Thursday 26 April 2018

Lessors boost unsecured issuances

In a previous Insight, Ishka reviewed the composition of lessor debt to understand how their sources of funding had evolved over the years. For a while now, lessors have been increasingly tapping the capital markets as a healthy investor appetite provided ample supply of capital. Although there has been robust demand for both secured and unsecured issuances, the unsecured bond market in particular has seen a greater share of activity. The opportunity to improve credit ratings which in-turn allows for further capital raisings meant that almost all major lessors substantially increased the level of unsecured debt over the years.

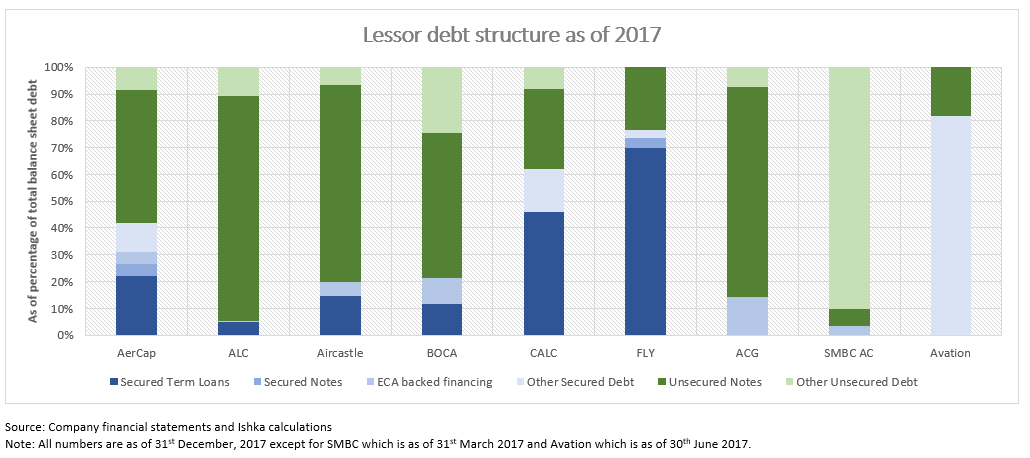

As can be seen from the chart lessors have continued to use the capital markets as their primary source of financing in 2017. This is not surprising considering the ample supply of capital in the market. Unsecured borrowings remain the largest source of financing for nearly all the lessors in this study and lessors such as Aircastle, CALC, BOC Aviation and ACG further increased the share of unsecured debt in 2017. The only lessor that has increased the share of secured debt in its total borrowings is FLY. The lessor entered into a term loan facility amounting to $332 million during the year. Although, it also issued unsecured notes amounting to aggregate $300 million, it was used to redeem its more expensive outstanding $375 million 2020 notes. FLY believes that this help in annual interest savings of nearly $10 million as a result of the lower coupon and lower amount outstanding. The lessor also repriced, amended and extended some of its other existing term loans, which should help to further lower its annual interest bill.

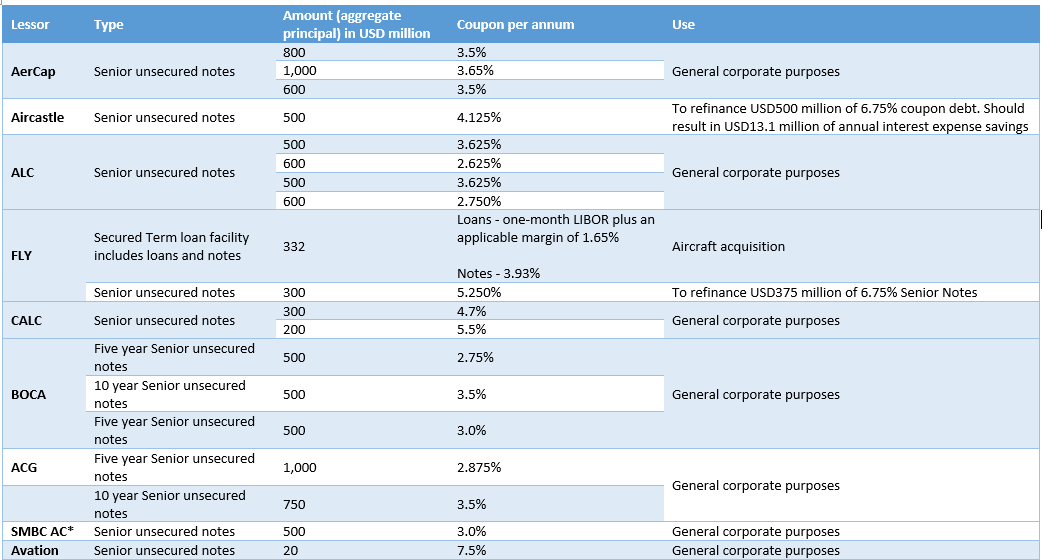

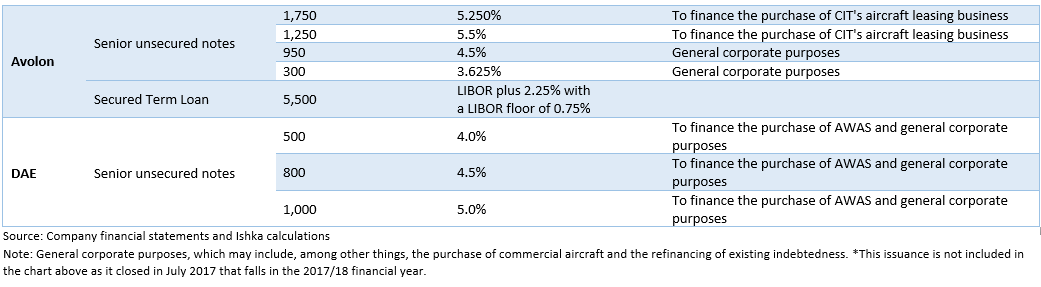

Below is a summary of the key debt issuances during 2017 across the major lessors.

The list above contains both investment grade and high-yield lessors. As highlighted in the Ishka Vista, a new aviation finance market forecast, containing more than 100 pages of commentary and analysis, unlike 2016, 2017 saw greater number of issuances by non-investment grade platforms compared to investment grade lessors. It shows how the markets have remained open to both investment grade and high-yield credits. And as unsecured debt is a virtuous circle, issuances without encumbering assets improves credit standing among the ratings agencies allowing them to issue more unsecured debt. Lessor credit metrics have continued to improve in 2017 and as such unsecured debt activity will remain robust in 2018. The first three months of 2018 has already seen several unsecured bond issuances from the major lessors.

The Ishka View

Thanks to ample supply of capital, lessors continued to tap into the debt capital markets for their financing needs in 2017. Despite the historical sensitivity of unsecured capital markets to credit ratings, markets have shown confidence in both investment grade and speculative credits. 2018 is likely to be no different; as lessor credit metrics have continued to improve, conditions remain ripe for further unsecured issuances. In the short-term there is no question lessors will seek to access the unsecured market, especially as rates remain relatively attractive. Many are doing so, not just because of the flexibility it confers, but in a bid to obtain enough unsecured debt to ensure an investment grade blessing from the rating agencies.

Sign in to post a comment. If you don't have an account register here.