in Lessors & Asset managers , Aviation Banks and Lenders

Thursday 20 April 2017

Goshawk’s next steps

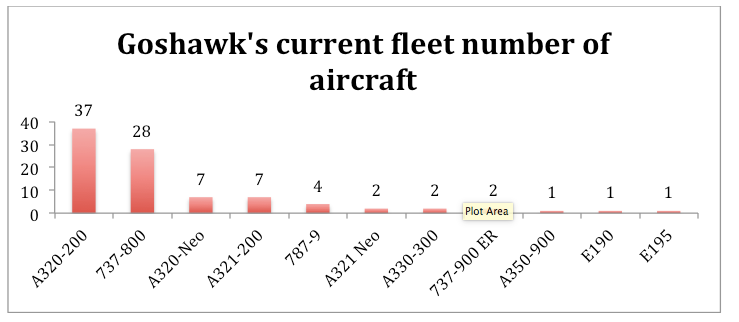

Goshawk is one of the industry’s newer lessors but has achieved remarkable growth in a relatively short space of time. Since its launch, a little over three years ago, it now operates 77 aircraft and has commitments for a further 24 aircraft that brings its total future portfolio to 101 aircraft. The lessor has a committed portfolio of more than $5 billion of assets according to the firm’s CEO Ruth Kelly.

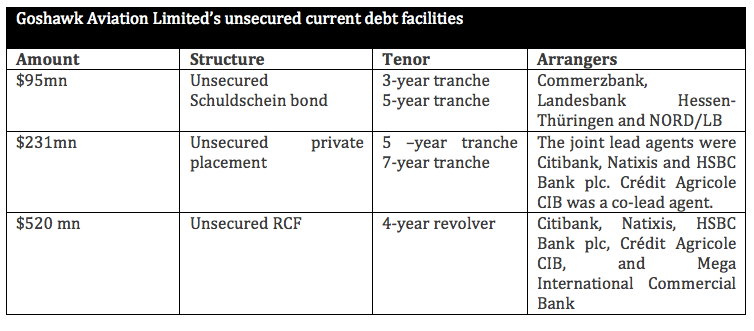

Goshawk has benefitted from good timing. The lessor launched several years ahead of a flock of new leasing entrants. As a result, it has created a sizeable core fleet with desirable younger aircraft. This has helped it attract a range of debt investors. To date it has successfully diversified its funding base with both - a $95 million unsecured Schuldschein issuance, and an unsecured $231 million private placement. The lessor also has an unsecured $520 million bank revolving credit facility which is set to grow further in the coming months, and a $425 million warehouse facility. It also has a number of secured facilities.

The key question facing Goshawk is how the lessor expects to expand as market conditions appear to be tightening. Kelly has previously stated that the firm plans to acquire approximately $1 billon of assets a year. The Ishka View is that the lessor’s key strength lies in its experienced management team. Goshawk appears to be achieving growth by buying aircraft through sale/leasebacks. As lease rates, especially for younger aircraft, appear to be compressing due to increased competition, Goshawk is managing to provide a series of packaged sale/leaseback solutions to airlines, through multiple aircraft deals, as well as combining debt solutions to win mandates.

Goshawk’s expansion

Goshawk was launched in November 2013 by Investec Bank (Investec) and two initial co-shareholders Chow Tai Fook Enterprises (CTFE) and the Cheung Kong group. The Cheung Kong group sold its stake to NWS Holdings Limited (NWS) as it then set up its own rival leasing firm, Accipiter. Last year Investec sold its stake in Goshawk to the two existing co-shareholders NWS and CTFE.

The firm has a young aircraft fleet with an average age of 2.5 years and an average remaining lease length of around c.8 years. Kelly states that most of the firm’s recent aircraft acquisitions have been through sale/leasebacks and that the type of aircraft preferred by the lessor, “young aircraft with long leases and good lessees, predominantly narrowbody aircraft,” have been harder to acquire through portfolio acquisitions from other lessors.

“So there haven’t been a whole lot of portfolios fitting that profile”, confirms Kelly. “And where they have occurred you know, frankly we haven’t been able to meet the pricing expectations. So in the last year, year and a half, sale leaseback has been our predominant channel and what we found in the sale leaseback channel is that we can compete on things other than price.”

Kelly explains that Goshawk has been able to win deals by packaging together sale/leasebacks with debt solutions. “So for example, we’ve been successful with a number of airlines in terms of helping them with PDPs. There are other balance sheet issues that people sometimes have to grapple with, for example, you know they have particular book value issues that they need solving. And again we would speak to them and listen to them and see what the requirement and see if there is something we can do to help them to meet that requirement.”

Goshawk’s asset choices

Goshawk has mostly narrowbodies in its fleet something which Kelly states that is unlikely to change. “We’re predominantly a narrowbody lessor and we don’t plan to change that. There is room for some widebodies in our fleet. Currently we’re running at about 20% widebody aircraft, by value. And if we do sale/leasebacks on widebodies then really you know we are looking for quality lessees and long leases.”

Goshawk has two Embraer aircraft in its portfolio, which Kelly explains was part of an existing aircraft portfolio the lessor acquired. “If we ever do acquire any other regional jets it’s probably going to be in that context but regional jets is not a target aircraft of ours,” explains Kelly.

The lessor has not placed any speculative orders yet but Kelly states that the lessor is “not adverse” to placing an aircraft order in future. “As a mature leasing company it is a product stream that we do believe will be valuable to our business. It’s not going to be a major part of our business. So I don’t think you’ll see us heavily shifting towards new orders, but certainly if we could make a transaction work in terms of pricing and in terms of delivery slots, that is something for sure we would look at for the business.”

The Ishka View

Goshawk’s fleet has grown quickly in a relatively short space of time with a diversified client base. Goshawk’s success has been its ability to increase the size of its fleet but still keep its portfolio of aircraft relatively young. This has helped the lessor sell its story to investors and has helped diversify its funding base. Goshawk has shown an appetite for innovative funding structures both with an unsecured Schuldschein issuance as well as its own PDP loan structure for Etihad’s four 787-9s as part of a sale/leaseback deal.

The question is: what lies ahead for the lessor? The firm has proven it can raise debt cheaply and has proved adept at using the capital markets for unsecured debt. Ishka anticipates that with a growing investor appetite, and if it maintains its impressive track record, Goshawk should continue to raise cheap debt. The challenge it faces will be in acquiring attractive assets, particularly with rival lessors bidding keenly for assets. One big advantage the firm has over some newer rivals is an experienced management team. Goshawk’s answer to leasing competition so far is providing balance sheet solutions to airlines combined with an appetite for widebodies and multiple aircraft deals to achieve growth. Another potential answer may be direct orders from the OEMs if the sale/leaseback market for new aircraft proves particularly difficult in future.

Please Note: The views expressed do not constitute investment advice. We accept no liability to recipients acting independently on its contents in respect of any losses, including, but not limited to profits, income, revenue or commercial opportunities.

Sign in to post a comment. If you don't have an account register here.