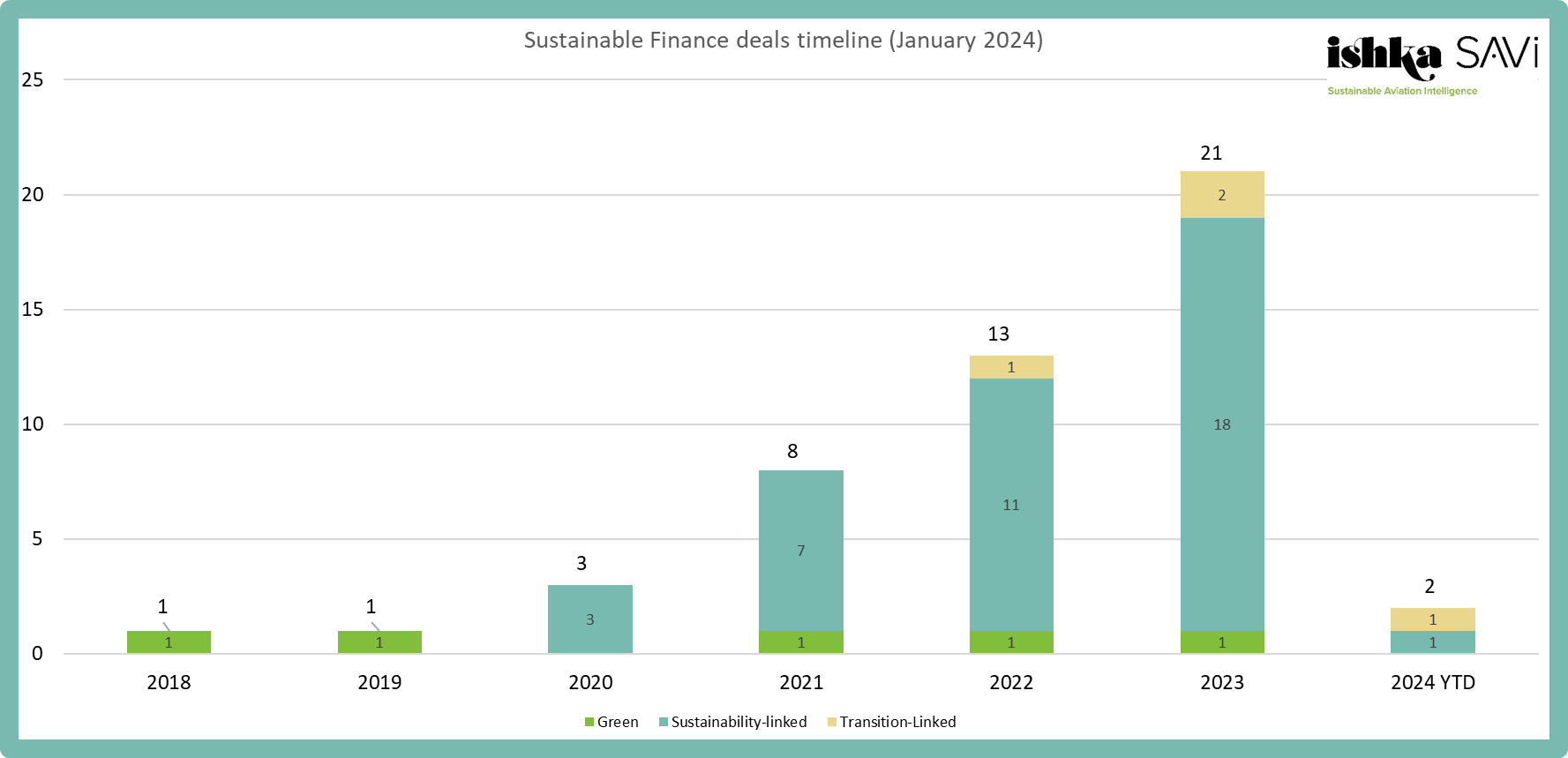

Sustainable finance deals in aviation involving airlines and lessors or with aircraft as collateral grew once again in 2023, matching the approximate 60% annual growth rate of the preceding year, according to Ishka SAVi sustainable finance deal tracker data. Ishka identified 21 transactions throughout 2023 compared to 13 in 2022. Mirroring trends in other sectors, sustainability-linked transactions (18) came ahead, with the remaining three consisting of two transition-linked deals and one transition bond following the Green Bond Principles.

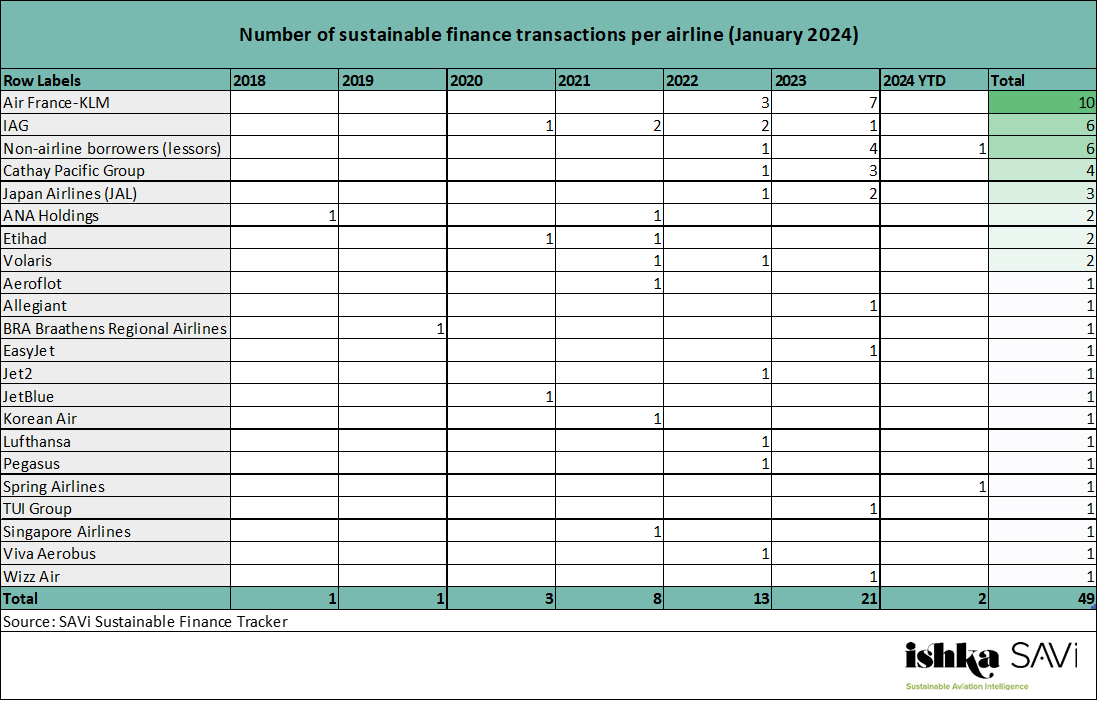

Emissions intensity consolidated itself as the main sustainability performance target (SPT), with SAF use and fleet renewal taking a backseat in popularity. A number of aviation borrowers accessed sustainable finance for the first time in 2023 – including two leasing companies – but around half of the publicly-announced transactions involved two airlines: Air France-KLM (seven transactions) and Cathay Pacific Group (three transactions).

The growth of sustainable finance in aviation

Note: The number of transactions for each year is based on deal announcements. In the case of aircraft financing, each transaction can involve more than one aircraft. For example, in 2023, at least 15 aircraft deliveries were funded through sustainability-linked transactions, but proceeds from other facilities were also expected to support aircraft acquisition. Data as of end of January 2024.

Note: The number of transactions for each year is based on deal announcements. In the case of aircraft financing, each transaction can involve more than one aircraft. For example, in 2023, at least 15 aircraft deliveries were funded through sustainability-linked transactions, but proceeds from other facilities were also expected to support aircraft acquisition. Data as of end of January 2024.

Sustainable finance deals in aviation only represent a small fraction of the entire aviation finance deal universe, but their number has been inching up progressively over the past few years. Since 2021, public announcements of these transactions have increased 62% annually. This is despite the overall global market value of sustainable finance across all sectors staying relatively flat in 2022 and 2023 after peaking in 2021, according to figures by Environmental Finance Data (EFD).

The growth of sustainable finance in aviation has been driven by sustainability-linked loans (SLLs). Of the 21 transactions recorded in 2023, 17 were loans or transactions using sustainability-linked debt (such as JOLCO aircraft financing). Among those 17, four were sustainability-linked revolving credit facilities (RCFs), which according to research by BNP Paribas have grown exponentially in the past 12 months: approximately 50% of RCFs in EMEA were renewed as SLLs last year.

For aircraft financing, sustainability-linked JOLCOs remain a popular option for first-tier airline credits. Air France-KLM, Cathay Pacific Group, and Wizz Air all financed aircraft deliveries through sustainability-linked JOLCOs in 2023.

Air France-KLM leads the pack

Note: Data as of end of January 2024

Note: Data as of end of January 2024

Air France-KLM continues to be the undisputed airline leader on sustainable finance, with seven transactions announced in 2023, adding to another three in 2022. European rival IAG and Cathay Pacific Group are the other two main repeat borrowers. In 2023, first-time airline borrowers comprise:

- Allegiant Air, with a $100-million sustainability-linked RCF maturing in 2026 that includes a requirement to gradually secure a portion of the Borrowing Base exclusively with new-technology assets over the term of the facility.

- EasyJet, with a $1.75-billion sustainability-linked UKEF-guaranteed term loan facility linked to a reduction in carbon emission intensity in line with the carrier’s SBTi-validated target.

- TUI Group, with a €2.7-billion ($2.92 billion) sustainability-linked RCF maturing in 2026 with emissions targets for multiple sectors in which it operates, including an SBTi-approved target of reducing CO2e per RPK by 24% by 2030 compared to 2019 levels.

- Wizz Air, with three Airbus A321neos delivered under JOLCOs structured by lessor ABL Aviation with sustainability-linked features.

Lessors make an entrance

Aircraft lessors and asset managers became involved in several transactions in 2023. In addition to ABL Aviation (mentioned above), Tokyo Century also structured a sustainability-linked JOLCO lease for an Air France Airbus A350 in 2023 (together with Société Générale) while Jackson Square Aviation (JSA) structured two Air France A350 sustainability-linked leases.

Most notably, three leasing platforms raised sustainability-linked financing in 2023:

- China Aircraft Leasing Group (CALC) issued a low-carbon transition bond maturing in 2026. The 3.85%-coupon Shanghai-issued bond allowed to lessor to raise RMB 1.5 billion ($210 million) for the purchase of new aircraft "with high fuel efficiency" and the "upgrade and replacement of aged aircraft.” It was CALC's second low-carbon transition bond following the successful issuance of an earlier one in October 2022.

- SMBC Aviation Capital closed a $150 million five-year unsecured bilateral loan facility with Bank of Communications (Hong Kong) Limited, which Ishka understands is the first sustainability-linked debt raise by any investment-grade lessor. The facility is linked to the lessors’ carbon intensity of its owned fleet and gender diversity across currently under-represented levels of seniority in the business.

- CDB Aviation closed its inaugural Sustainability Linked Loan, anchored with a $625 million syndicated term loan facility, with SPTs contingent on reducing the carbon intensity of CDB Aviation’s fleet, pursuing a target to reach 60% new-generation aircraft by number of aircraft by the end of 2025, and increasing the level of Diversity, Equity, and Inclusion (DEI)-related training for the workforce.

China leads the way in 2024 via Spring Airlines and CALC

Shanghai-headquartered low-cost carrier Spring Airlines is the first airline to access sustainable finance in 2024. In early January, it became the first company in China to close a loan aligned with what is reported to be the country’s first transition finance taxonomy. According to a report by environmentalist non-profit China Dialogue, the 310-million-yuan ($43.7 million) loan was provided by Shanghai Pudong Development Bank (SPDB).

According to a People’s Daily report, Spring Airlines will set up “Sustainability Performance Targets such as tonne-kilometre emissions and the proportion of SAF used, which will be linked to the floating interest rates of SLL [Sustainability-Linked Loan].” Proceeds from the loan will be used to support the introduction of fuel-efficient Airbus A320neo aircraft. See this recent SAVi Five report for more details.

Meanwhile at the end of January, Hong Kong-headquartered lessor China Aircraft Leasing Group Holdings Limited (CALC) announced the launch of an unsecured revolving syndicated loan totalling a maximum of $500 million, with an initial placement size of $350 million, to finance part of Pre-Delivery Payments (PDP) for its new aircraft orders. According to CALC, it is the largest aircraft PDP finance cross-border transactions in global aircraft leasing market in 2023 (when it closed) and represents the aircraft leasing industry's first sustainability-linked PDP loan facility. China Construction Bank Shanghai Branch served as the lead arranger.

The Ishka View

The final tally for 2023 meets Ishka’s growth expectations for sustainable finance deals in aviation, and similar growth is expected for 2024 – some of which will be driven by Chinese institutions. The existence of privately placed deals with little to no associated disclosure restricts the observable universe of sustainable finance deals in aviation of this bourgeoning market. Ishka understands that more airlines are following Air France-KLM and Cathay Pacific Group in showing a preference for sustainable finance structures to fund aircraft.

Ishka notes that French institutions have been taking a clear lead for these products. In addition to Air France-KLM leading the airline table, French lender Crédit Agricole Corporate and Investment Bank (CA-CIB) also appears to be the lead arranger for sustainable finance transactions, having participated in at least 12 sustainability-linked deals in aviation so far. Other large French lenders also continue to be very actively involved in the space.

This is a summary of recent trends based on the SAVi Sustainable Finance Tracker. For a summary of typical incentives, aircraft, and banks featured in aviation sustainable finance transactions, see SAVi report: ‘Sust Finance in aviation: Taking stock of incentives, aircraft, banks, and attitudes’.

For feedback and questions on the data, please email savi@ishkaglobal.com .