in Aircraft values, Lease Rates & Returns , Aviation Banks and Lenders

Tuesday 18 December 2018

No longer freight-ened by cargo?

Financiers and lessors appear to be increasingly open to financing and supporting widebody freighters, according to research by ATOZ Aviation Finance (ATOZ), an independent advisory firm based in Luxembourg.

According to a survey of roughly 200 lessors and financiers conducted by ATOZ, more than 94% of lenders are either currently financing widebody freighter assets or considering doing so in the next 12 months, compared to 69% of lessors surveyed. “There has been a real change over the last two to three years,” explains Yves Germeaux, managing director at ATOZ. “To be honest, some of these banks never looked at a widebody freighter until 2016. Before then, it was difficult to finance these assets as only a limited number of banks were doing this and had taken the time to understand the assets.”

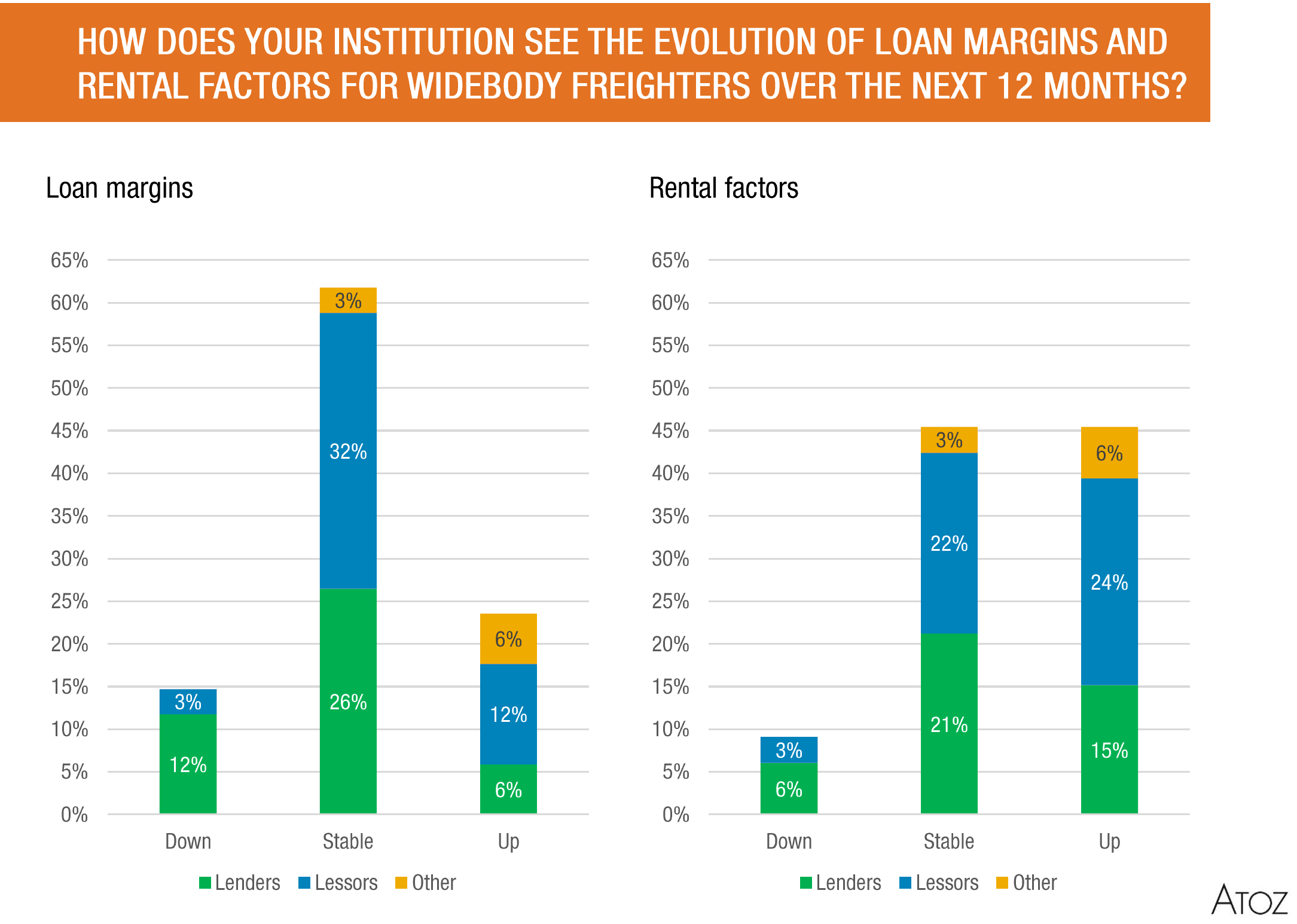

Germeaux believes the change in attitude has been driven by better performing cargo freighter firms and the increasing global demand for air cargo. As more banks enter the aviation finance market, many existing lenders complain that winning mandates to fund popular narrowbody assets has become increasingly difficult while financing margins have contracted substantially. Less popular assets such as widebody freighters are therefore appealing because they allow banks a better chance to preserve margins. According to the survey, 6% of respondents believe that loan margins will remain stable in the next 12 months while 91% think that rental factors for widebody freighters will remain stable or rise over the same period.

Overcoming freighter hurdles

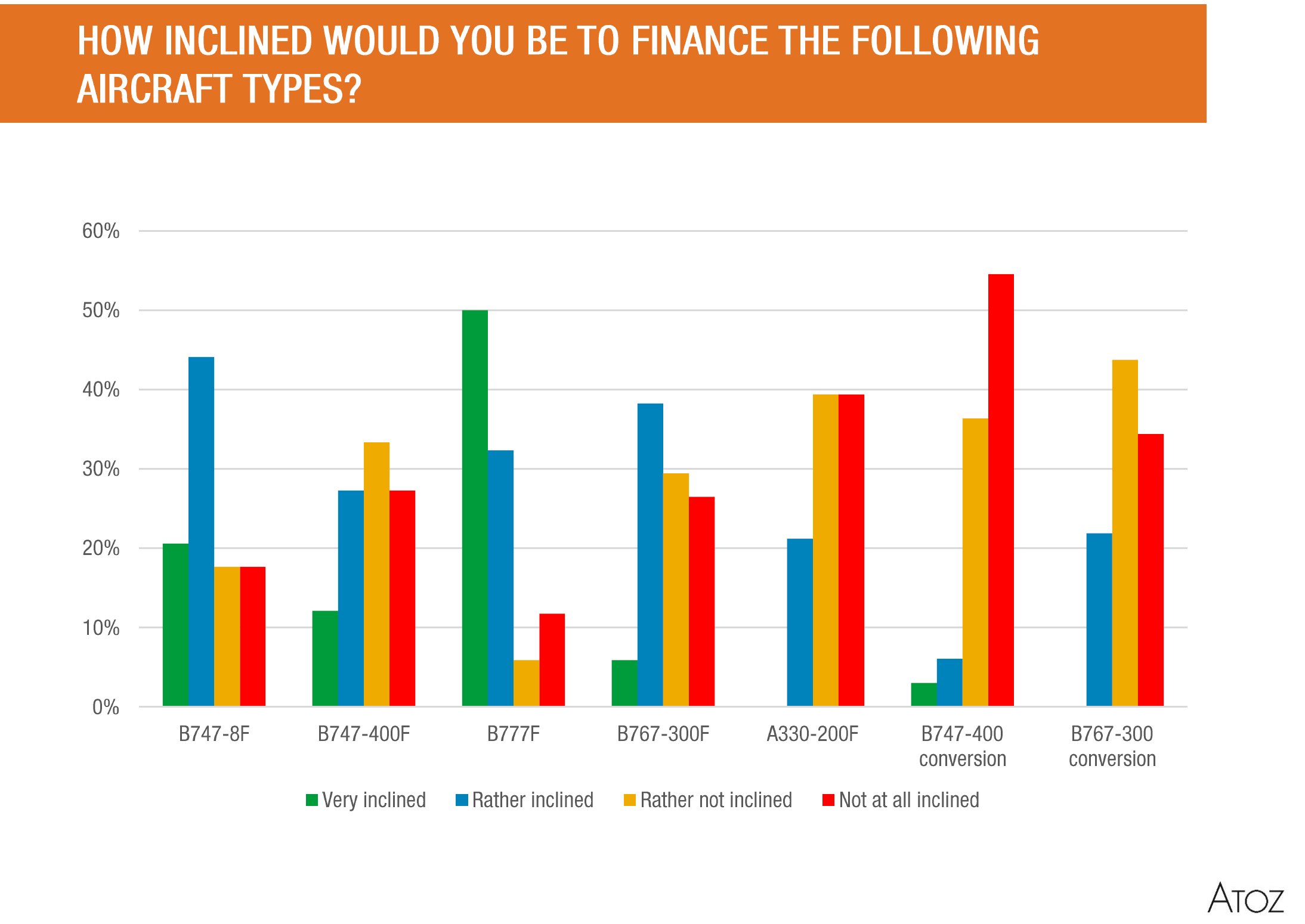

Not all widebody freighters are equal. Financiers and lessors indicated a clear preference for the 777F and the 747-8F, with more than two-thirds of respondents stating they are either rather inclined or very inclined to fund the two assets over a choice of seven widebody freighters. Aviation finance professionals also indicated a slight preference (55% vs 45%) for OEM conversions as opposed to third-party conversions.

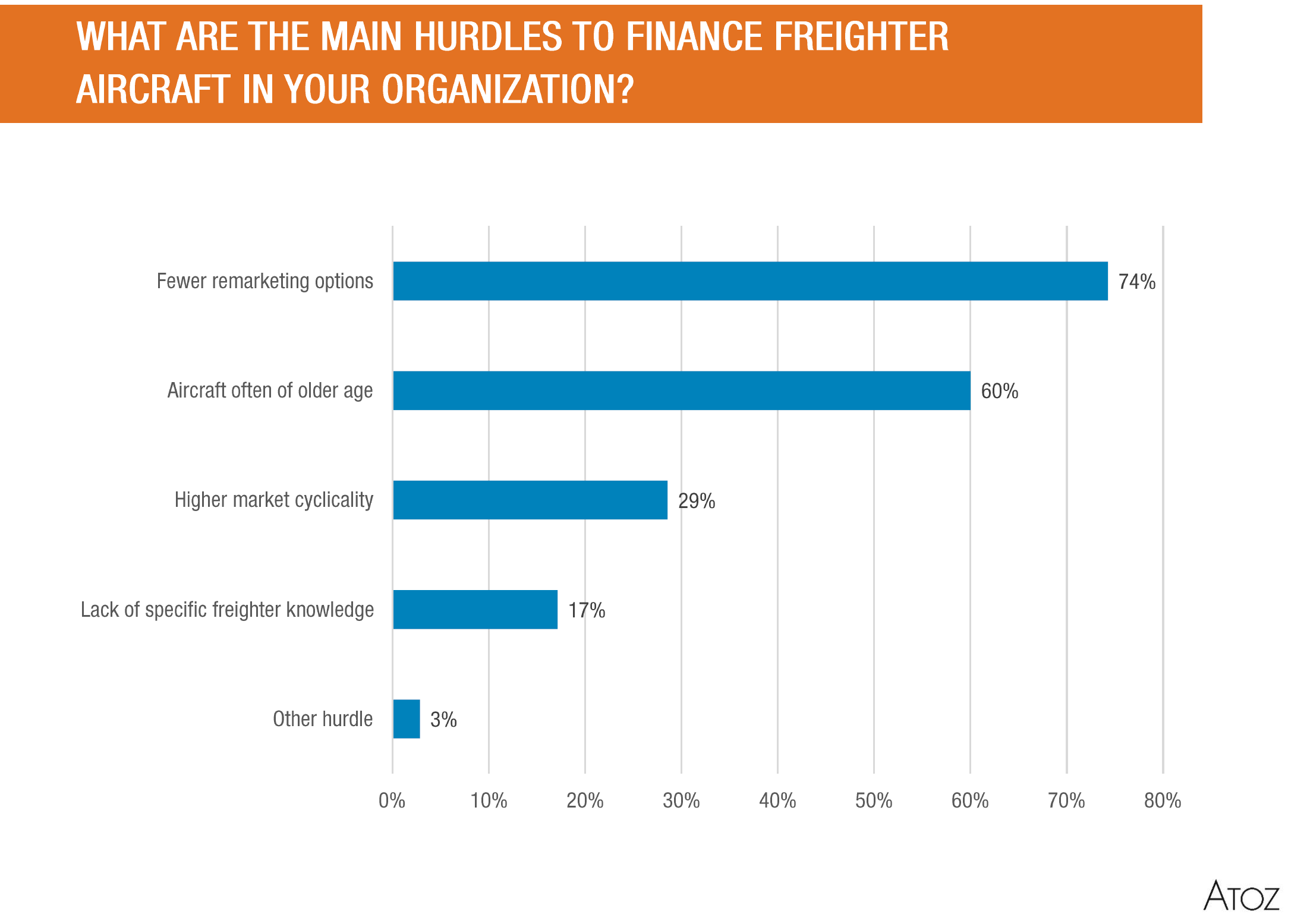

Financiers and lessors still face challenges when financing these assets. Cargo is notoriously volatile compared to the commercial aircraft traffic and demand “is generally a multiple of global GDP, both rising and falling,” explains Germeaux. This, combined with the limited size of the operating base, has historically deterred many financiers from the sector. This was confirmed in the survey. The biggest hurdle for most respondents remains the limited remarketing options (74%), followed by the age of the aircraft. However, financiers did indicate an openness to funding older assets when it comes to widebody freighters with 44% of lenders stating that the maximum age of the asset could be 25 years or higher by the end of the financing.

The Ishka View

Widebody freighters have historically been a challenge for financiers – and for good reason. The number one obstacle for both lessors and bankers in terms of funding these assets is the limited operating base. Germeaux estimates there may be around 15 firms operating a significant number of freight widebodies. These include dedicated cargo firms as well as airlines like Lufthansa or Emirates that have cargo operations. This leaves financiers with limited remarketing options in the case of default.

Nonetheless, the survey does unpick a seismic shift in attitude, especially from banks with regards to the assets, many of which would have struggled to fund these aircraft just five years ago. Much of this has been based on improvements in the profits of cargo firms and the rise in cargo global demand, but the timing is also fortunate. Air cargo is going through an interesting period with several firms offering, or planning to offer, competing third-party conversion programmes. Having interested financiers lined up gives these programmes a much better chance to do well.

*Source ATOZ Aviation Finance, an entity of ATOZ, an independent Luxembourg-based advisory firm, offering aircraft financing, fleet management, and strategic and risk management solutions to airlines and financiers.

Sign in to post a comment. If you don't have an account register here.