in Aircraft values, Lease Rates & Returns , OEMs, Cargo & Engines

Thursday 11 April 2024

Q1 2024: Engine buyers predict lease rates will continue to rise

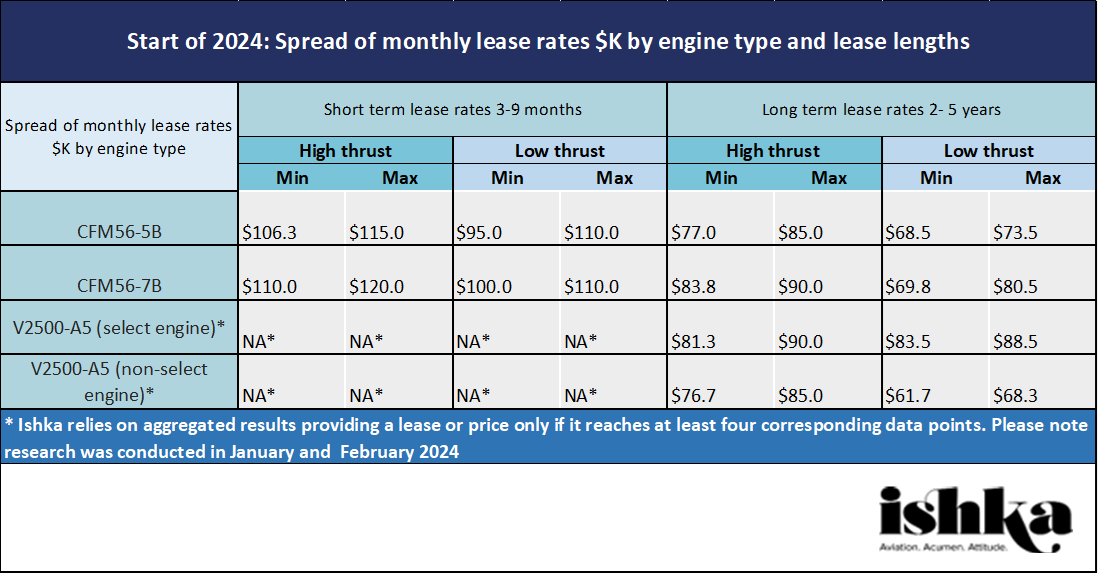

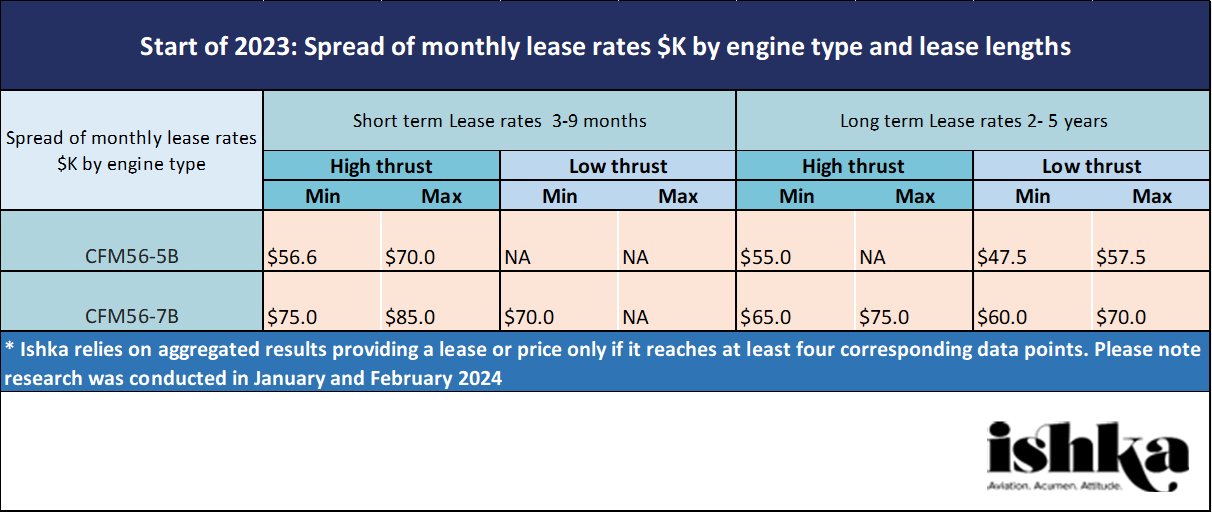

Aircraft engine buyers surveyed by Ishka have confirmed that some single-aisle engine lease rates nearly doubled between the start of 2023 and 2024, with the majority (approximately 85%) believing lease rates for narrowbodies engines will continue to rise for the rest of the year. A 15% minority believe some engine lease rates were close to reaching peak levels but were unlikely to go down for at least the next 12 months.

Respondents indicated that short-term lease rates for high-thrust CFM56-5B variants had nearly doubled from $56,000 per month to $110,000 per month between January 2023 and January 2024, while lease rates for CFM56-7Bs had also significantly increased over the same period.

Respondents highlighted that airlines, which were already extending the lease of some of their spare engines throughout 2023 (see a March 2023 Ishka interview with Ishka+ conversation with ELFC's COO Richard Hough), have continued to look for longer lease terms this year.

Engines prices also increase

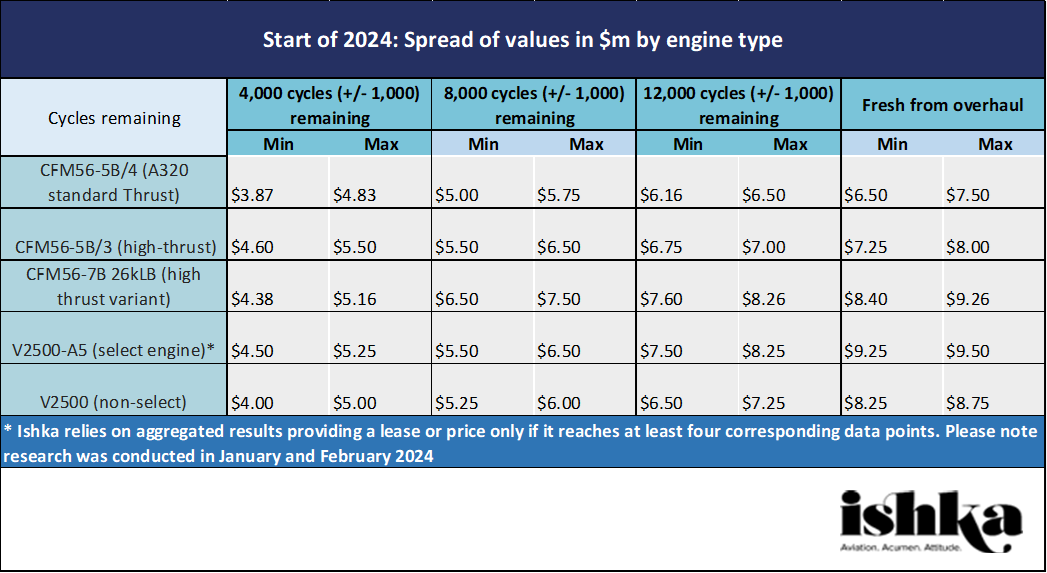

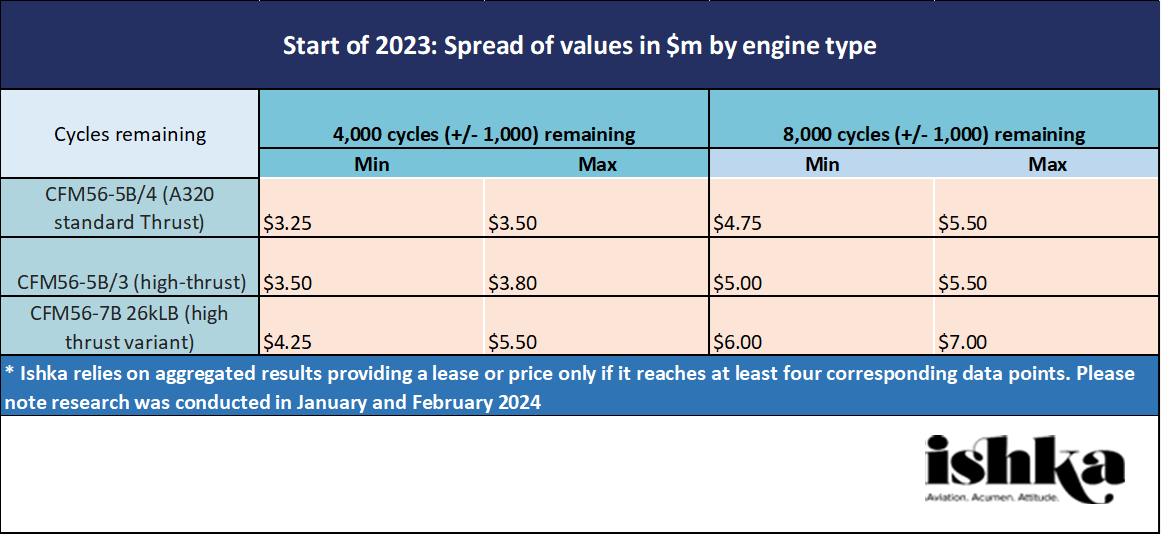

The survey showed that prices for many single-aisle aircraft engines had increased in the last 12-months, regardless of remaining cycles, due to the shortage of serviceable engines, made worse by long MRO turnaround times.

Respondents to Ishka’s survey stated that prices for the high-thrust CFM56-5B/3 variant with 4,000 cycles remaining, had increased from between $3.5 million to $3.8 million in January 2023 to a range of $4.6 million to $5.5 million by January 2024.

A similar price increase could be seen for the CFM56-5B/4 (the standard thrust for the Airbus A320) with 4,000 cycles remaining which rose by at least 19% over the same period from between $3.25 million and $3.5 million to a range of $3.87 million to $4.83 million..

Prices have continued to rise since Ishka’s February 2024 survey, three recent sources confirm, pointing to the CFM56-7B as a particular example. Prices for a CFM56-7B 26kLBs are now nearing $10 million for engines with around 8,000 cycles remaining, the sources said.

The Ishka View

It is striking how the market for used aircraft engines has changed over the past 12 months. The stilted demand for engines post-Covid dramatically shifted during the course of 2023 due to a combination of factors, many of which continue to distort the market.

One big driver has been new-tech engine performance issues. Airlines and lessors have shared concerns over how quickly some CFM LEAP engines have needed to be overhauled, while Pratt & Whitney’s powdered metal issues have forced the grounding and inspections of hundreds of Airbus A320neo Family aircraft.

Engine buyers agreed that longer MRO turnaround times, and the limited availability of slots are still driving current engine lease rates upwards. But several sources disagreed as to how long MRO bottlenecks will continue to be an issue. All respondents agreed engine lease rates look set to be at elevated levels for at least another 12 months but worryingly for airlines most believe narrowbody engine lease rates could continue to rise further.

Interested in being included in Ishka’s next engine buyer’s survey? Email Dickon Harris (dickon@ishkaglobal.com)

Sign in to post a comment. If you don't have an account register here.