in Lessors & Asset managers , Lessor finances , Capital Markets

Wednesday 10 May 2017

Lessors go unsecured

In a previous Insight (Lessors trim funding costs), Ishka highlighted how the borrowing costs of most non-Chinese lessors have gone down during the last four years. For many of these firms, the average cost of borrowing is now influenced by the pricing of their senior unsecured notes. The public lessors have improved their fundamental creditworthiness, albeit to varying extent for each lessor. Many have made a conscious effort to de-risk their portfolio. These efforts, combined with a benign capital market environment, have helped them enjoy competitive pricing on their bond issuances.

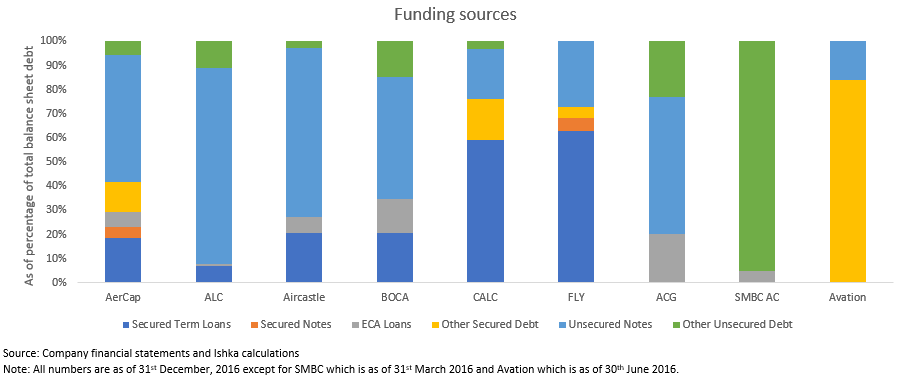

Lessors have been able to leverage the liquid capital markets to raise record levels of unsecured debt in the last few years. Unsecured debt now represents the major source of their financing, with a few exceptions.

Unsecured debt is virtuous circle. If a lessor can raise debt without encumbering assets it improves their credit standing among the ratings agencies allowing them to issue more unsecured debt. Barring a significant macro correction within the capital markets, the Ishka View is that lessors will continue to be able to issue more unsecured bonds, especially as their credit metrics continue to improve.

Capital markets replace secured bank financing

For most lessors, the average cost of borrowing is now influenced by the pricing of their senior unsecured notes. During the last four years, lessors have leveraged the abundant liquidity in the capital markets and have raised a substantial amount from unsecured notes. Unsecured notes now represent the biggest source of financing for all major lessors, barring SMBC AC, FLY and CALC. And as their creditworthiness has improved, the average borrowing costs for lessors have trended downwards.

Lessors like SMBC AC and BOC Aviation, which are majority owned by large banking organisations, too have tapped the capital markets. BOC Aviation, already sources the majority of its debt from the capital markets, and is noteworthy for having the lowest funding costs for any public lessor. The lessor, despite being majority owned by Bank of China maintains a high degree of operational independence and is listed on the Hong Kong Stock Exchange. SMBC AC successfully closed its first $500 million senior unsecured notes offering in July 2016 while managing to secure attractive pricing (the transaction is not captured in the chart above as it occurred after the financial year end.) SMBC AC’s deal is reflective of how the larger lessors are now easily issuing unsecured debt.

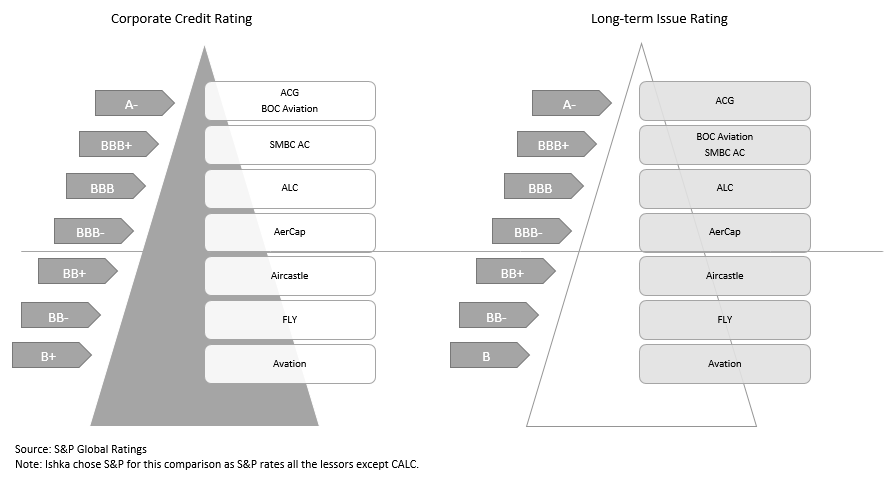

SMBC AC and ACG benefit from being majority owned by, and being strategically important to their respective parents. SMBC AC’s corporate credit rating of BBB+ is a three-notch upgrade from its standalone credit profile of BB+ on account of its parent Sumitomo Mitsui Financial Group Inc. (SMFG), a large Japanese bank. Similarly, ACG’s A- rating is three notches above its standalone credit rating BBB- on account of Pacific Life Insurance. Similarly, BOC Aviation, also enjoys a three-notch rating upgrade from its standalone credit profile of BBB- on account of being majority owned by the Bank of China. However, it is important to note that the lessor on its own still maintains a strong credit profile and has taken commendable steps to de-risk its portfolio. In standalone terms, ALC’s credit ratings fare better than others in its peer group which is not a surprise considering its strong financial and operational standing. However, this is not to say that other lessors are weak, in relative terms, ALC has managed to maintain a strong credit standing for a consistently long period.

The Ishka View

There has been a move towards the unsecured debt model by the major lessors globally. In the absence of major shocks, capital markets are expected to remain one of most important sources of financings for most major lessors in 2017. Unsecured financing now plays a major role in provision of capital to aircraft lessors. This has been helped greatly by the abundant liquidity in the capital markets and a general improvement in the lessors’ creditworthiness and quality of portfolio. Many lessors are now rated investment grade, while others such as Aircastle, are near investment grade. Getting an investment grade has greatly helped access to the unsecured market.

Cost of financing is a major-and in some sense perhaps the most important-source of competitive advantage among big lessors. Any adverse impact on the cost of funding--such as a cycle of interest rate hikes--will have serious implications for a lessor's competitiveness. Lessors' pursuit of cheap unsecured financing is fundamental to the long-term strategy/survivability of the business model.

In 2016, there was a 71.3% increase in unsecured notes year on year from $15 billion in 2015 to $25.7 billion with lessors accounting for the bulk of this rise. Early indicators suggest that this trend will be repeated again in 2017.

Sign in to post a comment. If you don't have an account register here.