Tuesday 18 July 2017

fastjet’s rough road to recovery

A year ago African low cost carrier fastjet was on the verge of bankruptcy. The airline has raked up $253 million of net losses off a meagre $237 million of revenues in the five years it has been in existence. In a previous Insight, Ishka highlighted how the airline had been crippled by a poor network and fleet strategy, overambitious growth plans and challenging macro conditions. Ishka held little hope for the airline in its last analysis unless it made some radial and difficult changes. However after having studied its latest strategy, the Ishka View is that the carrier might just have given itself some semblance of a chance of survival. Crucially fastjet has taken managed to create some initial fleet & network rationalisations.

Poor strategy led to money drain

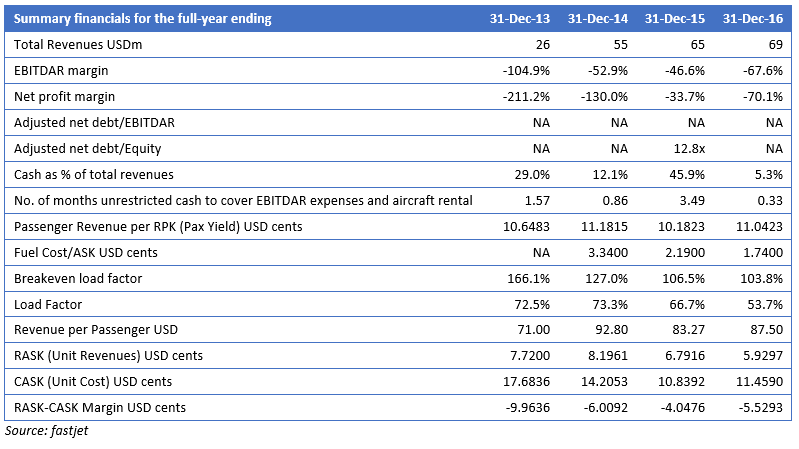

Even a cursory look at the carrier’s key metrics reveals just how poor its original strategy was. Breakeven load factors were consistently above 100% which highlighted the airline’s dangerously bloated cost structure. fastjet’s costs were so high and unsustainable that even if it had filled every single seat on all its flight, the airline would still have made a loss.

The bulk of the airline’s woes emanated from its aircraft portfolio. As of July 2016, the airline operated five A319s across its fairly limited and thin network. The small narrowbodies were in reality too large for the network fastjet was operating in. This contributed to substantially lower fleet utilisation leading to depressed revenues. The airline still had to continue paying the relatively high rental charges for the A319s , while it would have much better off renting a smaller turboprop or regional jet. This led to a clear mismatch between what the airline earned and spent. This resulted in extremely weak fundamentals as demonstrated in the table below:

In addition, even though, the carrier’s main country of operation was Tanzania, its holding company was based at Gatwick near London in the UK. As such, the management, and most support functions, were all based in the UK while the airline operated in Africa. This strategy could work for a large organization with established processes but it was always going to prove challenging for an airline start-up.

Change is in the air

The carrier’s future depends on the success of its stabilisation plan. The plan seeks to rationalise its aircraft portfolio and route network, reduce costs and improve revenues. Some of the highlights of the plan are detailed below:

A Fleet overhaul - From having five A319s in its fleet in mid-2016, the airline now technically operates only two aircraft, one A319 in Tanzania and one E145 in Zimbabwe. It also operates an additional A319 which is in the midst of being returned to the lessor. The remaining A319 will remain in service until August 2017 after which the airline plans to operate only ERJ aircraft. The carrier plans to operate two ERJ190s in Tanzania by October 2017 and two ERJ145s in Zimbabwe by August 2017.

Network rationalisation – The new management has taken steps to withdraw from underperforming routes and also re-adjust some direct services as extensions to other routes. Also, the carrier’s previously over-ambitious growth plans have been postponed until its existing routes start delivering positive and satisfactory results.

Cost optimisation – The biggest cost optimisation initiative was the relocation of the headquarters from the UK to Africa. Even though it still is not in its key home market at least the management and support functions are now much closer to the airline’s operations. In addition, the carrier renegotiated several of its supplier agreements and through its organisational restructuring managed to eliminate duplication of several processes.

Revenue initiatives - Along with cost saving measures, the carrier is also pursuing some revenue maximisation initiatives such as improving distribution through travel agents, developing a new mobile phone gateway and a new contact centre. fastjet also has an interline agreement with Emirates.

Most of these initiatives have either been already completed or are in a fairly advance stage. However, since they were initiated in the second half of 2016, any positive effects, will most likely be realised and visible during 2017’s financial year.

Ishka views all the above steps as favourable and sensible. The new management appears to have realised the earlier mismatch between their offering and the market requirements and has taken some bold and drastic measures to improve the situation.

New management and major shareholder

fastjet’s management team and board has also undergone substantial change in the past year. fastjet’s current CEO, Nico Bezuidenhout, who is spearheading the overhaul strategy, had previously worked with South African Airways’ (SAA) LCC unit Mango since its inception in 2006. Mango is among the select few LCCs in Africa that have recorded a profit. fastjet also has a new non-executive Chairman and a Chief Financial Officer with previous work experiences at Mango and Air Chef, another SAA subsidiary. In addition, the carrier has also entered in a strategic partnership with Solenta Aviation, a South African airline with primarily turboprop fleet. The agreement allows fastjet to wet-lease certain aircraft from Solenta at a reduced cost for the next five years in addition to some other services. In return, Solenta became a 28.4% shareholder in fastjet as part of a $48 million equity deal.

The Ishka View

Ishka views the steps taken by fastjet favourably. While there are still several challenges facing the airline, it has given itself some chance of survival. The airline industry has seen several examples of new airlines attempting to grow very rapidly but failing quite spectacularly – recent examples include Japan’s Skymark Airlines and India’s Kingfisher Airlines. Both airlines overestimated demand in their respective markets and were quick to order lots of aircraft, even the larger A380s. Eventually, unsustainable operations, overcapacity and competition forced these airlines to either enter bankruptcy protection or shut down operations. Fortunately, fastjet appears to realised its limitations. From a completely dire situation, the airline appears to have found and adopted a more sensible approach.

While fastjet may be an insignificant player for most lessors and investors as of now, if the airline maintains its prudent approach and does not get swayed towards overly ambitious growth plans, in the long term there is significant potential in sight. This means early investors and lessors could hope for a respectable and, possibly, a robust return on investment. However, the airline is still operating in a particularly difficult operating environment. Despite its potential for aviation the macro challenges in Africa are numerous. Even in the current low fuel price environment most airlines in Africa remain unprofitable. The region still awaits a pan-Africa Open Skies Agreement – any kind of relaxation so far has ended up benefiting non-African carriers like the ME3 carriers rather than Africa based airlines. fastjet’s new management have succeeded in creating breathing space for the carrier and while the carrier’s future looks brighter it is still very uncertain.

Sign in to post a comment. If you don't have an account register here.