in ESG & Regulation , Aviation Banks and Lenders

Tuesday 6 December 2016

Law firms end legal confusion over US ABS rules

Originators of Aircraft ABS deals are not subject to the US Dodd-Frank’s 5% risk retention rules, according to a panel of aviation lawyers in a new white paper. Law firms Clifford Chance, Hughes Hubbard, Milbank, Pillsbury and Vedder Price state that aircraft ABS transactions will be exempt from so-called skin-in-the-game clause due to come into effect on 24 December 2016. The crux of their argument is that they cannot be considered self-liquidating assets under the SEC definition.

Zarrar Sehgal, a partner at Clifford Chance, and one of the authors of the paper, confirms that the new Dodd-Frank risk retention rules don’t apply, and were never intended to apply, to most standard structured aircraft portfolio transactions: “Most structured aircraft portfolio transactions are not self-liquidating, and therefore should not qualify as "asset-backed securities" under the Securities Exchange Act of 1934; as the risk retention rules only apply to asset-backed securities as defined under the Exchange Act, traditional aircraft portfolio transactions should be excluded from these rules.”

The Ishka View is that the white paper is timely and welcome and will help reassure ABS investors and lessors seeking to prepare ABS deals. However, the real test of this legal opinion will only come when a lessor successfully concludes the sale of an ABS E-note and constituting a true sale of aircraft.

What does the definition say?

Section 941 of the Dodd-Frank Wall Street Consumer Protection Act defines an asset-backed security as:

“A fixed income or other security collateralised by any type of self-liquidating financial asset (including a loan, a lease, a mortgage, or secured or unsecured receivable) that allows the holder of the security to receive payments that depend primarily on cash flow from the asset…”

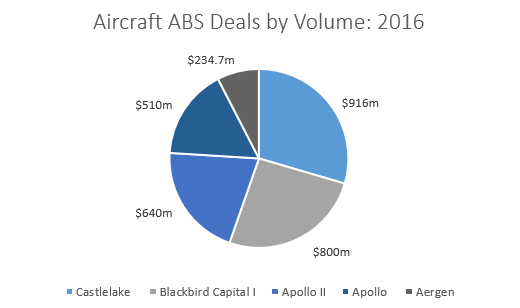

Source: Ishka research

Why are aircraft ABS not self-liquidating?

The authors believe that aircraft ABS are not self-liquidating because the initial revenues from the assets under lease are not sufficient to pay off the debt and interest at the terms end – a definition that has been used by the courts for around a century. Unlike, real-estate securitisations, an aircraft ABS requires active management to be successful. Each aircraft in the transaction is likely to be re-leased, perhaps several times, over the life of the portfolio before being ultimately sold. This is because it would be highly unlikely for a lessor to repay back the debt with the leases as they stand at the beginning of the term.

In this way aircraft ABS are strikingly similar to a corporate bond i.e. repayment depends on the management’s ability to secure a decent operating income. To recap, to be considered an asset-backed security, and therefore liable to skin in the game, repayment must rely primarily on cash flow from a pool of self-liquidating assets. However, a significant portion of the value of an aircraft ABS is held in the aircraft’s residual value. In order to meet the debt and interest terms the asset will have to be sold. So, in legalese, the holder of the security is not primarily dependent on cash flow from the asset, they are dependent on other factors. The resulting cash comes not from operating the asset but by selling it. In this way, the security cannot be considered not self-liquidating.

Lease-backed ABS exclusion is no accident

Although the Securities and Exchange Commission (SEC) has not expressly interpreted the Dodd-Frank definition, it is very similar to previous definitions. The pre-2005 definition (adopted in 1992), defines an ABS as one that is “primarily secured by the cash flows of a discrete pool of receivables or other financial assets…that by their terms convert into cash within a finite time period,” – which sounds familiar. Legally, this was widely held not to include lease-backed ABS.

In 2005, the SEC expanded the scope of the definition to include certain transactions backed by leases which also relied on some residual risk. No express reference was made to leases that do not self-liquidate. This is as the law currently stands.

However, the drafters of Dodd-Frank initially intended on changing this. The final house bill explicitly included lease-backed ABS under the meaning of an asset-backed security and established a bright-line test of greater than, or less, than 50% residual value. This was dropped by the Senate. In the view of the authors of the white paper, this was not an accident: “We believe that the drafters of the CRR rules deliberately excluded lease backed ABS which does not self-liquidate from the definition of the Exchange Act ABS.” A clear indication that Dodd-Frank intends to fall back on the pre-2005 definition of an asset-backed security.

The Ishka View

The white paper should reassure lessors who rely on lease-based ABS transactions that they will not be forced to retain a 5% share of the portfolio’s residual risk. The paper argues that aircraft assets are not self-liquidating because they depend on active management of the portfolio, including re-leasing and sale or part-out of the aircraft assets. Furthermore, repayment of the debt issued in these transactions typically does not depend primarily on cash flow from self-liquidating assets but instead relies on other sources of cash flow, particularly realizing the residual value of the aircraft assets. The white paper provides timely legal reassurance to many lessors, and their investors, looking to do ABS transactions. ABS transactions have proven popular with investors and an invaluable debt-raising tool for an increasing number of lessors. However, only a small fraction of ABS deals involve a true sale of aircraft to a third party through an E-note sale. The legal argument is welcome but will not be tested properly until a lessor successfully completes the sale of an ABS E-note sale. With fewer E-note buyers in the market this might take some time.

Sign in to post a comment. If you don't have an account register here.