Tuesday 7 February 2017

Will they stay? Irish lessors, Brexit and tax

Every two seconds, an aircraft leased from an Irish-based lessor takes off from somewhere in the world. As a global aviation hub Ireland is the clear leader, and Irish lessors account for 50% of the world’s leased commercial aircraft. But recent tax changes, Brexit, and competition from rival aviation hubs in Singapore and Hong Kong have increased doubts about the country’s dominance in the aviation sector.

A recent Deloitte survey of 400 aviation finance executives found that a full 38% think Brexit will damage Ireland’s attractiveness as a leasing base. While 43% of lessors expect to relocate at least a minority of their businesses following the introduction of new OECD and EU tax rules and 28% expect a full relocation.

The Ishka View is that Ireland is in no danger of losing its international competitiveness. Ireland currently has between €83 billion and €113 billion in aviation assets under management. Fears that these could migrate abroad is the result of irrational pessimism. Ireland has built up significant advantages including low corporation tax, generous write-down provisions and double tax treaties that will be hard to undo or replicate any time soon.

It’s not all about corporation tax

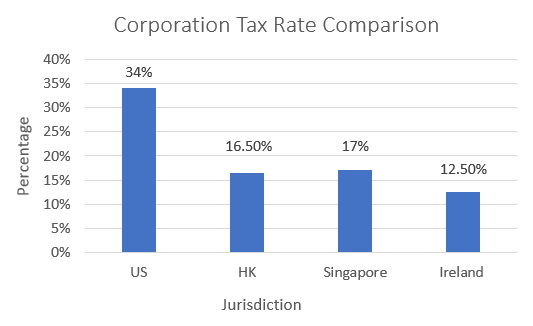

Irish lessors’ net leasing income was $11 billion (€9 billion) in 2014. However, the success of leasing in Ireland cannot simply be attributed to the country’s low marginal rate of corporation tax. Ireland has the lowest corporation tax of any major aviation hub at 12.5% (see chart below) and has a depreciation write-off period of eight years.

A recent report by economists at the Central Bank of Ireland singled out write-down provisions as particularly advantageous. It points out that the average retirement age of commercial aircraft is increasing and is now around 25 years, with 50% of a given fleet staying in operation beyond this. The report concludes that: “the useful economic life, then, tends to be considerably longer than the depreciation period allowable for tax purposes.”

By contrast, a Hong Kong lessor is not allowed to claim tax depreciation on the cost of an aircraft if that aircraft is leased outside Hong Kong which makes it unattractive for global leasing companies. Singapore has a headline rate of 17% but under its Aircraft Leasing Scheme incentive, the applicable rate on qualifying income can drop to 10% or even 5%.

However, Ireland’s real advantage lies in its double tax treaties. It has doubled the number of countries in its tax treaty network to 72 in recent years and now includes most of the world’s major economies, accounting in aggregate for more than 80% of world GDP. Many of them provide for zero withholding tax on incoming lease rentals. Since tax treaties take a long time to agree, Ireland’s advantage will be hard to replicate in the short term.

Source: Ishka research

Responding to a challenge from Asia, Ireland has focused on attracting and retaining senior overseas executives in the leasing industry by lowering their income tax burden. The Special Assignee Relief Programme, part of Ireland’s national aviation policy, operates by allowing a 30% deduction from any employment income above €75,000. The programme was reviewed by the government in 2015 and has been extended for a further three years. An upper salary threshold of €500,000, identified as a major shortcoming in the scheme, was removed last year.

In 2011, Ireland added another inducement for lessors without an existing trading platforms to establish in Ireland. The Finance Act of that year designated special purpose vehicles (SPVs) consisting of engines and aircraft as qualifying assets which allow tax treatment as a trading company like any other. This means that an SPV can claim tax deductions for all financing expenses.

Research by the Central Bank of Ireland which has attempted to build a database of all the lessors and related SPVs operating from Ireland, has revealed how important SPVs have become Researchers found there were 300 SPVs solely dedicated to aircraft leasing in the country. However, SPVs used by lessors are likely to come under fire and be denied double taxation benefits under the Base Erosion and Profit Sharing (BEPS) initiative.

Relocation fears are overblown

Ireland is facing twin pressure from the BEPS initiative (see Ishka’s previous report, Closing the tax loop: BEPS and aviation) and the EU Commission which is unhappy with Ireland’s low-tax regime. In the Deloitte survey, 60% of respondents agree that proposed double tax treaty changes aimed at lowering the threshold of what constitutes a taxable presence in a foreign country will result in increased scrutiny and challenges for aircraft lessors.

But there is little to fear. Scrutiny will reveal that while Ireland’s tax rate is competitive the country is not a tax haven. Leasing companies may be global, but they provide a tangible set of services, rather than simply exploiting a tax jurisdiction, and do have a significant taxable presence in Ireland. The BEPS proposals are not designed with jurisdictions like Ireland in mind. The number of global leasing companies in Ireland now exceeds 30, with around 1,000 people directly employed by lessors. Taxation is part of the reason, but not the sole reason for Ireland’s success in this industry.

On the other hand, while aviation executives may worry about the effect that Britain’s decision to leave the European Union will have on lessors, Irish respondent are more sanguine. 70% of Irish executives who took part in the Deloitte survey do not believe that Brexit will be harmful to Irish lessors. In fact, no respondent could find any evidence at all that that Brexit would result in this sort of threat.

Ishka View

Ireland’s leasing companies are unlikely to migrate to rival aviation hubs any time soon. Some concern and uncertainty over tax changes is justified. However, concern over Brexit is unfounded. Much of Ireland’s advantage is the skills and knowledge invested in its human capital, its scale: half of the world’s leased fleet is managed by Irish lessors. Moreover, Ireland’s legal framework is increasingly interwoven with the International Registry (IR). The Minister for Transport, Tourism and Sport holds a 20% shareholding in Aviareto, the SPV that was established to run the IR. This gives lessors access to legal redress in disputes. This contract has been extended to at least 2021.

Sign in to post a comment. If you don't have an account register here.