Wednesday 29 November 2017

Global airline leverage levels improve by 7.5%

Similar to airline liquidity, leverage is one of the key financial metrics used in-order to assess the creditworthiness of an airline. In simple terms, airline leverage is the number of years an airline will take to pay off its adjusted debt using its EBITDAR.

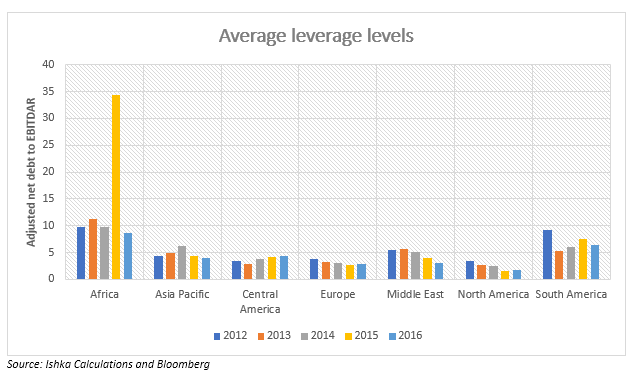

At a global level, leverage improved by an average annual rate of around 7.5% falling from 4.3x at the end of 2012 to 3.1x at the end of 2016. The same factors that led to enhanced liquidity levels also contributed to the improved leverage ratios. Record low oil prices seen during 2015 and 2016 meant that airlines’ fuel expense outlay dropped significantly. This resulted in robust EBITDAR margins which, among other reasons, helped to improve airline leverage ratios.

Ishka calculates leverage as adjusted net debt divided by annual EBITDAR

Commercial aviation is a capital-intensive industry and airlines typically tend to borrow quite heavily in-order to fund aircraft purchases and working capital needs. Airlines use a mix of operating lease and debt in-order to finance aircraft purchases. Operating leases are off-balance sheet items and airlines are not required currently to recognize such assets and liabilities on their balance sheet.

While most regions, apart from Central America, saw a decline in leverage levels over the four years under study, at an absolute level, only North American carriers have what can be described as a healthy leverage ratio on average. All other regions, are above the healthy threshold of 2.0x. In some ways, this is also a reflection of the difference in the strategy between airlines in North America, which is a developed mature market compared to Asia Pacific or Central America, which are emerging markets where airlines are expanding rapidly adding more aircraft each year by borrowing frequently. Most North American carriers, on the other hand, operate with significantly older fleet and are not adding new aircraft at the same pace as their emerging market counterparts. They have been more focused on using their excess cash to reduce the level of debt.

Outliers - The good and the bad

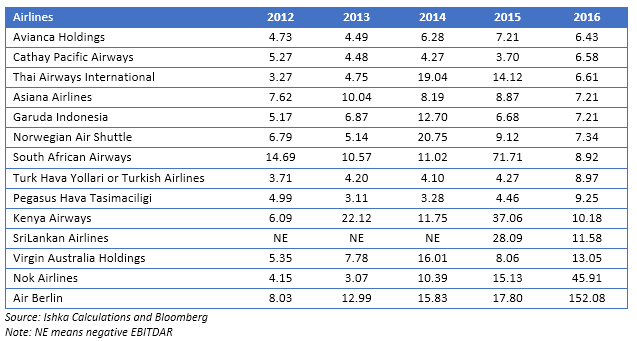

While average levels of leverage have improved y-o-y, there are still airlines with unsustainably high levels of leverage. These are some of weaker airlines with relatively high levels of leverage:

Airlines with Higher Level of Leverage

Africa remains a leverage laggard due to the structural challenges that confront the region’s airlines. Several major airlines from the region are close to bankruptcy and surviving solely on government aid. Among them are South African Airways, Kenya Airways, Arik Air to name a few.

Among the Asia Pacific carriers, only the legacy carriers such as Singapore Airlines Group, Japan Airlines, Air New Zealand and Qantas have acceptable levels of leverage. All other airlines have taken of sizeable levels of debt (including operating leases) to fund their aircraft purchases. As long as these airlines maintain robust operating cash flows there should not be any major challenges in servicing the debt or leases.

Among the Central American carriers, both Volaris and Grupo Aeromexico have taken on substantial levels of debt and leases in-order to fund their growth and leverage the fast-expanding Mexican air travel market.

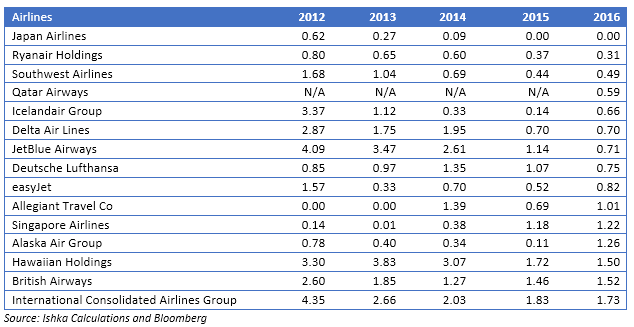

easyJet, Lufthansa, Icelandair, Ryanair, British Airways as well as its parent IAG all are among the heathiest airlines not just in Europe but worldwide. On the other hand, airlines such as TAP Portugal, Norwegian, Air Astana, Aeroflot have relatively higher levels of leverage. Air Berlin, which was Germany’s second largest carrier, collapsed in 2017 after Etihad Airways, one of its key stakeholders pulled out of the airline. As the numbers clearly show, the airline had an unsustainably high leverage ratio all throughout the last four years. Following an extremely challenging year due to numerous political and terrorism-related disturbances, the Turkish carriers; Pegasus and Turkish Airlines (Turk Hava Yollari) saw a significant deterioration in their leverage ratios during 2016.

Among the Middle Eastern airlines Ishka studied, none had concerningly high levels of leverage. Qatar Airways was the healthiest thanks to its huge pile of cash resources which significantly reduces its net debt.

And these are among the stronger airlines with healthy leverage levels:

Airlines with Low Leverage

Unlike the rest of the world, most North American carriers have a fairly healthy leverage ratio with a number of airlines being below the threshold of 2.0x. Among the strongest performing airlines are Delta, Alaska Air Group, Allegiant, Hawaiian Airlines, Southwest Airlines, United Continental and WestJet.

Finally, South America, where leverage still remains fairly high relative to other regions. The region has been through a challenging few years and as such the low fuel prices has not had as positive impact as other region’s airlines have experienced. Positively though, there has been a commendable improvement to leverage levels relative to 2012.

The Ishka View

Airline leverage is probably the most critical metric when it comes to assessing airline financial health. It is, therefore, not surprising that all airlines that are rated investment grade and above by major credit rating agencies all have a leverage ratio of less than 2.0x. And two of biggest airline failures in recent history (Air Berlin and Transaero) both reached unsustainably high leverage levels a year before they collapsed.

While the record operating profitability seen during 2015 and 2016 has certainly helped airlines to improve their debt to EBITDAR ratio, few airlines are below the healthy level of 2.0x. This is, however, not to say that all airlines above 2.0x are unhealthy. Airlines with robust operating cash flows will have little trouble servicing their fixed charges which include interest and aircraft rental payments. However, as airlines also tend to operate with a high degree of operational leverage, meaning small changes in revenues can have major impact on earnings, it becomes especially tough for airlines who have substantial levels of borrowings during times of downturn. Airlines with the lowest levels of leverage will have the greatest flexibility to maneuver in challenging economic conditions.

Sign in to post a comment. If you don't have an account register here.