in Aircraft values, Lease Rates & Returns , Investor Briefings

Thursday 19 January 2017

Are twin-engine widebodies a good investment?

In this Insight, Ishka looks at the investment proposition offered by twin-engine, twin-aisle (widebody) aircraft. Ishka lists both the major concerns surrounding these assets as well as the six key drivers that make twin-engined widebody aircraft, potentially, an interesting proposition for investors.

A lot of the recent investor concern is due to the sudden availability of several older widebodies in the current market. The Ishka View is that the age and number of inactive A330s and B777s reflects just 5% of the combined current fleet for both asset types which Ishka would deem to be normal operating circumstances. Manufacturers have responded with cuts in production rates which should help the residual value performance of the asset class.

The twin-engined widebody – right size, right time?

The Airbus A350-900 entered into service in the last two years. Airlines have ordered more than 800 units and 64 aircraft have already been delivered. The larger A350-1000 also recently made its first flight. 2018 will see the first deliveries of the A330neo, adding to an A330 family that has already witnessed over 1,300 deliveries.

At Boeing the last two years have seen 787-8 deliveries pass the 300 mark, while the 787-9 will pass the 200 deliveries mark in 2017 – overall, the 500th 787 was delivered to Avianca in December 2016. This milestone was achieved five years and three months after the delivery of the first 787-8, which makes it the fastest twin-aisle aircraft to reach the 500th delivery mark. (It took the 777 programme nine years to reach the same milestone in 2004). The larger 787-10 is due to fly for the first time in 2017, with first delivery in 2018, and over 700 787s remain in the backlog. Boeing’s 777, with over 1,400 deliveries to date, is also evolving in the shape of the 777X. Production is scheduled to begin in 2018, in preparation for deliveries in either late 2019 or early 2020. A total of 306 777Xs have already been ordered.

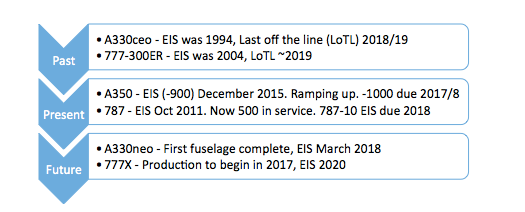

The chart below summarises the status of each twin-engine aircraft programme

Excludes pre-1990s models such as B767, A300/A310 etc.

Source: CAPA Fleets Database

With many new twin-engined twin-aisle models being introduced, the route opportunities available to airlines have never been greater.

Despite some recent concerns, twin-engine twin-aisle aircraft have the ingredients to be an attractive investment proposition, especially for those whose investment strategies match the market dynamics of widebody aircraft. There are already over 90 lessors/managers active in the widebody market (compared to 120 lessors and managers active in the more established narrowbody market) with 10 lessors accounting for 60% of the leased widebody fleet, much the same ratio as found in the narrowbody sector.

Ishka identifies six key drivers that make the twin-engined widebody aircraft an interesting proposition:

Servicing of core routes

The bulk of the widebody fleet tends to serve the core routes of major regional and international airlines, routes that have heavy and/or consistent traffic flows. While many of these are naturally long haul (in Europe and the Americas the average stage lengths are over 3,300nm) the average stage lengths in growth markets such as Asia and the Middle East are actually below 2,200nm. Twin-engine widebody models have evolved to be optimised to perform all of these routes efficiently and economically, and the new generation of models are opening up even more route opportunities.

Lengthy lease terms

Because they serve an airlines core routes, widebodies exhibit a tendency to remain with their original operators for a longer lease term, compared to narrowbodies. This provides a longer uninterrupted revenue stream, usually at a healthy lease rate, and the potential for less downtime over the life of the asset. Recent market analysis indicates that 77% of widebody aircraft leased to airlines have remained in service with their original operator for at least 9 years, 56% have reached 13 years with their original operator and 31% reached 17 years with their original operator. The corresponding figures for narrowbody aircraft were 46% after 9 years, 28% after 13 years and 12% after 17 years.

As many widebody leases are structured around 8 to 12 year terms, there is clearly a significant level of lease extensions and renewals occurring. Airlines will make regular and ongoing investments into the interiors and configurations of their widebody aircraft over time. This investment is often recovered through extending the leases, which in turn provides longer periods of utility and revenue generation. This can typically end up being a win-win situation for the lessee, as lessors will often look favourably at the option of lease extension first of all, rather than manage the process of a lease return.

Robustness of lessees (staying power)

Widebody aircraft lessees are typically regarded to be among the stronger airline credits. This will include major airlines and flag carriers that tend to be able to ride out downturns and market disruption better than smaller, perhaps less well capitalised carriers or LCCs that will predominantly have a narrowbody fleet focus. Stronger credits which exhibit lower default risk are more likely to secure the longer, uninterrupted revenue streams that a longer term investor is seeking.

Widebody fleet evolution

The twin-engined widebodies being delivered today already represent a much more efficient technology fleet compared to those of the 1990s. The next five or six years of production are already mapped out, with at least six new models entering service. The airlines have spoken (through their order books) and have chosen models predominantly in the A330, A350, 777X and 787 market sectors for their ‘next generation’ widebody needs. Each of these types is introducing the latest in fuel efficiency, cabin comfort and performance capability.

Coming in…Going out

With the new entrants on stream, the older A340, 747, and 767 models are leaving frontline, active service. United recently announced the accelerated retirement of its 747-400 fleet. The A330ceo and ‘classic’ 777, which includes the 777-300ER, are nearing the end of their production runs; these popular models will continue to provide the backbone of the twin-engined widebody fleet for at least the next 10-15 years. The A330neo, A350, 777X and 787, in all their variants, are destined to fulfil the bulk of future widebody demand in the coming years.

Fleet replacement and growth demand

The twin-engine widebody models bring two significant features to the market:

1. Capability – their payload/range performance enables airlines to open new routes and explore market opportunities, as well as serve existing networks, expanding their utility and application.

2. Improved Operating Economics – the new models provide significant efficiency gains that enable the older generations of twin and four-engined models to be replaced.

As the global widebody fleet becomes standardised around a core number of types/engines and their populations and customer bases grow in response to their wider capabilities and applications, their liquidity will improve. Coupled with traffic growth forecasts that are strongest in the core widebody markets (Long Haul/InterContinental and InterRegional), the role of the widebody is being recognised in the airline order books.

An important and strategic tool for lessors

More than 120 lessors manage narrowbody aircraft on lease to airlines. Their relationships with these airlines can be enhanced and supported by being able to offer a wider selection of asset types, such as widebodies or regionals, as and when their customer airlines require. Having access to a widebody portfolio has proved to be an effective marketing and relationship tool for many lessors, especially when successful airlines grow and expand their remits.

Widebody market concerns

There are a number of near term pressures within the widebody market that are presenting challenges to lessors, lessees and the OEMs.

Liquidity issues

Recently perceived high levels of used widebody availability has highlighted some of the general liquidity issues regarding widebody fleets, relative to the narrowbody: a smaller market size; fewer operators; an asset class that has traditionally been more ‘route specific’; a historically weaker residual value performance; and an immature secondary market. The higher capital requirement per unit also means lessors have not been as embedded in widebody ownership as they are in narrowbody aircraft.

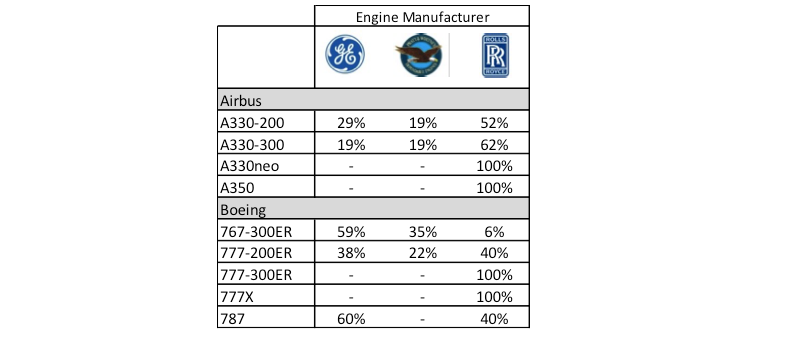

Widebody liquidity has, in the past, also been hampered by the dilution of fleet populations through having a number of engine OEM choices e.g. the 777-200ER and A330ceo had three engine options, the 767-300ER had two (and a half), fragmenting the operator base and fleet size for the overall programme. The 777-300ER, as will the 777X, and A350, however, come with a single-source engine OEM option, and some other models have only two choices, which will support the remarketing effort in the longer term. The table below indicates the market share of each engine manufacturer for delivered aircraft

Source: Manufacturer’s, CAPA Fleets

Many of the liquidity factors can be managed and mitigated by structuring transactions with the six key demand drivers in mind.

Storage and availability

In terms of availability, some of the recent excess capacity came as a result of airline failures and restructurings – Transaero, Skymark and Malaysia Airlines in 2015; TransAsia in 2016. Other availability has come from the release of interim lift that had been acquired some years previously to provide cover for the initially delayed deliveries of 787s and A380s. A third source of availability has come from airlines responding to weaker than anticipated traffic growth.

The core component of the current twin-engined widebody market consists of A330s and B777s. Over 80 A330s and 60 B777s are currently in store, some temporarily (transitioning between leases) and others more longer term. In the context of a combined current fleet of over 2,500 A330s and B777s, around 5% is inactive. Almost half of the stored A330s and B777s are over 15 years of age. These levels reflect what Ishka would deem to be normal operating circumstances.

Currently offered for sale are 18 A330-200 and 1 A330-300. Also offered for sale are nine 777-200/ERs and 3 777-300/ERs, from traders/brokers and from lessors/asset managers. In the context of a combined fleet of 2,500 A330s and B777s, less than 1% is for sale, which again reflects a reasonably stable market environment.

Size of the secondary ‘aftermarket’

Ishka expects availability to continue to present near term issues, with some airlines returning widebodies and not extending leases in 2017 due to a variety of factors (overcapacity concerns in Middle East, geopolitical issues, sluggish traffic growth in specific markets) however there are other market balances at play that can mitigate the impact.

Some of these problems were created by the ‘over-ordering’ of widebodies, or extending leases on older aircraft that were due to be phased out/retired, to cover for delays in B787 and A380 deliveries, and to a lesser extent, A350 deliveries. Now that the B787 and A380 have caught up with their production schedules, and the A350 is ramping up, there are effectively some excess aircraft now in operation, the older examples of which are expected to be phased out more rapidly than the newer interim lift aircraft, which may take time to accommodate. Fuel price is a key factor – a relatively low fuel price will see older aircraft retained for longer (as their economics improve against newer models).

Operating costs

As widebody aircraft typically have larger airframes and engines than their narrowbody counterparts, the costs associated with their overhaul and maintenance are inevitably higher on a unit basis and the headline numbers can appear daunting unless considered on a per passenger seat or revenue generation basis. Careful management of maintenance reserves, overhaul intervals, the lease transition process and aircraft utilisation can also help ensure costs remain proportional.

Transition costs

The transfer from one operator to another can result in higher costs, but these events are less frequent than with narrowbody aircraft. The transition times are also longer, simply due to the scale of the reconfiguration required and the lead times for (often bespoke) interiors, but again the events are less frequent. In recognition of this, significant efforts are being made by both the OEMs and the airlines to reduce both costs and timing with a number of programmes under development.

How the market is responding & prospects for the future

Airlines and OEMs are both working at improving the supply/demand balance. Probably the most important trend that is happening today in the widebody market is the reduction in some widebody aircraft production rates, and the rebalancing of supply and demand through order deferrals and retirements.

Production rates

In well documented developments, the production rates for the A380, B747 and B777 are experiencing near term reductions: the A380 to roughly 1.5 per month in 2017 then 1 per month in 2018; the 747 is running at 0.5 per month; and the B777 from 8.3 per month in 2016 to 7 per month in January 2017 and down again to 5 per month by August 2017.

The A330 rate, which had reduced from 9 per month 2015 to 6 in 2016, is to stabilise in 2017 at 7 per month due to attractive pricing, near term order fulfilment and relative low fuel costs. A350 rates are scheduled to rise to 10 per month in 2018 and 787s from 12 per month today to 14 per month by 2020.

The modest increases in some rates, and the prudent reduction in others, will help to manage the delicate balance of supply and demand.

Streamlining the inventory

Some widebody aircraft orders are being deferred (e.g. Emirates A380s, American A350s) or cancelled (Aeroflot recently cancelled eight aircraft from its order for 22 A350s and Delta cancelled 18 787s) and retirements of older widebody aircraft are accelerating (United is now retiring its remaining fleet of 20 747-400s by the end of 2017, a year earlier than planned). As there is less speculation in widebody orders to begin with, deferrals and cancellations are material events.

The cumulative effect of production rate cuts, order deferrals and cancellations, and accelerated retirements, is expected to help address the inventory balance. We expect to see more of the same happening during 2017. This is also a positive signal for asset value retention and will provide support for lease rates going forwards.

Traffic growth in all the right places

It is important to remember that the location and growth rate of future passenger demand will not necessarily reflect the trends of the past. With growth strongest in the Asia Pacific region, and with India now beginning to build credible momentum (the growth in urban middle classes - not just in India - is correlated to long haul travel demand), the expectation is that widebody aircraft will play an increasingly important role. The long haul traffic growth rate is forecast to continue to exceed short haul growth, a good signal for widebody operators.

Profitable long haul businesses also require the economies of larger, fuel efficient aircraft which can generate the lowest seat mile costs. Lower trip costs can also stimulate route development, help grow the secondary markets, and broaden the operator base. In addition, the ability of widebody aircraft to provide a greater number of premium seats (business and premium economy classes) offers further opportunity to improve margins.

The opportunity in the shorter range, but higher capacity/density routes remains that of replacing older aircraft models with modern, fuel efficient types, and in providing additional capacity to open new routes or replace narrowbodies as traffic levels develop.

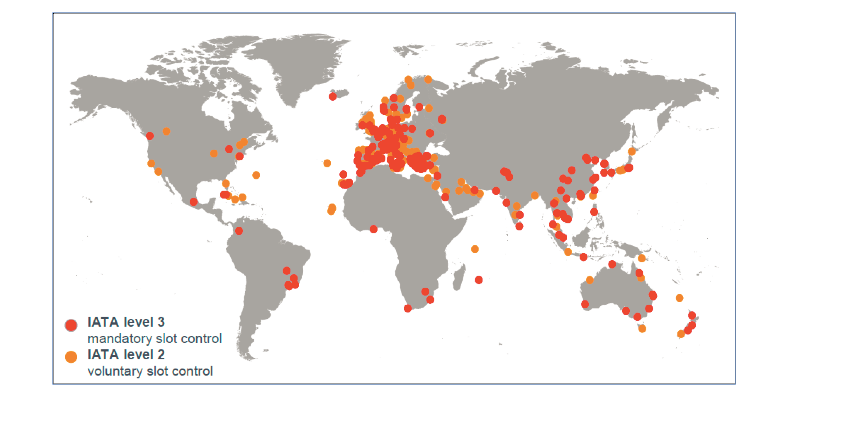

Practicality

New airports can be built (China already, and India probably, will lead the way) however economic, environmental and logistical issues will prevent many established airports from expanding to accommodate more aircraft movements. Airport slot constraints will therefore mean that, for many key airports, the aircraft serving them will become larger. More than 80% of ‘mega cities’ and their associated airports are already slot constrained. At Heathrow, for example, 10% of passengers were carried on the A380 in 2016, up from 8% in 2015 and 6% in 2014. The figure for 2017 is expected to be 12%.

Airports where capacity controls are in place

Source: IATA World Scheduling Guidelines: Level 2 & 3 at primary city airport

The Ishka View

Many of the current questions surrounding widebodies have been promoted by the availability of several older assets. However, the number and age of stored and inactive A330s and B777s, the bulk of the widebody market, reflects what Ishka would deem to be normal operating circumstances. The long-term economic drivers in the aviation industry help build the case for widebodies. Ishka recognises that production rate cuts are supporting capacity discipline, while traffic growth continues in the long haul markets.

As airlines continue to focus on seeking the best seat mile costs to counter yield pressures, the net combination of these influences should help correct the supply/demand balance. This will tighten the supply of aircraft and favour a more positive response in the residual value performance of twin-engined widebody aircraft.

(Figures referenced in this report are correct as of 31st December 2016)

Please Note: The views expressed do not constitute investment advice. We accept no liability to recipients acting independently on its contents in respect of any losses, including, but not limited to profits, income, revenue or commercial opportunities.

Sign in to post a comment. If you don't have an account register here.