in Aircraft values, Lease Rates & Returns

Thursday 31 August 2023

Pricing Benchmark: MAX prices keep up with A320neos

Listen to the article

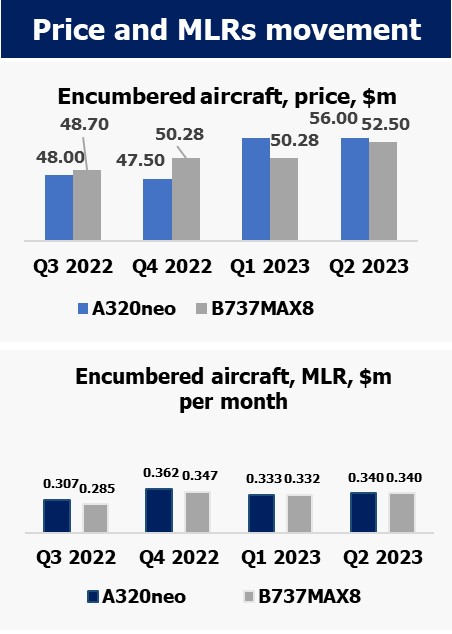

Aircraft values for both the Airbus A320neo and Boeing 737 MAX have rebounded to pre-COVID-19 levels, with no material delta between the two aircraft types, according to research from Ishka’s Aircraft Pricing Benchmark team.

A320 Neo pricing which began trending upwards from Q4 2022 has continued well into this year, with high-end pricing approaching $58 million, say surveyed participants, with LRFs ranging between 0.5% - 0.58% and typically not exceeding 0.6%.

Similarly, the Boeing 737 MAX 8, has been experiencing a gradual recovery in market values and lease rates. As of mid-2023, contributors see the B737 MAX 8's market value at approximately $52 million with a monthly lease rate of around $345,000, both of which reflect a modest increase since the start of the year. There appears to be a steady demand for the B737 MAX 8, indicating a degree of restored trust and acceptance within the aviation industry.

A limited number of RFPs is helping keep lease rate factors competitive for SLBs. Despite the increase in interest rates, lease rate factors are generally continuing to plateau, rarely surpassing the 0.6% mark.

However, concerns persist regarding engine and maintenance costs, exacerbated by a shortage of MRO (Maintenance, Repair, and Overhaul) services. Some of the Pricing Benchmark contributors are especially concerned about escalation, which is increasingly becoming a noteworthy factor.

Sign in to post a comment. If you don't have an account register here.