Nevertheless, lessors had to recognise impairment charges on certain select aircraft. Despite the portfolio sales, some lessors continue to hold a substantial number of older aircraft that are susceptible to impairment risk. For the purpose of the analysis, Ishka examined the in-service and inactive fleet aged between 15 to 20 years as of October 2016. Select aircraft in this age group are most susceptible to write-downs and exposed to impairment risk.

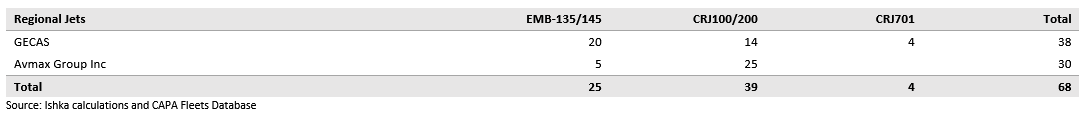

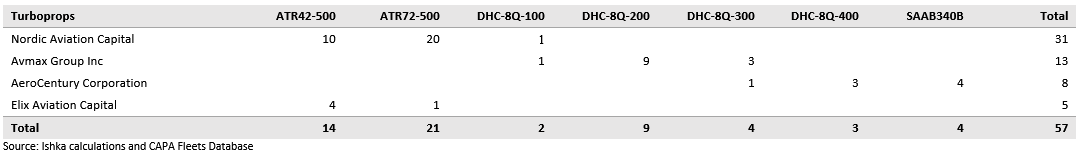

The following represent the number of aircraft (in-service and inactive) across each variant aged between 15 and 20 years owned by lessors.

As mentioned earlier, most of the larger historical impairments were for the older widebodies which remain the most at-risk group. While the secondary market for single-aisle aircraft has been remained comparatively robust over the last two-three years, demand for twin-aisles has come under some form of stress, particularly for the A330-200 and 777 ‘Classics’. The introduction of the 787, A350, A330neo and forthcoming 777X are beginning to take the place of the likes of the A330s, 777-200ERs as the twin-engine mid- to long-haul of choice. As such, airlines have been looking at the phasing-out stage of certain twin-aisles from their fleet.

Even though narrowbodies are relatively more liquid, higher fuel prices and lack of demand could put pressure on the cash flows and fair values of select narrowbody fleet as well. In addition, a number of new more fuel-efficient narrowbody aircraft are slated for delivery between 2017 and 2023 which could make select portion of the older narrowbody fleet redundant.

Several lessors are in the midst of a fleet overhaul strategy under which many older aircraft have been retired from the fleet. As a result, some of the aircraft highlighted above could have already been written down (mainly aircraft held for sale as of October 2016). However, it is important to note that some of the older metal that exited from these lessors has been transferred to joint-venture special purpose entities that are indirectly or directly under the control of the lessors themselves. While these sorts of JVs allow the lessor to do-away from the accounting requirement of recording the asset on their balance sheet, they still have to account for the equity portion of their holdings in the JV.

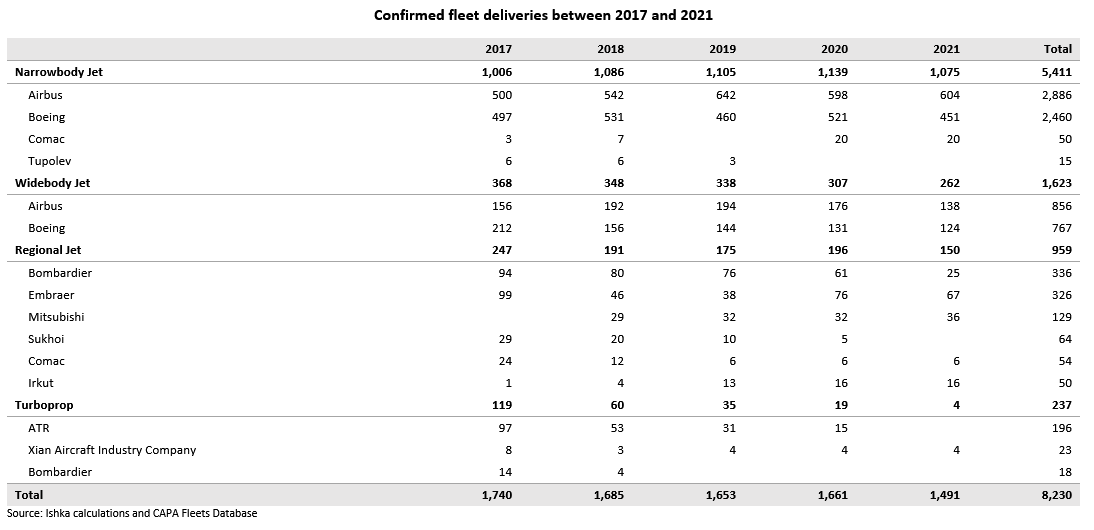

Many new aircraft slated to enter service

With more than 1,500 aircraft scheduled for delivery each year between 2017 and 2021, there is an elevated risk with the older, technologically obsolete, less fuel-efficient aircraft of a non-recoverable decline in carrying values and cash flows, with some of these reductions potentially being material in nature. And if market fails to grow as projected or even if there is a temporary blip with passenger growth, the industry would find it difficult to successfully absorb all this additional capacity further affecting the older fleet.

In the last three to four years, airlines have used the newer aircraft to add new routes and frequencies and have been keen on keeping aircraft utilisation rates high. This has forced them to take a hit on yields. As a result, airlines have started to adjust their capacity in an attempt to improve their yields. With new aircraft scheduled for delivery in the coming years, does it mean that airlines will be forced into retiring the older aircraft?

While some airlines have already deferred deliveries of some of their near-term positions, not all will have that flexibility, or even desire, to defer orders. These deferrals and other leading indicators (declining airline yields and worsening load factors) already point towards overcapacity appearing in the market.

Not all airlines or lessors will be interested in newer aircraft - and there will remain a demand for the older metal, the oversupply of older aircraft coming from lessors and airlines, could further squeeze market values of these aircraft or reduce the useful economic lives from earlier estimates, or compress expected cash flows thus elevating impairment risk.

The Ishka View

The secondary market for select older aircraft, especially single-aisle aircraft has been reasonably strong during 2015 and 2016 on the back of lower fuel prices. However, fuel prices have slowly started to creep up and are hovering near the $50 per barrel mark which, though, not yet ominously high, is still twice the lows of 2015 and 2016. Combined that with a stagnant revenue environment, airlines will sooner rather than later be forced take steps to minimise their fuel expenditure and optimise capacity, both of which are likely to impact demand for older aircraft going ahead. In addition, with a substantial backlog of new aircraft scheduled for delivery; technologically obsolete, less fuel-efficient aircraft will once again be increasingly at risk of reduced cash flows or residual values than estimated earlier. There already have been several impairments since 2012 on certain select mid-life and end-of-life aircraft. In addition, any dramatic changes in macroeconomic and geopolitical conditions further heightens the risk of impairment on certain older fleet that are still on the balance sheets of lessors.

Disclaimer: This research and analysis is based on publicly available data. Out of the universe of lessors, a limited number are publicly traded. Please use caution when interpreting the data.

Sign in to post a comment. If you don't have an account register here.