Sunday 8 January 2017

A review of start-up airlines in 2016

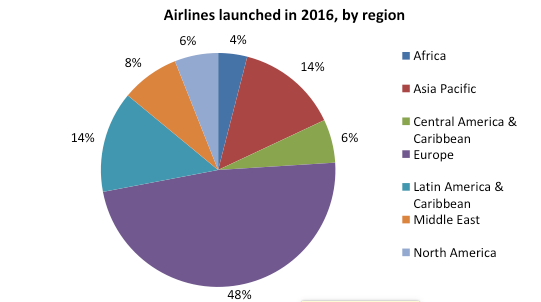

Each year new entrants attempt to find a niche in the airline market and 2016 was no exception. According to Ishka research there were 47 new airlines started last year. Europe was the largest growth market last year with nearly half (48%) of all airline start up in the last 12 months. Followed by Latin America (14%) and Asia (14%).

Ishka has segmented these new airlines by their business model. The chart below summarises the proportion of new airline entrants that actually begun operations by each of the established airline business models that exist. While some carriers may straddle two business models, for the purposes of this analysis they have been categorised based on their primary operation.

The second chart breakdowns the geographical spread.

Cargo airlines

Of the four cargo airlines to launch in 2016, all of them were based in Europe. Of these four, three were effectively off-shoots of existing airlines. The first is CargoLogicAir – which is a subsidiary of Volga-Dnepr and operates with a Boeing 747-400F; ASL Airlines Spain (formerly known as Pan Air Lineas Aereas) and ASL Airlines Belgium are subsidiaries of Irish aviation services company ASL Aviation and were part of TNT Express, the Dutch global cargo, mail and logistics corporation brand, before ASL acquired the airline operations of TNT Express, comprising TNT Airways and Pan Air Lineas Aereas in February 2016. One proper start-up was Sky Gates Airlines, a Russian-based airline which began operations in October 2016 with a leased 747-400F.

Charter airlines

Figures suggest there were around 11 new charter operators launching a service during 2016. Europe saw the highest proportion with five. BRA - Braathens Regional Airlines was established in February 2016 following the merger of Swedish carriers - Malmö Aviation, Sundsvallsflyg, Braathens Regional and regional brand, Sverigeflyg. The merger included the consolidation of Braathens' regional subsidiaries as well; and uses ATR72-600 aircraft. Small Planet Airlines Germany was started as a subsidiary of the Small Planet Group and is based in Berlin. It utilises A320s and has signed an agreement with Thomas Cook for some of its Mediterranean destinations. In Greece, Orange2fly was launched in September 2016 using A320s. It was founded by ex-SkyGreece executives. Anda Air, based in Ukraine, began chartered operations in October 2016 on behalf of Feeriya using an MD-83.

Elsewhere, in the Middle East there is Fly Jordan and Al Bayraq. The former is using a 737-300, while the latter, a subsidiary of Saudia, has a handful of A319s. Around Central America and the Caribbean, there is Dominican Wings, which is a subsidiary of Lithuanian wet-lease specialist, Avion Express. It is using an A320 for services, having begun operations in February 2016. Also in the same area of the world is Air Costa Rica, although it is unclear whether it has actually launched operations. It is believed to have a 737-300 and a couple of Fokker 100s.

Latin American Wings, based in Chile, begun scheduled charter flights in January 2016. It has a single Boeing 737-300 believed to be sourced from fellow start-up Chilejet.

Lastly, in North America, Crystal Luxury Air has been setup as the chartering subsidiary of cruise company, Crystal Luxury Air. Crystal has bold plans to utilise a Bombardier Global Express XRS, a Boeing 777-200LR and an Airbus ACJ319 on charter jet services to Crystal destinations.

Full service airlines

Very few airline start-ups can be easily classified as full service airlines. Many new entrants would likely fall into an intermediate, or hybrid, category between a full service and a low-cost carrier (LCC) operation.

In Africa, Air Djibouti began operations in August 2016, and is a relaunch of the former national carrier of Djibouti. It uses a mixtures of Fokker F-27, two BAe 146 aircraft and one 767-300 aircraft on regional and international routes.

In the Middle East, Nesma Airlines (Saudi Arabia) has been established as an affiliate of Egyptian carrier Nesma Airlines (Egypt). It has plans to expand its fleet to six aircraft over the next three years, as it takes delivery of A320 family aircraft and ATR 72-600s. SaudiGulf Airlines is a rare example which could be considered as a truly new airline. The carrier, which started operations in October 2016, utilises a fleet of three A320 aircraft and has 16 Bombardier CS300 on order. It becomes Saudi Arabia’s fourth domestic carrier, after Saudia, flynas and Al Maha Airways.

In Latin America, Alas Uruguay replaced PLUNA, which ceased operations in 2012, as the country's new flagship carrier. Although it began services in January 2016, using 737-300s, it has had an ignominious start after being forced to suspend operations in October 2016. There is also Sol del Paraguay Lineas Aereas. Having suspended services in August 2012 due to financial issues, the carrier relaunched operations in January 2016 utilising a Cessna Caravan aircraft.

In the Asia Pacific area, Himalaya Airlines was relaunched as the carrier formerly known as Yeti Airlines. It has a single Airbus A320. In China, Yunnan Hongtu Airlines launched domestic services to the country's northeast region in May 2016, using an Airbus A321 aircraft. It has plans to expand its fleet to 100 aircraft in 10 years and have five to seven bases. Also in China, Air Guilin began services in June 2016. It is a joint venture between the Guilin Municipal Government and HNA Group, utilising a fleet of two A319 aircraft from Beijing Capital Airlines. While in Samoa, an airline called Talofa Airways began operations in August 2016, using a couple of Twin Commander 690Bs (one for the real aviation geeks there). There is also Air Carnival in India, which has transitioned from a charter airline to scheduled operations, which were launched in July 2016. It has a single ATR72-500.

Finally, in Europe, four airlines were established. Tus Airways, in Cyprus, started flights in February 2016 following the failure of Cyprus Airways in 2015. It operates domestic and short-haul international services using a couple of Saab 200 aircraft. Alliance Airline (Armenia) launched its maiden service in June 2016, with wet-leased equipment from Nordwind Airlines. Fly One (Moldova) also begun flights in June 2016 and operates scheduled and charter services on international and domestic routes using two A320 aircraft. Lastly, there are reports of Armenia Airline beginning services in July 2016, using Boeing 737-500 and -700 variants of aircraft.

Low cost carriers

The trend in ‘full service’ carriers creating low-cost offshoots continued unabated in 2016. This was the case for virtually all nine ‘new’ LCCs that entered the market in 2016. Launching in China was Jiangxi Air, a joint venture between Xiamen Airlines and Jiangxi Aviation Investment Co. It is utilising Boeing 737-800 aircraft and has plans to expand its fleet to 30 aircraft by 2020. Also in Asia, Air Seoul has been created as a subsidiary of Asiana Airlines, having begun services in July 2016. It operates with three A321s from Asiana, with plans to take delivery of two more aircraft in 2017.

AZALJET begun flying in March 2016, using the Embraer 190, and is intended to be the low-cost subsidiary of Azerbaijan Airlines. Norwegian Air UK was established as a subsidiary of the Norwegian Group, using the 737-800 and 787-8. In June 2016, Lufthansa launched Eurowings Europe to provide regional European routes using a fleet of seven A320s. The major legacy groups in Europe are all grappling with how to counter the emerging low cost long haul threat; brought about in no small part by the advent of the Boeing 787. IAG will start a low cost long-haul operation, but how is not clear yet. Air France-KLM has announced it will do the same, but faces opposition from the unions, particularly in France. Lufthansa is in a similar boat with their pilots’ union, so they have been treading carefully with any expansion of Eurowings into long-haul flying.

Elsewhere in Europe, Cobalt Air in Cyprus began flying in July 2016 using some of the workforce from the defunct Cyprus Airways. Under a five-year plan, it intends to expand its fleet size (currently three) to 15-20 A320s and 6-10 A330s. Elsewhere in Europe, specifically France, French Blue has launched as a longhual low-cost airline, having been established by Groupe Dubreuil, parent company of Air Caraïbes. The subsidiary plans to operate with a fleet of four aircraft including two A330-300s and two A350-900s.

Launched recently in December 2016 Wingo is a Colombian low-cost unit of Panamanian airline group, Copa Holdings and utilises a fleet of four Boeing 737-700 aircraft.

Continuing the Latin American trend of having a subsidiary airline ending in the name of the country for every nation in that continent, Mexican LCC, Volaris has established Volaris Costa Rica which wet-leases aircraft from Volaris. It began operating flights in November 2016.

Regional/Commuter airlines

In this category, seven airlines came into existence during the course of 2016. Most were reincarnations of existing, or previously existing, airlines. Within Latin America there is Chilean Airlines, which is a rebranded entity that replaces defunct Chilean regional operator, AeroDesierto, which ceased services in July 2015. It is using a 737-200Advanced (without hushkits!) Amaszonas Uruguay is borne out of BQB Líneas Aéreas, established in 2010, after being acquired by Amaszonas in April 2015 from integrated Uruguayan tour operator Buquebus. It is operating a Bombardier CRJ200LR. Launching operations in January 2016 was Fly All Ways. Based in Suriname, it has acquired a couple of ex-KLM Fokker 70 aircraft and operates to a handful of cities in the north of the continent.

In Europe, Air Europa Express was launched as part of Globalia’s plans to compete with IAGs Iberia Express. It operates the Metro III and the ATR42-320 aircraft; which means it puts turboprops up against ‘jets’ (A320s). This is Globalia's third attempt at creating a regional subsidiary. The first was another airline with the same name which collapsed in 2001; a second airline known as Universal Airlines never commenced operations. In Portugal, TAP Express has replaced Portugalia as TAP Portugal’s wholly-owned subsidiary regional carrier – it currently utilises ATR72s and Embraer 190s.

Based in Africa, and launching in November 2016, is Binter CV – a subsidiary of Spanish carrier, BinterCanarias. The carrier operates inter-island services in the Cape Verde archipelago using an ATR 72-500.

Virtual airlines

Lastly, there was what would be considered four ‘virtual’ airlines that launched in 2016. The idea of these ‘airlines’ is to focus on providing an air service while outsourcing as many non-core activities to other organisations. Given this whole setup, they cannot be classified as a true licensed operator but have been highlighted here for the sake of completeness.

Three of these airlines are based in Europe – one each in Norway (goTo Nordics), in Italy (FlyErnest) and France (Fly Kiss). The other is NewLeaf Travel, a Canadian firm that uses aircraft and crew provided by Flair Airlines. Despite launching in July 2016, it has already dropped or terminated plans for some proposed new routes as a result of it says is WestJet’s attempt to stifle any competition.

The Ishka View

Overall, the year 2016 has prolonged a trend in producing very few true ‘new’ airlines. Most new carriers were either offshoots of existing airlines or airlines groups, or else rebrands of already surviving carriers. What is left is only a handful of truly new airline firms.

Despite an environment of cheap fuel and financing, there have been very few, well-capitalised airlines with national or even international aspirations appearing since the spate of bankruptcies and consolidations of the past decade. In both North America and Europe, the world’s most mature airline markets, there is little space in the pond for the small fish due to the large koi carp occupying most of the water. Anyone who wants to launch an airline faces substantial hurdles, given the scarcity of gates and terminal facilities at many airports, not to mention the capital costs. On top of all that, the larger aircraft a start-up chooses, such as a Boeing 737 or Airbus A320, create far greater capacity risk and the threat of a competitive response by incumbents.

Most true start-ups are following the advice and taking smaller aircraft and flying them strategically, filling niches the heavyweights have either abandoned or left ripe for competition. That means primarily smaller regional markets where they stand a better chance of being able to survive.

Please Note: The views expressed do not constitute investment advice. We accept no liability to recipients acting independently on its contents in respect of any losses, including, but not limited to profits, income, revenue or commercial opportunities.

Photo: Wendy Cope

Sign in to post a comment. If you don't have an account register here.