Friday 19 January 2018

Why should funds invest directly in aircraft assets?

In a guest Insight piece ABL Aviation, an aircraft asset manager, explores the benefits of investing in aviation and the returns investors can achieve compared to other asset classes.

Real assets are increasingly becoming an essential building block in an investor's portfolio. The shift has been driven by investors' wish for protection from market volatility and future inflation. The Financial Times reported the total assets under management (AUM) managed by the top 100 alternative investment managers rose to $4 trillion at the end of 2016; driven by inflows into real assets. If the fund-raising activities of 2017 are anything to go by this figure is expected to rise significantly.

Real assets offer exposure to long-term, physical assets that provide yield, income, or income generating potential. A cash-flow generating segment in an investor's portfolio is valuable because it can balance long-term objectives against short-term market moves.

The move into real assets has been gradual. A standard response from investors is real assets requires time for them to become comfortable with their illiquid nature. However, this illiquidity typically translates into a return premium, albeit dependent on a specialised investment manager's skill. Many investors start their real asset investing with core real estate in their home country. Over time, it can expand into infrastructure, shipping, and aircraft.

Compared to direct investments in shipping, real estate, and infrastructure, aircraft is a relatively new sub-asset class. Nonetheless, aircraft assets share several common characteristics with other real assets. Aircraft are hard, illiquid assets with long economic lives. They require significant cap-ex investments, typically financed with a substantial level of debt. In return, they offer relatively predictable cash flows. In our view at ABL Aviation, we see several factors investors should consider when comparing aircraft against real estate assets.

1. CASH YIELD

Aircraft assets offer stable cash flows in US Dollars (USD) over their economic life, which is typically 25 years. In contrast, cash flows provided by shipping are more susceptible to the present phase of their maritime cycle. Real estate and Infrastructure offer cash flow in the local currency with the potential to grow with inflation. Meanwhile, aircraft cash flows decline over time, although, they remain robust relative to the depreciated value of aircraft as they age. Importantly, infrastructure and real estate provide inflation hedges for investors (i.e. their rental income can increase over time).

2. REGULATORY BARRIERS & ECONOMIC LIFE

Of the four real asset types, aircraft experience the highest level of regulation; heavily influencing the supply-demand dynamic of aircraft. It can take several years to manufacture and certify new aircraft types; fostering a duopoly between Boeing and Airbus. The net effect is a relatively predictable supply-demand dynamic for aircraft; leading to reduced technological risks and obsolescence. Consequently, aircraft enjoy a predictable economic life. In contrast, shipping is far less regulated and does not experience a similar duopoly; creating a volatile supply-demand dynamic, which can be detrimental to its defined economic life. Meanwhile, real estate and infrastructure are subject to local regulatory regimes that differ across asset types and regions. However, their economic life tends to be relatively stable, and the asset may appreciate.

3. LIQUIDITY

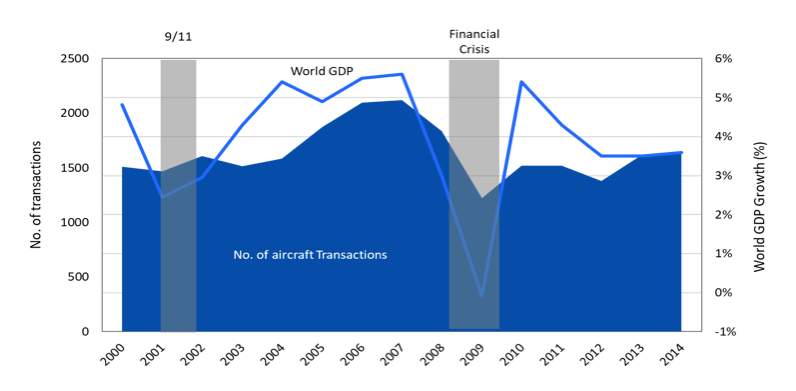

Aircraft are a reasonably illiquid asset. Trading aligns with the economic cycle (see Figure 1). Narrowbodies – 737 NGs and A320ceos – trade more frequently than widebodies – 777s and A330s. The industry is not very transparent; trading data is unreported. The market relies upon valuations as a proxy for price. Similarly, shipping is a reasonably illiquid asset. Recently, it has experienced a supply-demand imbalance; resulting in excess over-capacity. Meanwhile, its market is more transparent, separated into three distinct markets: i) dry bulk, ii) tanker, and iii) container. Infrastructure by its nature is a highly illiquid asset. It is heavily reliant on the scale of the asset and the involvement of a regulatory body or government, and this can lead to long delays in the sale process. Real estate is relatively illiquid and is correlated to the strength of the local economy; leading to delays in the sale process.

Figure 1 – Transaction Volume of Used Aircraft Transactions

Source: Ascend and IMF

4. VALUE CREATION

A unique characteristic of aircraft is they are mobile. They can be transferred to different markets; continuing cash flow generation; leading to value creation and a return premium. Additionally, income and asset valuation are in USD. Ships are also mobile; however, their type and the complexity of maritime networks are considerable constraints. Its value creation is more opportunistic and subject to higher volatility. The scale of infrastructure and its relatively stable cash flow means it can accommodate higher levels of debt. Focusing on optimisation the financial structure leads to value creation. However, the extended holding period of infrastructure means their discounted cash flows are highly susceptible to relatively small changes in underline assumptions (i.e. projected growth rate). Additionally, the exit values are highly subjective. Real estate tends to be difficult to replicate as there are significant regulations and legal restrictions at national and local level. A substantial debt portion finances real estate, underpinned by stable rental income that typically grows with inflation. Value creation is focused on maintenance, refurbishment and re-leasing.

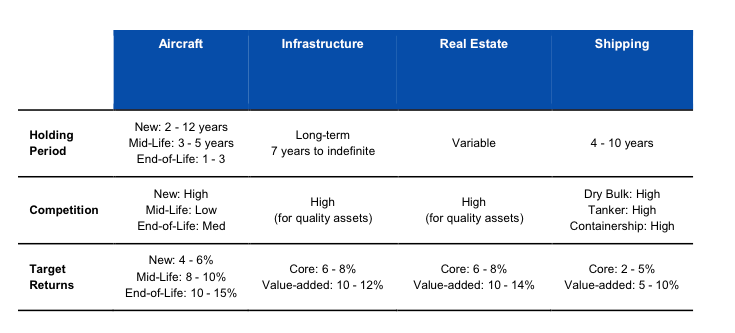

5.TARGET RETURNS

ABL Aviation’s analysis of the return performance for aircraft versus shipping, infrastructure, and real estate is outlined in Figure 2. Based on current market observations and experience with similar transactions, ABL Aviation sees the return profile for aircraft align with its age. For example, mid-life aircraft typically make 8 to 10 percent returns from a narrow body on a 3- to a 5-year lease. However, this age group requires significant technical expertise and is a value-added investment. In contrast, shipping's recent cyclical downturn has negatively affected its return performance. Infrastructure and real estate offer similar returns for core and value-added investments. The critical element is understanding how each real asset provides different diversification options.

Figure 2 – Return Performance: Aircraft vs. Other Real Assets

Source: ABL Aviation analysis.

The ABL AVIATION VIEW

A significant challenge investors face is the struggle to analyse and understand aircraft asset as an investment opportunity. This challenge is due to three factors: i) limited performance data, ii) inherent lack of transparency, and iii) the fragmented nature of investment managers who specialise in aircraft assets. Consequently, investors have traditionally invested in operating lessors rather than directly in aircraft themselves through an asset manager.

ABL Aviation's Managing Partner, Ali Ben Lmadani, believes this will change as the industry will undergo “a disintermediation shift.” Investors will seek to invest directly in the aircraft assets and begin to move away from the operating lessor model. The reason is because most, if not all, operating lessors offering asset management services, have an inherent conflict of interest - according to ABL Aviation. Ben Lmadani asks: “Who should an operating lessor prioritise during an airline bankruptcy: the assets they book on their accounts or managed accounts for Investors in SPCs? The removal of inefficient intermediaries in the supply chain will lead to the emergence of the independent asset manager. At ABL Aviation we believe we are at the forefront of this transformation."

Sign in to post a comment. If you don't have an account register here.