Monday 3 April 2017

How sustainable is LATAM’s return to profitability?

LATAM Airlines posted its first annual profit in six years. The airline moved back in to the black in 2016 and has benefitted from both the improving macroeconomic situation in Brazil as well as the strengthening of the REAL against the US dollar.

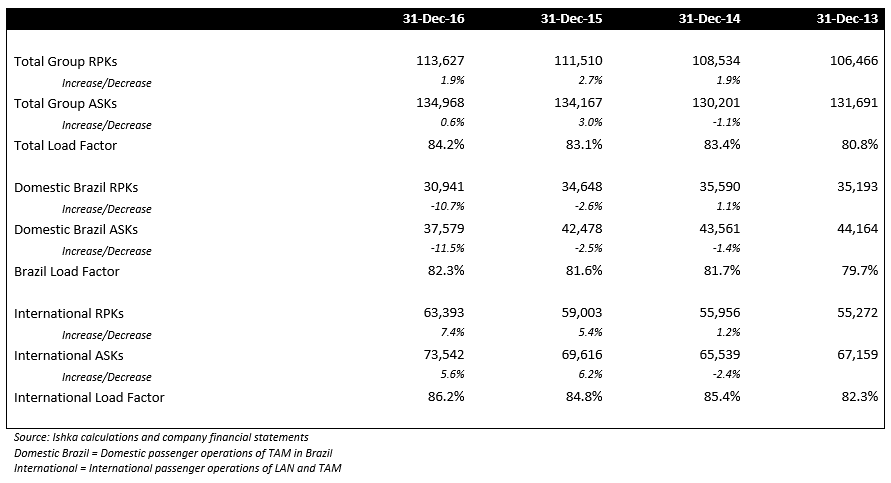

LATAM has been actively restructuring its fleet. Ishka’s analysis reveals that the company has taken credible steps to restructure its operations and optimise its fleet particularly on its domestic segment. As a result, the scale of operations is much smaller now (especially in domestic Brazil) which has contributed to the company’s improved operating performance.

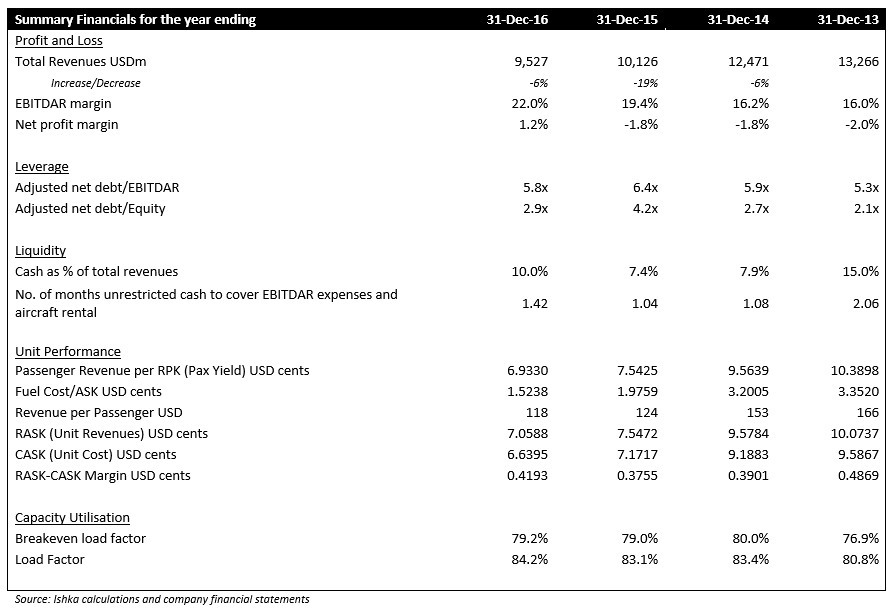

Load factors remained healthy and improved during the four years Ishka studied. However, challenges still remain – both internal as well as external. Group net margin and RASK-CASK spread, though positive, remains very thin. 2017 is a critical year for LATAM and healthy performance during the year will prove the company’s return to truly healthy fundamentals.

LATAM’s turbulence and Brazil’s macroeconomic woes

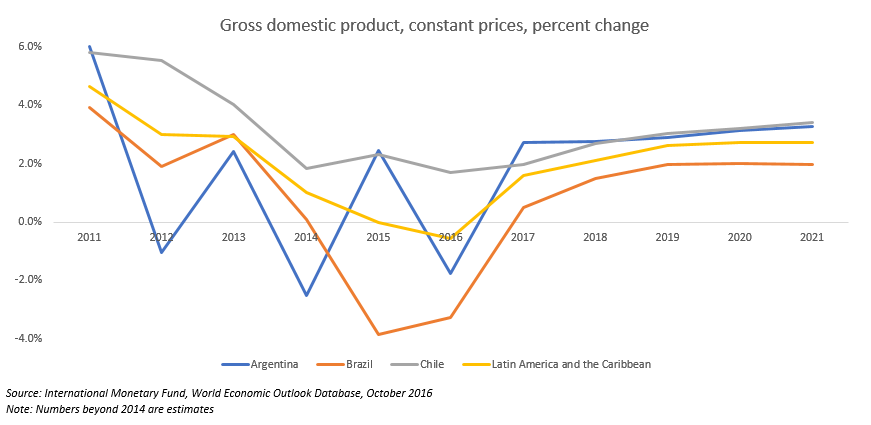

The macroeconomic performance of Latin America, especially Brazil, which accounts for nearly one third of the group’s revenues has been a key factor behind the poor performance of LATAM during the last two-three years. Brazil fell into a recession following the collapse in commodity prices. In addition, the country has been facing political unrest as well that culminated with the impeachment of its president, Dilma Rousseff.

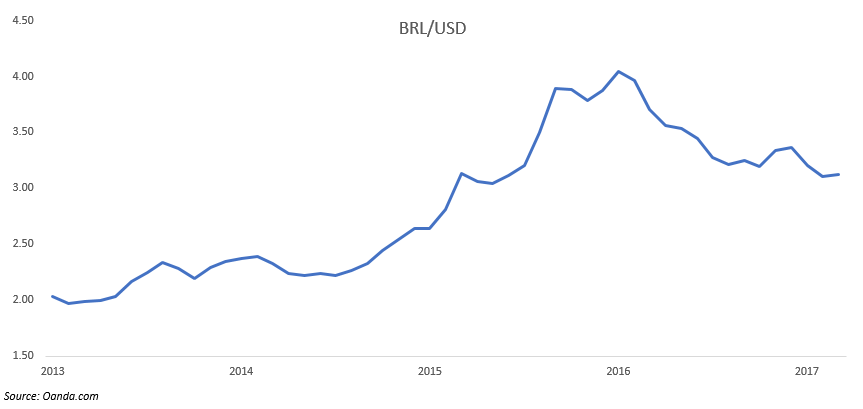

To make matters worse, the Brazilian Real started depreciating sharply against the US dollar from 2013 onwards before falling to a record low in late 2015 and early 2016. Foreign exchange loss was a major expense item for the company during the last four years and under normal circumstances, LATAM would have posted healthy profits (profit before tax) every year. Not surprisingly, the group’s Brazilian operations struggled and dragged the performance of the entire company down. However, things look optimistic from 2017 onwards and the entire region is showing signs of recovery which bodes well for the company. The currency also showing signs of strengthening in relative terms and has appreciated to some extent since the record low of 2015. This had an immediate impact on the fundamentals, with the company posting a significant foreign exchange gain in 2016 - helping it to return to the black.

Despite consistent net losses operating margins remained robust

As mentioned earlier, while bits of LATAM’s fundamentals have demonstrated improving trends some have deteriorated or continue to remain weak. The company’s operating performance as measured by EBITDAR margin was robust for all four years and further improved in 2016 reaching a strong 22%. This is mainly on the back of lower fuel bill. The carrier’s revenues were down for 2016 - due mostly to capacity optimisation in Brazil. LATAM’s revenues from Brazil (TAM Airlines’ domestic operations) nearly halved over the last four years. LATAM’s liquidity and leverage remain worryingly low despite improving on the back of last year’s stronger operating performance. Also, despite the significant reduction in operating expenses, the company’s RASK-CASK margin remains very thin and is lower now than four years ago. The fall in yields has become a global phenomenon for airlines. LATAM is not alone to suffer yield pressure, but its yields have nearly halved during the last four years.

TAM Airlines (Domestic Brazil) domestic operations have shrunk by nearly 15%

One-third of LATAM’s fleet is now leased

Nearly one-third of LATAM’s fleet was leased as of December 2016. Some of the major lessors to the airline group include SMBC, AerCap, SKY Leasing, Volito Aviation, BBAM, Orix Aviation, Jackson Square Aviation and Avolon, among others.

The Ishka View

LATAM’s troubles coincided with the macroeconomic and geopolitical issues in Brazil and Latin America as a whole. Brazil has undergone major upheaval in the last two-three years with the economy falling into recession and the impeachment of its President. Economists predict that Brazil is set to recover. The Ishka View is that LATAM’s performance is also likely to continue to improve for 2017 in-line with the improving macroeconomic situation. LATAM has been prudent at capacity addition, and has responded practically to lessening passenger demand. Even when the company was posting net losses, its operating performance remained relatively robust considering the troubled situation in its largest market. The company has adjusted its fleet delivery plan and is scheduled to induct only seven aircraft in 2017 - all on operating lease. This will help save significant Capex and also assist the company in avoiding adding too much capacity. LATAM is in a better situation now than it has been for the last three years. However, 2017 is still a critical year for LATAM. A decent performance in the next 12 months will prove the company’s return to truly healthy fundamentals.

Sign in to post a comment. If you don't have an account register here.