Sunday 11 June 2017

Is the boom period over for the ME3 carriers?

After a long period of impressive growth and profitability, it appears that the ME3 carriers now find themselves in a challenging spot. Emirates saw its net profitability fall by nearly 80% in FY 2016/17. Etihad too is struggling particularly with its non-performing and loss-making minority interests. And now, following the diplomatic row between Qatar and five other Gulf nations, there are question marks on Qatar Airways’ future performance as well. In this Insight, Ishka looks at the key developments and challenges affecting these three carriers. The question is whether the boom period is over for these airlines.

The Ishka View is that it is too early to speculate whether the ME3 carriers are heading into a downturn. These are well-run organisations with reasonably sound business models having a very strong financial backing. However, circumstances do suggest that the situation is not the same as during the past decade and the carriers are possibly past their boom period of rapid growth and strong profitability. But to be fair to these airlines, some of their challenges are not of their own but brought about by the changing macroeconomic and geopolitical landscape.

Airlines of choice for long-haul travellers

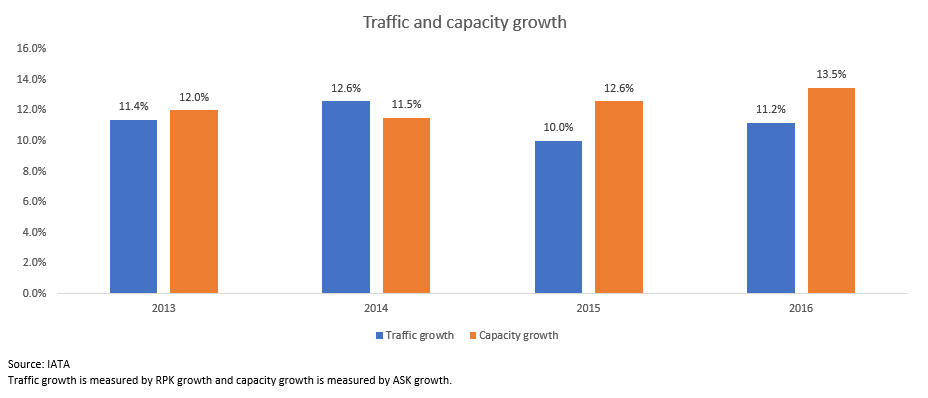

During the past decade, the ME3 carriers have carved a special niche for themselves by becoming the airlines of choice for most international flyers flying across Asia and Europe/North America. They have managed to build up a strong reputation by offering first class service at extremely competitive pricing. They been a constant source of challenge for network carriers on either side of the gulf by capturing a substantial portion of the east-west and vice-versa traffic fully leveraging their prime geographic location. As is now widely known, nearly two-thirds of the global population lives within an eight-hour flight from the region making them ideal for stopovers. And to make the stopovers more attractive, their owners have invested huge sums and built massive and glitzy airports. In summary, the ME3 carriers had a lot going for them which helped them achieve an impressive double-digit growth rate for a very long period.

These carriers have muscled their way into prominence by placing jumbo orders of mostly widebody aircraft, particularly Emirates. The pace of growth has been so phenomenal that the Dubai flag carrier is presently the biggest operator of widebodies globally and even the A380s with several more on order.

However, the robust market seems to have softened in the past year and half. Both Emirates and Etihad have faced headwinds in the past one year. And the recent geopolitical developments are now expected to take a toll on the Qatari flag carrier, Qatar Airways.

Gulf political fallout will affect all three carriers

Qatar Airways’ challenges have been accentuated by recent geopolitical developments. The current diplomatic row between Qatar and the four gulf nations of Saudi Arabia, UAE, Egypt and Bahrain is expected to significantly affect Qatar Airways. These four nations have ended diplomatic ties and have also cut all transport links with Qatar which they allege to be supporting extremist organisations. This means that the Qatari flag carrier cannot use the airspace of any of the above four countries. Qatar is virtually surrounded by these four countries and the airspace blockade means that the airline will have to re-route its flights, in some cases, even flying in the opposite direction for a while to avoid entering these airspaces. This will certainly increase fuel costs and also the flight times. But for the carrier to even re-route its flights, there has to be sufficient bandwidth on the alternative routes. Invariably, Qatar Airways will have to manage capacity constraints and re-work its flight schedule. The additional restrictions could dissuade flyers away from the Qatari flag carrier. And even if the airline drops down fares to retain customers which it will most likely do, it risks a weaker top-line. The combination of a weaker top-line and higher operating expenses would squeeze profitability. Qatar Airways will hope that the respective governments will resolve this situation soon as the current embargo is not in anyone’s long-term interest. While on the face of it, Qatar Airways appears to be the biggest loser as a result of this episode, there is likely to be a wider economic impact on the entire region as well. This in-turn could indirectly affect Etihad and Emirates.

Etihad struggles on account of some of its minority investments

Similar to Emirates, Etihad too has an impressive story to tell. From a small regional short-haul airline the Abu Dhabi flag carrier is now a major global network carrier. As well as growing organically, the carrier has also relied on several minority investments in order to expand. Etihad over the years has partnered with, and made many equity infusions in, several international airlines such as Jet Airways, airberlin, Alitalia, Etihad Regional (formerly Darwin Airline), Air Serbia, Air Seychelles, and Virgin Australia. And this is where there have been some challenges. Its strategy of minority interests and inorganic growth hasn’t paid off completely. Alitalia and airberlin have been the biggest disappointments and have cost Etihad significant money. The Abu Dhabi carrier has so far pumped around EUR2.1 billion in airberlin while its Alitalia investment has cost it nearly EUR1.4 billion. Any positive gains from its other investments might have been wiped off by the issues at these two airlines. Ishka does not want to speculate the reasons behind James Hogan’s decision to step down as Etihad’s chief executive. It is, nevertheless, an important and noteworthy development as Hogan presided over the carrier’s strategy for the past 10 years. The carrier has also announced that it will undergo a strategic review to increase efficiency and better face challenging market conditions. It has recently withdrawn from making any further investments in Alitalia after the Italian flag carrier’s employees rejected Etihad’s restructuring plan.

The combination of a weak top-line and rising operating expenses hurts Emirates

Emirates’ decline is probably the most visible as the carrier reports detailed annual accounts unlike the other two. Ishka has widely covered Emirates and its current situation. In a previous Insight (Could Emirates slide into the red?), Ishka analysed the reasons behind the Dubai flag carrier’s 80% drop in profitability during the 2016/17 financial year and the probability of the airline falling into the red. Emirates, the largest of the three carriers, has been challenged by softening traffic conditions and revenue pressures.

A weak global economic environment, geopolitical challenges in some key markets, and currency woes halted any revenue growth in the last two years despite reasonably robust traffic growth. Combined that with increasing cost pressures particularly in 2016/17 meant that the airline’s bottom-line was squeezed out.

US electronics ban and immigration restrictions

In the first quarter of 2017, citing increased threat for in-flight terrorist incidents, the US and UK banned all electronic devices larger than a smart phone in the aircraft cabin on flights originating from certain airports in the Middle East and North Africa. This list included Dubai, Abu Dhabi and Doha airports. As per IATA, the effect of this ban will be visible in the second half of the year and Emirates is expected to be hit the most. Already demand for travel to the US from Dubai has fallen substantially since the start of the year. As per data from CAPA and OAG, Emirates reduced its capacity between Dubai and the US by nearly 30%. As per an article on the Financial Times, Sir Tim Clarke, Emirates’ CEO, has removed 13 aircraft from the US market, and has made it clear that he will ground them if new routes cannot be found.

The Ishka View

Changing macroeconomic and geopolitical circumstances are already starting to have an effect on the ME3 carriers. The situation now that necessitates a pragmatic approach. It is too premature to say that the ME3 carriers are heading for a downturn. These are well-run airlines with reasonably sound business models and their problems primarily emanate from macro factors. Having said that, there is still scope for strategic changes in order to better align with the new market conditions. And indications are the airlines are responding. In addition, unlike other major flag carriers around the world, all three are owned by their respective state governments and have access to their financial muscle. However, one thing is certain: they are now in more challenging period than they have ever been in the past decade.

Sign in to post a comment. If you don't have an account register here.