in Aircraft values, Lease Rates & Returns , Assets

Friday 2 December 2016

Will Comac manage to steal market share from existing OEMs?

The ARJ21 and C919 mark China’s entry in the field of mainstream commercial aircraft manufacturing. Both aircraft are being developed and built by Commercial Aircraft Corporation of China (Comac), a Shanghai-based state-owned aircraft manufacturing company. It has been a challenging process for the OEM so far - both programmes have been delayed by several years and have consumed billions of dollars in development costs.

The ARJ21 regional jet entered service in 2016, 14 years after its development was launched and the C919, a single-aisle aircraft, is scheduled for its first delivery in 2018/19, also a number of years behind schedule. In addition to the delays, Comac has several other teething challenges to contend with, including developing the necessary after-sales infrastructure to support delivered aircraft.

The aircraft types also currently lack international (EASA/FAA) certification, further restricting China’s ability to market these aircraft internationally. Despite these shortcomings and challenges, the Ishka View is that progress is being made, especially for the C919 programme which is in a position to learn and adapt from the challenges and issues faced by its smaller sibling. Market sources confirm the view that one of the world’s largest aviation markets will generate significant demand for aircraft domestically in the next 20 years and a local OEM offering a competitively priced product, possibly in local currency, will be attractive. Internationally though, existing OEMs, with their well-established infrastructures, will continue to dominate and it will take long time for Comac to make material in-roads into non-Chinese markets.

Haltering progress

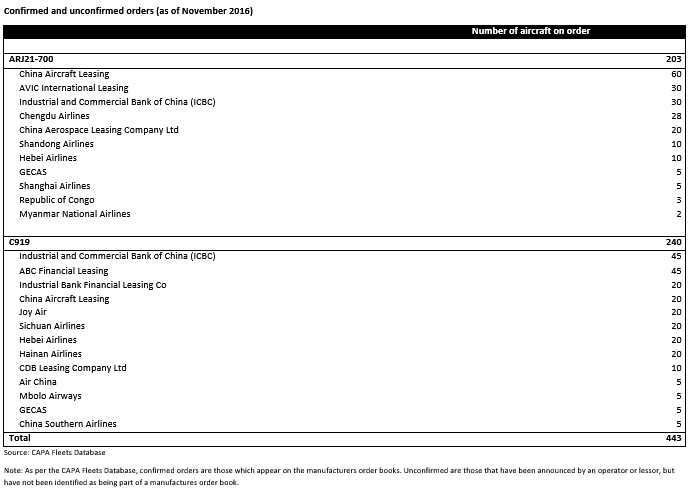

As the aircraft currently lack certification from major international airworthiness authorities including the US Federal Aviation Administration (FAA) and the European Aviation Safety Agency (EASA) this effectively puts several developed markets out of reach. This is reflected in the orderbooks of both the C919 and ARJ21. Almost all of Comac’s orderbook is comprised of Chinese customers, barring a commitment from GECAS (GE is the engine provider on both) and a few orders from smaller African airlines.

Comac, is naturally much more focused on capturing a share of the large domestic Chinese market, rather than winning over North American and European aircraft buyers, in these early stages of the programme. While the ARJ21 or C919 may not prove to be as efficient or operationally superior to the E2s, MRJs, NEOs or MAXs, they are likely to be less expensive than their international rivals, a key factor for many, relatively, young Chinese airlines. Outside of China, Comac also has the potential to sell its aircraft to carriers in Southeast Asia and even Africa, both regions where China has considerable infrastructure investments and can rely on state support to help push through orders as part of wider state investment talks. Comac is already working on an updated version of the ARJ21 that would bring the aircraft more in line with its more efficient and high-tech competitors, and more importantly complying with the US FAA’s standards. This would open additional markets for the aircraft, but will take years to achieve.

Airbus and Boeing are winning the order-war …for now

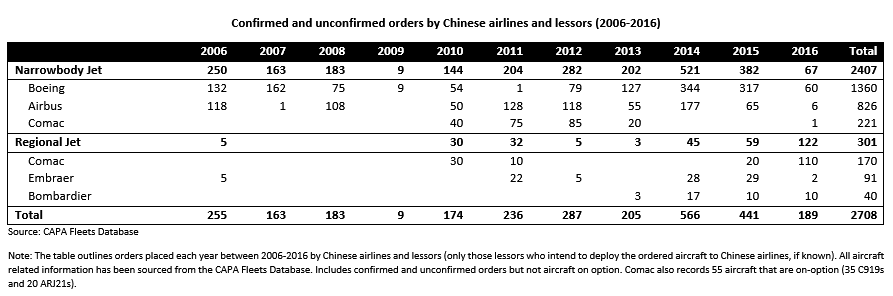

Ishka looked at Comac’s orderbook during the last 10 years and compared it to the other OEMs. Ishka’s findings show that the delays seem to have had a mixed impact on Comac’s orderbook. While Boeing and Airbus understandably dominate the single-aisle market, ARJ21 already has the largest orderbook among the regional jet segment (for the China market). However, it is important to note that Comac is a state-owned entity and aircraft procurement in China is also state-controlled. As a result, it is highly likely that many of these orders will have been finalised with some form of state-backing.

Comac’s orderbook appears light vis-à-vis its established rivals. However, many airlines and lessors prefer to play the wait-and-watch game before increasing their exposure on a clean-sheet aircraft design. Comac already has the ARJ21 in service and has used much of what it has learnt on developing the regional jet, in building the larger aircraft. Reports on the progress of the aircraft appear upbeat from market sources. Ishka understands that the C919 programme is progressing well and that Comac is extremely committed to delivering on both the technical as well as non-technical requirements of launching a clean-sheet aircraft. However, aircraft programmes are notorious for generating delays.

Local currency product

One inherent advantage that Comac has of being a local OEM, is that it can sell aircraft in local currency rather than in dollars. This saves Chinese carriers from the FX risk of having dollar-denominated aircraft assets on their balance sheet while most of their revenue is in RMB. This is a big advantage particularly given the forecasted size of the Chinese aviation market over the next 20 years.

Getting its aftermarket sales support right

There is a general consensus among all major OEMs and industry bodies like IATA that China will be the largest aviation market in the world in the coming decade. OEMs have forecast that China will need more than a trillion-dollars worth of aircraft between 2016 and 2035. However, in-order to leverage this potential, Comac not only has to iron out any technical issues with the aircraft but also to allay any concerns that customers may have with respect to non-technical issues, the biggest being after-sales infrastructure for maintenance and the availability of spare-parts. Existing OEMs already have a well-established infrastructure to support their clients. Setting-up an equivalent and comprehensive support system will take time and this gives the existing OEMs an edge over newer OEMs like Comac. One other question that hangs over the programmes is the remarketing potential of these aircraft. Unless Comac manages to penetrate the non-Chinese markets, any aircraft coming off their first leases will be limited to finding customers in the Chinese market only. This could also affect demand for the aircraft going forward. Current and residual values will become an increasingly important feature as these aircraft start to deliver, especially to leasing companies where asset risk and value exposure have greater relevance.

Last but not least, there are also some concerns relating to reliability and safety. Any incidents or major malfunctions have the potential of derailing a new aircraft programme, Boeing 787s for example had a troubled induction. China’s other recent venture at aircraft manufacture, the MA60, was initially marred by several accidents and was grounded by several countries. If the ARJ21 and C919 are confronted with similar issues, the reputation of these aircraft would be hampered significantly. In such a scenario, even Chinese airlines would become sceptical of the aircraft and the nascent demand for both aircraft could disappear. While this is true for any new aircraft irrespective of who has built it, it is even more relevant in case of the ARJ21 and C919. China has been making aircraft for more than 40 years, however, the ARJ21 and C919 are the first passenger jets ever to be designed and built in China and therefore it will take time for the OEM to build trust in the market. Market sources, however, have expressed confidence in Comac’s technical capabilities and are optimistic that they should be able to deliver a reliable product.

The Ishka View

Ishka’s analysis of OEM orderbooks for China shows that the existing OEMs are still favoured over Comac. The Ishka View is that the uncertainty associated with the two programmes, and its lack of certification in the US and Europe is clearly limiting Comac’s marketing reach. However, now that one of the two aircraft programmes is in service, Comac will use the experience and apply the learnings to its upcoming product and allay some of the concerns that potential customers may have. Nearly all major aircraft programmes (clean sheet as well derivatives of existing products) have had some production issues in the past decade and Comac’s programmes are no different. However, market sources are optimistic and believe that Comac is technically equipped to handle any teething issues that may come up during the initial stages of the C919’s lifecycle.

There is a sense in the market that Comac is taking all the right steps with a long-term perspective and is extremely committed to delivering a reliable product. There is growing confidence that in the medium- to long-term Comac will prove a worthy competitor for Airbus and Boeing in its home market. There is likely to be no shortage of financing if a local Chinese airline or lessor wants to acquire the C919. In addition, Comac benefits from unrivalled state support which will help it win orders both domestically and in countries where China has considerable state investments.

In the short-term, until Comac delivers on non-technical aspects such as an after-sales support infrastructure, and concerns with remarketing, or pilot and crew transition to a new aircraft, then existing OEMs will continue to dominate airline orderbooks. The delay means that Comac will inevitably take more time to establish confidence in the market. Barring a safety disaster with the C919, Comac would become a serious, third option alongside Airbus and Boeing for Chinese carriers. How quickly will this happen? It is a long-term game, but to help answer this question Ishka plans to monitor Comac’s order position vis-à-vis other OEMs on a regular basis and will highlight any new trends that emerge.

Please Note: The views expressed do not constitute investment advice. We accept no liability to recipients acting independently on its contents in respect of any losses, including, but not limited to profits, income, revenue or commercial opportunities.

Photo: Comac Media Gallery

Sign in to post a comment. If you don't have an account register here.